Can I Use The Mobile Wallet To Counter App Fatigue?: Real Questions From Real Marketers

Vibes co-founder Alex Campbell answers questions from marketers looking to overcome mobile app fatigue and drive sales.

There is no question that mobile is playing a more important role in influencing consumers as they shop.

According to a recent report by Deloitte Digital, 19 percent of all retail sales are influenced by mobile content. Over the past five years, marketers have continued to pour money into mobile apps as a means to influence these shoppers.

Our own research shows that only about 22 percent of mobile-influenced shoppers are influenced by an app.

That means a vast majority of shoppers influenced by mobile are getting their information from something other than an app. That influence can come from one or more mobile channels including email, search, the mobile web, SMS and the mobile wallet.

Linking these channels together creates a kind of mobile marketing portfolio; as with any portfolio, marketers must constantly make decisions on how best to maintain this balance to get the maximum return.

We’re quickly approaching a point where spending more on an app may actually not optimize your mobile marketing return.

One clear sign you’re approaching the limit is when you start to see slowing growth of app installs. This canary in the coalmine means you need to quickly look beyond your app to find other forms of mobile marketing that can influence shoppers.

It could be the holiday season — or perhaps it is due to the increased attention to mobile shopping now that Apple Pay is available — but in the last few months, Vibes has received an influx of inquiries from retailers around this problem of app fatigue.

As such, this article will be the first of an ongoing series with Marketing Land. First off, I will address one of the top questions Vibes is receiving at the moment: Can I use the mobile wallet to counter app fatigue?

Mobile Wallet’s Influence

Marketers can absolutely use the mobile wallet to influence shoppers. The mobile wallet brings mobile-specific features to marketers that can be used to influence shoppers that increasingly look to their phones for information. (I discuss this at length in my recent three-part series for Marketing Land.)

The launch of Apple Pay shows that the mobile wallet is not only here to stay, but also that it will continue to evolve as innovative companies iterate the customer experience. Secondly, and possibly most importantly, the mobile wallet is already being used to drive significant ROI for companies like Pep Boys, Neiman Marcus and The Home Depot.

Wallet brings valuable features that can be used to influence shoppers. In fact, a number of these features are common with apps. Reminders can be pushed to anyone who has downloaded your content into a mobile wallet. Reminders can also be automated to trigger when a customer is in your store.

These reminders work for marketers. We’ve seen a 64 percent increase in redemption when used correctly.

These reminders also work for consumers. Consumers actually like getting reminders because they see the experience as their phone remembering for them. Their phone remembers that they wanted to use an offer and it’s nudging them when they can use it.

Mobile Wallet’s ROI

The mobile wallet drives significant ROI. The mobilization of coupons and offers for Passbook and Google Wallet has been a revelation for leading automotive service provider Pep Boys.

The company found that 26 percent of customers that viewed a Pep Boys offer on their phones, saved it to Passbook. And 30 percent of those customers ended up redeeming that mobile wallet offer in-store.

View YouTube Video

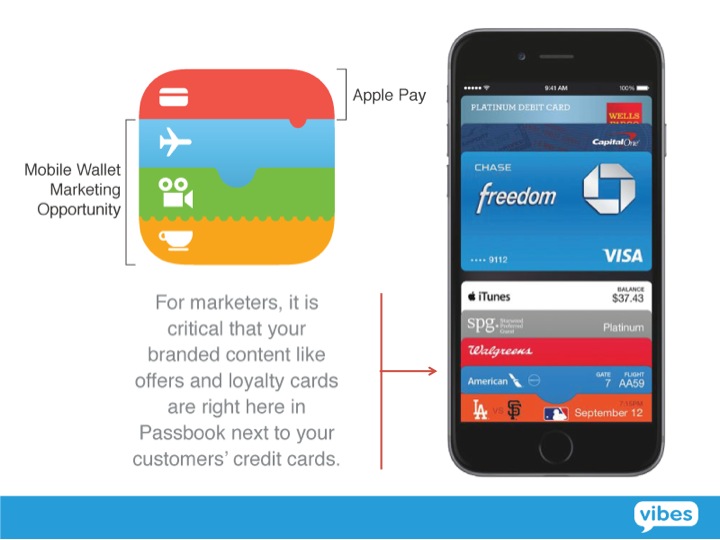

I advise marketers to not only invest in Passbook and Google Wallet for the overall experience, the proximity to customers’ credit cards and the broad reach it provides, but also for the convenience and financial opportunity for your business.

For instance, since its launch in April 2014, the campaign mentioned above for Pep Boys has driven seven-figures in sales by leveraging mobile wallet. That’s a quick and beautiful ROI your company won’t be disappointed with.

Why Now?

The launch of Apple Pay on Oct. 20 is a strong confirmation that Apple CEO Tim Cook’s vision “to eliminate the traditional wallet” is well on its way to becoming a reality. Apple Pay is driving mobile wallet adoption in big ways.

More than 1 million credit cards were added to Apple Pay in the first 72 hours after its launch — that made Passbook bigger than every other mobile wallet combined.

At Vibes, we saw a 54.3 percent increase in Passbook Pass installs among our clients in October 2014 compared with September 2014 when Apple Pay was announced.

According to a CNET story citing Juniper Research, there will be 2 billion smartphone or tablet users engaging in some form of mobile commerce transaction by 2017. Marketers must prepare to make the most of the upcoming mobile wallet era by utilizing its functionality to improve mobile marketing.

Remember This Mobile Moment

Having been in mobile marketing for almost two decades, the introduction of the mobile wallet represents a landmark moment in our industry, reminiscent of 2003 when “American Idol” put text messaging on the map by letting fans text-in to vote.

Given its ease of use, vastly improved security over classic, plastic cards and its compatibility with the POS systems of the world’s leading brands, it’s not hard to understand why Apple Pay will change the way we pay for items going forward.

And while the launch of Apple Pay is important, it is the connection to Passbook that makes it such a valuable opportunity for brands and retailers. Now, for the first time, marketers can put their brand in the mobile wallet — right next to their consumers’ credit and debit cards.

If this is a real estate opportunity, it’s the opportunity of a lifetime — and the go-to spot for your brands coupons, offers, loyalty cards and more.

Contributing authors are invited to create content for MarTech and are chosen for their expertise and contribution to the search community. Our contributors work under the oversight of the editorial staff and contributions are checked for quality and relevance to our readers. MarTech is owned by Semrush. Contributor was not asked to make any direct or indirect mentions of Semrush. The opinions they express are their own.

Related stories