Microsoft Surface 2 Growth Outpaces Kindle, Nexus Tablets

Ad network Chitika has released data showing that Microsoft Surface 2 driven web traffic has grown at a faster rate (on a percentage basis) than tablets from Amazon and Google. However it’s growing from a very small base. Microsoft’s initial Surface and Surface Pro tablets were largely failures. Surface 2 (the successor to RT) has […]

Microsoft’s initial Surface and Surface Pro tablets were largely failures. Surface 2 (the successor to RT) has received better reviews. It sells for roughly $450 and is positioned directly against the traditional iPad. The more powerful Surface 2 Pro, which seeks to be a laptop replacement, starts at $899.

For this analysis Chitika looked at millions of North American ad impressions in the month that followed the late-October release of Surface 2. The company found that Surface tablets in the aggregate were now generating 6.4 percent of all non-iPad traffic in North America.

According to the data, Android devices collectively are responsible for just under 92 percent of non-iPad traffic, with Samsung being the OEM leader followed by Amazon. All non-iPad tablets collectively generate just under 20 percent of North American tablet-related traffic. By comparison the iPad controls 80.3 percent of tablet web traffic. That’s down slightly from the 81 percent Chitika reported in October.

A flood of inexpensive Android tablets this holiday season will drive additional consumer adoption at the “low end” of the market. There are roughly 150 million smartphones in the US today and, following the holiday, there will probably be more than 100 million tablets.

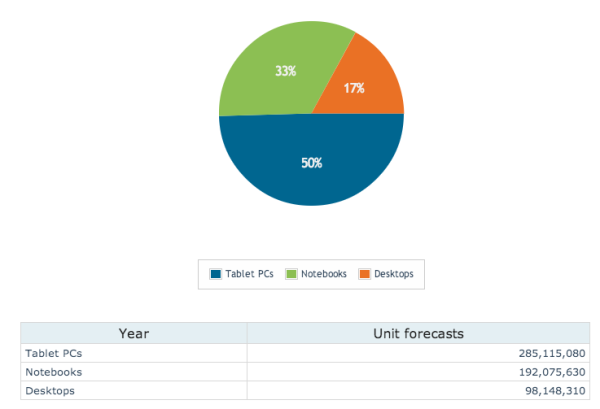

Hardware tracker Canalys projects that next year “tablets will almost out ship all other PC form factors combined, forming almost 50 percent the total client PC market.” It further argued that Microsoft tablets would grow from 2 percent (in 2012) to 5 percent of the global tablet market in 2014.

Source: Canalys

Contributing authors are invited to create content for MarTech and are chosen for their expertise and contribution to the martech community. Our contributors work under the oversight of the editorial staff and contributions are checked for quality and relevance to our readers. The opinions they express are their own.

Related stories

New on MarTech