Pandemic challenges intensify need for customer data platforms

As B2B and B2C buyers do more online, the CDP's ability to unify profiles is more useful than ever before.

While the global pandemic may have had a dampening effect on business in general, it also seems to have raised interest in precisely the types of solutions that customer data platforms (CDPs) deliver. When stay-at-home orders and social distancing guidelines spurred the movement of customer interactions – both B2B and B2C – to digital channels, marketers became increasingly interested in technologies that collect data from those interactions, unify them, deliver insights and enable campaign orchestration.

Whether that’s taking place in something called a CDP or whether the category morphs as it grows is up for discussion, however. In its most recent report on the market, Gartner predicted that 70% of independent CDP vendors will be acquired or will acquire adjacent technologies to diversify by 2023. According to Gartner, these players will get into of personalization, multichannel marketing, consent management or master data management (MDM) for customer data. In part, this expectation arises from the fact that the number of CDP vendors is so high (approaching 100, according to Gartner) that it’s difficult to believe they will all remain viable as individual entities.

In any case, the core CDP technology and its functionality aren’t going anywhere, as the use cases that have brought it to the fore are more important than ever. Gartner notes that marketing technology leaders it surveyed see CDP as “an investment worth planning for, and protecting, in an economic downturn.” Respondents ranked CDPs as one of the technologies they would least likely cut from their planned deployments, when Gartner asked about the possibility of eliminating items from the martech stack.

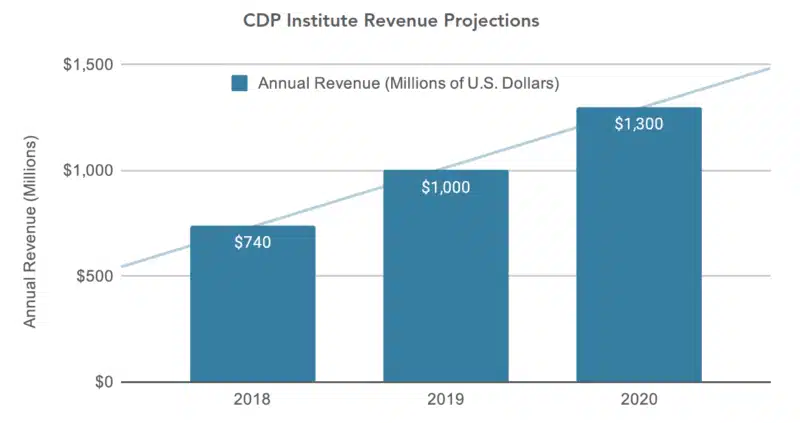

The CDP Institute, an organization that provides vendor-neutral information about customer data management in general and CDPs in particular, expected industry revenue to reach at least $1.3 billion in 2020. It hasn’t released any more recent forecasts. Meanwhile, ResearchandMarkets predicts the industry will grow to $10.3 billion by 2025, expanding at a compound annual growth rate (CAGR) of 34% between now and 2025.

This growth is being driven by the proliferation of devices and customer touchpoints, higher expectations for marketers to orchestrate real-time personalized experiences across channels and the need to navigate complex privacy regulations. The COVID pandemic has also been a factor, as the importance of customers’ digital interactions has been highlighted by social distancing measures and stay-at-home orders.

For more about these factors and to view in-depth profiles of CDP vendors, check out our MarTech Intelligence Report titled Enterprise Customer Data Platforms: A Marketer’s Guide.

Related stories