Android Tablet Shipments Soar, Usage Hasn’t Shown Up Yet

Strategy Analytics came out with Q2 shipment estimates for tablets — which are supposed to exceed PC sales by the end of this year on a global basis. It’s now a critical market segment. The data show Android tablets with a solid “shipments share” lead over the iPad. What the numbers appear to reflect is […]

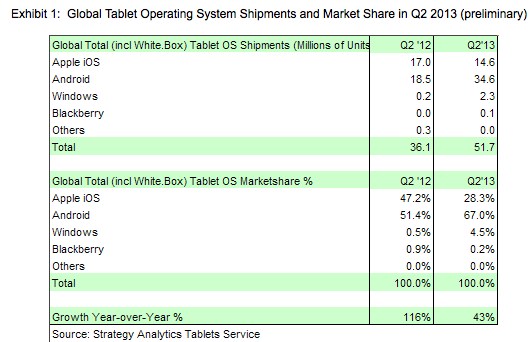

Strategy Analytics came out with Q2 shipment estimates for tablets — which are supposed to exceed PC sales by the end of this year on a global basis. It’s now a critical market segment. The data show Android tablets with a solid “shipments share” lead over the iPad.

Strategy Analytics came out with Q2 shipment estimates for tablets — which are supposed to exceed PC sales by the end of this year on a global basis. It’s now a critical market segment. The data show Android tablets with a solid “shipments share” lead over the iPad.

What the numbers appear to reflect is two-thirds Android market share vs. iOS. However that’s not reflected in actual usage, at least in North America, where the iPad has increased its share of Web traffic over Q1.

Collectively, according to Chitika, non-iPad tablets (essentially Android) are driving roughly 16 percent of all tablet-based Web traffic in North America. We may see that change in Q3 as all these tablet shipments perhaps translate into actual sales and usage.

I was in Best Buy last night buying a MacBook Air for my daughter. While Microsoft (including Surface) now has a prominent presence in the store, in terms of tablets, it’s really the iPad or iPad Mini vs. a sea of Android devices (Samsung, Lenovo, Acer, Asus, etc.). Amazon/Kindle is essentially the only standout Android tablet. Even the Nexus 7 is lost in the array of lookalike Android devices.

On the smartphone front, Kantar Worldpanel ComTech released market share figures for the US for Q2. They show the iPhone increasing share, Android essentially flat and BlackBerry bottoming out. However the firm also shows increasing Windows phone adoption.

Source: Kantar Worldpanel ComTech

When it comes to the growth of Windows phones, these data are curious. In Nokia’s recent earnings release the company, which is the leading maker of Windows handsets, reported selling 7.4 million Lumia unit sales globally. However, in North America, the company sold roughly 500,000 devices vs. 600,000 last quarter.

Accordingly, demand for Lumia and Windows declined in North America from Q1. The US comScore data (May 2013) also reflect a decline in Windows Phone share in the US market. The Nokia and comScore data thus appear to contradict the Kantar figures to some degree.

Contributing authors are invited to create content for MarTech and are chosen for their expertise and contribution to the search community. Our contributors work under the oversight of the editorial staff and contributions are checked for quality and relevance to our readers. MarTech is owned by Semrush. Contributor was not asked to make any direct or indirect mentions of Semrush. The opinions they express are their own.

Related stories