This startup used blockchain to raise $15 million for a blockchain-based ad network that pays users

AirFox is also developing the same platform as a way to automate microloans.

A Boston-based company has today reached its $15 million funding goal to develop a blockchain-assisted platform to store user profiles for advertising that pays users and for lenders who issue micro-loans.

Founded in 2016, AirFox currently has two main efforts, one in the US and one in Brazil. The $15 million funding was raised via a blockchain-based ICO (or initial coin offering) from 2,500 backers.

The one in the US is a non-blockchain platform that is licensed to two US-based wireless networked carriers, Life Wireless and Kroger Wireless.

For Android subscribers to those carriers, random user actions on a smartphone — such as every fifth device unlock or every third phone call — trigger the display of an ad from AirFox, via its integration with various ad exchanges.

The user gets credits for ad impressions, and those credits can be used to add up to 500 megabytes to the monthly data ceiling. A plan with a ceiling of one gigabyte of data per month, for instance, might be increased by 100 megabytes. AirFox co-founder and CEO Victor Santos told me that his company has about 200,000 active users on this licensed platform.

The consumer-focused platform in Brazil will be developed with the newly-raised funding. Its intention is to disrupt both advertising and lending with the assistance of blockchain technology.

AirTokens

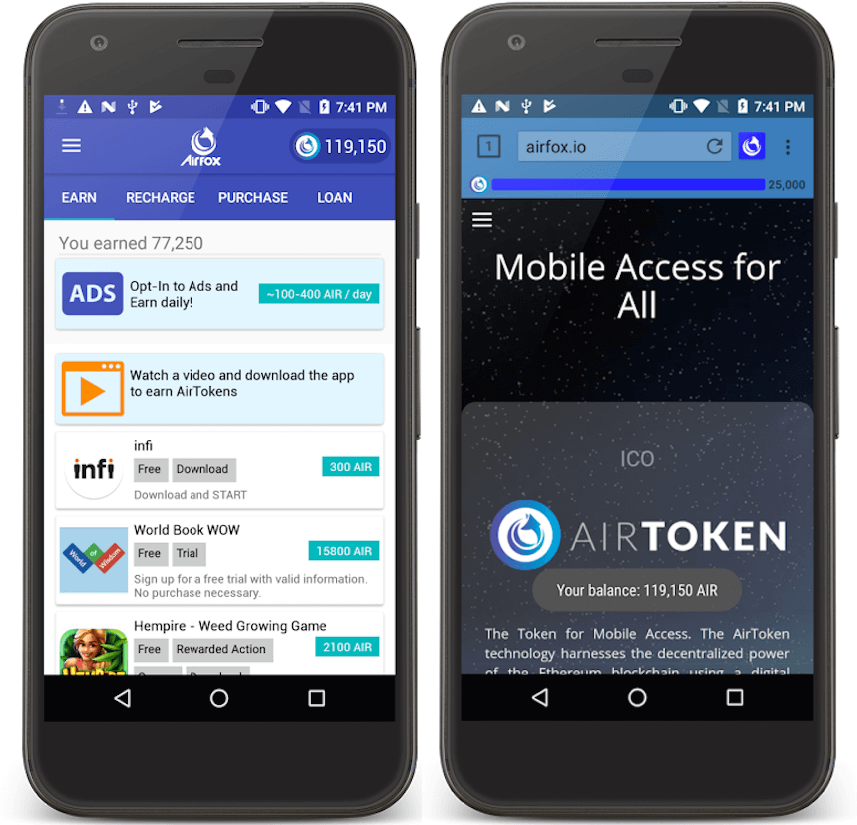

Through that platform, a user employs the AirFox mobile browser for Android devices. When the AirFox platform determines that the bandwidth and other conditions are most efficient, it serves ads into a box at the top of the browser. Again, those ads come from AirFox through integration with various ad exchanges.

Santos says the ads are mostly native, in that they resemble the content, style or both of the surrounding content. As with the US platform, the participating Brazilians get credits for ad impressions, except here they will be paid in AirTokens.

AirTokens are AirFox-issued cryptocurrency generated by a blockchain that will be deployed to assist this platform. Blockchain is the infrastructure technology behind the best-known cryptocurrency, bitcoins, and it can also be used to mint private cryptocurrency like AirTokens.

Fifty AirTokens equal one dollar, so if the CPM rate for the AirFox-delivered ads is $1/thousand, then the user gets one AirToken for every 20 ad impressions, since each AirToken is worth 2 cents or 1/50th of a $1/CPM. Santos said his company keeps 10 percent of the ad revenue, sharing the rest with the consumer.

Blockchain is not ready to fully replace the programmatic ad system, since it can’t yet run at those transactional speeds. But AirFox is developing the blockchain assist as a way to store hashed user profiles for ad targeting. The advertiser bids on inventory, makes the purchase, and then targets the ad to the user segment in the blockchain, such as males 30-35 in the São Paulo area.

Since every participating advertiser or exchange will have a locally updated and secure blockchain, Santos said, this kind of profile storage of targeting profiles should save money because it is more efficient.

Disrupting lending

But AirFox also has another use for those profiles, which could help to disrupt another industry.

The profiles, enriched by additional carrier-supplied particulars like whether the user pays bills on time, can be used by micro-lenders or others to make small loans to user segments, automatically.

For instance, a micro-lender might decide to loan $5 for additional data AirTokens to 500 users in the blockchain-stored segment of males 30-35 who pay their carrier on time every month. The consumers will have approved the use of the additional carrier-derived info for this purpose, Santos said.

The consumers might then repay the lender, for instance, with $5.50 in cash within three months at the local carrier office.

This blockchain-stored, decentralized ledger of profile info, Santos said, might also be used by other companies who want a quick way to find creditworthy customers, such as a car rental agency or an insurance company.

The platform in Brazil, he said, will primarily be focused on developing nations where mobile call time/data is very expensive. Next market: Mexico.

Santos expects the blockchain technology to be added to the Brazil platform by second quarter of next year. But, he noted, the microlending program will be launched first. Although the targeting/profiling use of the blockchain is similar for both mobile ads and micro-lending, he said, the ad use is more complex because of the need to convince so many ad players in that ecosystem.

Contributing authors are invited to create content for MarTech and are chosen for their expertise and contribution to the search community. Our contributors work under the oversight of the editorial staff and contributions are checked for quality and relevance to our readers. MarTech is owned by Semrush. Contributor was not asked to make any direct or indirect mentions of Semrush. The opinions they express are their own.

Related stories