Report: $31 Billion In “M-Commerce” By 2015

Holiday 2011 is being hailed by many as a kind of breakthrough for so-called “m-commerce”: people buying things on smartphones and tablets. Actually it was more of a breakthrough for smartphone “shopping.” Only a handful of sites — mainly Amazon and eBay — are actually seeing transactions through their mobile apps. The expectation is that […]

Holiday 2011 is being hailed by many as a kind of breakthrough for so-called “m-commerce”: people buying things on smartphones and tablets. Actually it was more of a breakthrough for smartphone “shopping.” Only a handful of sites — mainly Amazon and eBay — are actually seeing transactions through their mobile apps.

The expectation is that consumers will become progressively more conformable with buying things through mobile devices over time. That’s a reasonable assumption. Tablets are already seeing considerable “t-commerce” activity.

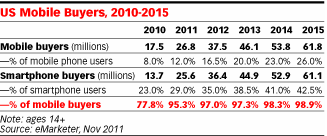

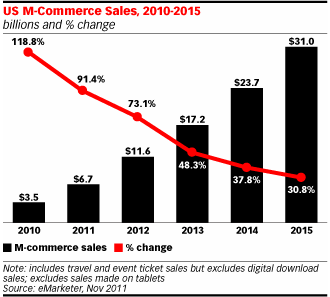

According to eMarketer m-commerce sales in 2011 were $6.7 billion. However the firm expects that to grow to $31 billion in US by 2015.

Currently large percentages of smartphone owners use their devices to do price checks, conduct product research and look at reviews (often in stores). However there are two principal reasons that relatively few people actually buy things through their phones: trust/security and convenience.

Many consumers are wary of mobile transactions, in the same way that early ecommerce was challenged by a lack of consumer trust. On a practical level, the larger issue is the challenge of entering credit card numbers on a mobile handset.

One novel approach to addressing the “credit card entry” problem is Card.io. It enables developers to integrate credit card scanning into their sites. Users then just take a picture of their credit cards to get the data into the app in question.

Beyond this mobile wallets and various mobile payments systems may overcome the convenience issue eventually. Indeed, Google Wallet sees itself as a platform and eBay wants developers to use PayPal for payments on their sites. But for now unless there’s a stored credit card number (e.g., Amazon) most consumers aren’t going to buy through a mobile device.

The stored credit card issue is one reason why iPhone users buy so many more paid apps than Android users, where there’s much more payments friction.

Eventually there will probably be a few third party standards that provide a secure and easy way to execute transactions on mobile devices without entering 16 digits. But that will take at least two or three years to emerge.

Contributing authors are invited to create content for MarTech and are chosen for their expertise and contribution to the martech community. Our contributors work under the oversight of the editorial staff and contributions are checked for quality and relevance to our readers. MarTech is owned by Semrush. Contributor was not asked to make any direct or indirect mentions of Semrush. The opinions they express are their own.

Related stories