Report: YouTube set to raise ad prices on premium ad inventory

Higher rates to go into effect in 2018, despite (or because of) the platform's brand safety challenges.

Even as it has hit several brand safety bumps over the past year, YouTube is poised to raise prices on premium ad inventory in the coming year.

Business Insider reported this week that the video platform will increase ad rates on reserved inventory by as much as 20 percent in 2018. That’s the premium inventory that advertisers can buy on a fixed CPM or CPD (cost-per-day) basis in advance rather than via real-time auction bidding. Reserved inventory includes masthead units on the home page and skippable and non-skippable pre-roll video ads. YouTube declined to comment.

YouTube continues to face hurdles in ensuring brands their ads will be served alongside unobjectionable content. The platform faced a backlash this spring when brand video ads were found running next to extremist content. The company has taken several steps to add more controls and provide a safer environment for brands, including eliminating ads from channels with fewer than 10,000 views, expanding the scope of videos that can be de-monetized and manually reviewing more than a million videos, in part to help train its algorithms to flag objectionable content more comprehensively.

Challenges remain, as illustrated last month when The Times of London reported ads from major brands such as Adidas, Amazon and eBay were seen running on videos posted by children that garnered sexually predatory comments. In October, YouTube removed RT.com from the list of channels included in the company’s Google Preferred advertising program on its most popular channels.

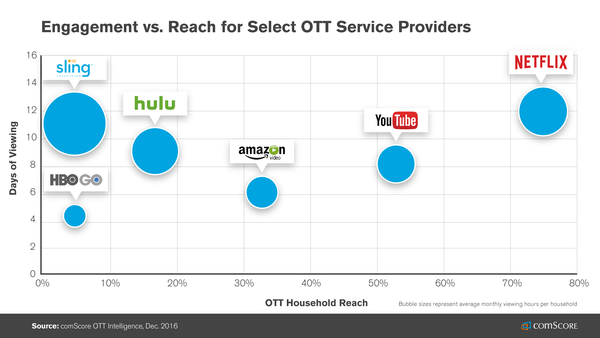

And yet demand from advertisers for YouTube’s premium inventory shows no sign of slowing, as it can offer the scale and targeting brands are looking for, often as a way to augment their TV buys. With over-the-top (OTT) viewership on the rise, YouTube is positioned to attract traditional TV dollars with reach into some 53 million OTT households in the US, according to comScore.

The irony of a company that faced an advertiser revolt over compromised ad placements and was essentially shamed into making changes is now raising prices as a result of those changes is likely not lost on buyers. That the demand is there, however, points to the power YouTube holds in the marketplace, as well as the willingness of advertisers to pay more for brand-safe ad environments. Taking a less skeptical view, creators and publishers of premium content on YouTube may see higher revenue from their videos on the platform.

Contributing authors are invited to create content for MarTech and are chosen for their expertise and contribution to the search community. Our contributors work under the oversight of the editorial staff and contributions are checked for quality and relevance to our readers. MarTech is owned by Semrush. Contributor was not asked to make any direct or indirect mentions of Semrush. The opinions they express are their own.

Related stories