Smartphones Have Big Quarter, Bigger iPhone 6 Anticipation Grows

Data from research firm Counterpoint (via AppleInsider) asserts that smartphones constituted 87 percent of all U.S. handset “shipments” in the first quarter. Shipments and sales are not identical. However feature phones are pretty clearly now on the way out in the US and other developed markets. Earlier Nielsen and comScore survey data reflect that US smartphone […]

Data from research firm Counterpoint (via AppleInsider) asserts that smartphones constituted 87 percent of all U.S. handset “shipments” in the first quarter. Shipments and sales are not identical. However feature phones are pretty clearly now on the way out in the US and other developed markets.

Data from research firm Counterpoint (via AppleInsider) asserts that smartphones constituted 87 percent of all U.S. handset “shipments” in the first quarter. Shipments and sales are not identical. However feature phones are pretty clearly now on the way out in the US and other developed markets.

Earlier Nielsen and comScore survey data reflect that US smartphone penetration is now at 70 percent. Higher quality, inexpensive devices such as the recently released Moto E ($129) are helping to drive deeper smartphone penetration.

Smartphone critical mass and related “cultural” changes argue that feature phones will very soon be only for demographic segments that consciously reject the “bells and whistles” of smartphones (e.g., older seniors).

A couple of forecasts anticipate that US smartphone penetration will reach 90 percent by the end of 2016. Once that happens it will be interesting to see how competition evolves and how that impacts hardware development.

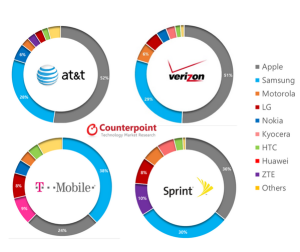

While Samsung is gaining on Apple, the latter remains the leading individual handset maker in the US. Anticipation for the iPhone 6 announcement and subsequent launch is building. Consumer surveys indicate a high level of potential demand as consumer buying of iPhones slows ahead of the coming product launch.

Apple is expected to announce at least a 4.7 inch screen iPhone and potentially a second 5.5 inch screen model.

On June 2 at its developer conference Apple will reveal “new hardware.” That will certainly include at least one new iPhone but may also include other hardware announcements (e.g., TV, smartwatch?).

Global Android smartphone growth has been driven by aggressive pricing and larger screens. Now that the new iPhone promises a larger screen, will it enable Apple to gain new market share with people who would otherwise be Samsung buyers?

Contributing authors are invited to create content for MarTech and are chosen for their expertise and contribution to the search community. Our contributors work under the oversight of the editorial staff and contributions are checked for quality and relevance to our readers. MarTech is owned by Semrush. Contributor was not asked to make any direct or indirect mentions of Semrush. The opinions they express are their own.

Related stories