WFA survey finds agency trading desks facing challenges from independent models

Brands are seeking greater transparency and control over programmatic buying practices, fueling growth for in-house and Independent Trading Desks.

Agency Trading Desks are still the primary avenue for large brands buying ads programmatically, but the model is facing challenges as demand for transparency rises.

According to a new survey by the World Federation of Advertisers (WFA), 90 percent of large brand advertisers that use Agency Trading Desks (ATDs) are “reviewing and resetting contracts and business models” to gain more control and transparency over the buying process.

More than 70 percent of those surveyed use ATDs as their primary model in all or some global markets. Of those, 42 percent are now working with ATDs at the agency level within the major agency holding companies. Just over half (51 percent) still work with the legacy holding company ATDs such as Xaxis, Accuen and Cadreon. “The shift has been driven by client demand to ensure closer working relationships between their day-to-day agency team and the programmatic buying team, to ensure consistency and simpler reporting,” the report finds.

Independent Trading Desks (ITDs), companies that operate outside of the major holding companies, are gaining favor. ITDs are now used by 46 percent of respondents, an increase of 12 percent from 2014. In-house or hybrid trading desk models are used by more than 20 percent of respondents. That marks a significant shift from 2014, when only a small fraction of WFA members employed in-house or hybrid trading models for programmatic.

In regard to the ongoing controversy of agencies marking up inventory before selling it to their clients, the majority of advertisers expressed their discomfort with the practice. Just 9 percent of respondents using ATDs agreed with the statement “we have ‘opted-in’ to principal trading and are comfortable with the potential conflicts of interest.” A full 62 percent of respondents disagreed with that statement.

While 53 percent of respondents described their trading desk operating model as “disclosed/transparentm,” a third of respondents said their trading desk model was “non-disclosed/non-transparent.” In a separate question, 34 percent said their contracts do not preclude arbitrage or principal trading in which the trading desks buy and sell inventory with a markup. Just over a fifth (21 percent) said they didn’t know.

Not surprisingly, Private Marketplace participation is increasing among respondents. A little over half (52 percent) said they are increasing spend on private exchanges with fixed pricing options; a combined 67 percent said they are spending more on private exchanges with invite-only auctions. A quarter of respondents say they are pulling spend out of open exchanges.

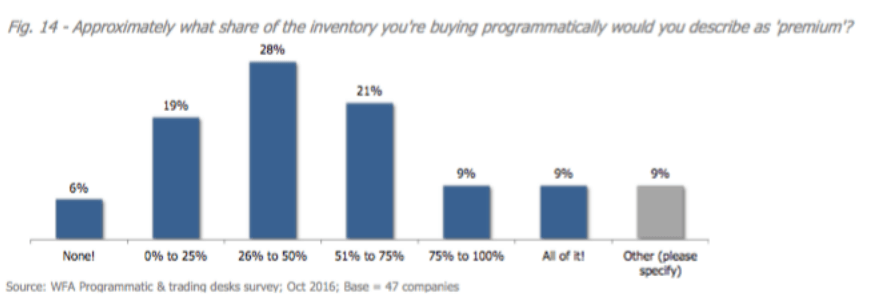

What is somewhat surprising is that while demand for so-called premium inventory is on the rise, more than 50 percent of respondents said that half or less of the inventory they bought could be defined as “premium.” Just 9 percent said all of the inventory they bought was premium.

The survey included 59 WFA member companies with a combined ad spend of more than $70 billion annually. Programmatic accounts for 16 percent of their digital ad spend, up from 10 percent in 2014, the year of the last survey. Display accounts for the largest share of programmatic spend, but 45 percent of respondents say they plan to decrease desktop display allocations, which accounted for 38 percent of programmatic spend. Nearly all (98 percent) plan to increase programmatic spend on mobile display and mobile video.

Matt Green, Global Media & Digital Marketing Lead at the WFA, said in a statement:

“Programmatic has expanded rapidly and it’s no surprise that the market and mechanisms that big brands use to spend through this channel are evolving. The rise of in-house, hybrid models and independent trading desks demonstrates that the original trading model left much to be desired. The second generation of trading models is now being built and while agency trading desks still take the greatest share of digital spend there are now real alternatives being developed that give brands more control over data and technology alongside the wider push to ensure greater transparency. Ultimately, there are advantages and disadvantages for each approach and brands should identify the strategic principles which matter to their businesses, as these will govern partner choices.”

Contributing authors are invited to create content for MarTech and are chosen for their expertise and contribution to the martech community. Our contributors work under the oversight of the editorial staff and contributions are checked for quality and relevance to our readers. The opinions they express are their own.

Related stories