Google Reorgs To Grab Brand Spend, YouTube The Anchor

Google bought YouTube in 2006 for $1.65 billion. There were two (or three) primary reasons: YouTube had “won” as the top online video destination, it was considered a “social media” property and Google saw it as the gateway to brand advertising dollars. For three or four years thereafter, financial analysts and institutional investors complained loudly […]

Google bought YouTube in 2006 for $1.65 billion. There were two (or three) primary reasons: YouTube had “won” as the top online video destination, it was considered a “social media” property and Google saw it as the gateway to brand advertising dollars.

Google bought YouTube in 2006 for $1.65 billion. There were two (or three) primary reasons: YouTube had “won” as the top online video destination, it was considered a “social media” property and Google saw it as the gateway to brand advertising dollars.

For three or four years thereafter, financial analysts and institutional investors complained loudly that YouTube was too costly and wasn’t making money — “when was it going to make a profit?” was the tired refrain. There were also numerous concerns about copyright liability (exemplified by Viacom’s $1 billion lawsuit against the company) .

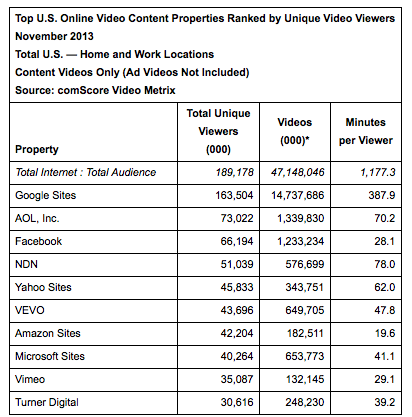

However, Google beat Viacom under the safe harbor rules of the Digital Millennium Copyright Act. And, it has continued to be the dominant video destination since the acquisition. It has the largest audience, most content and highest engagement of any online video network or site.

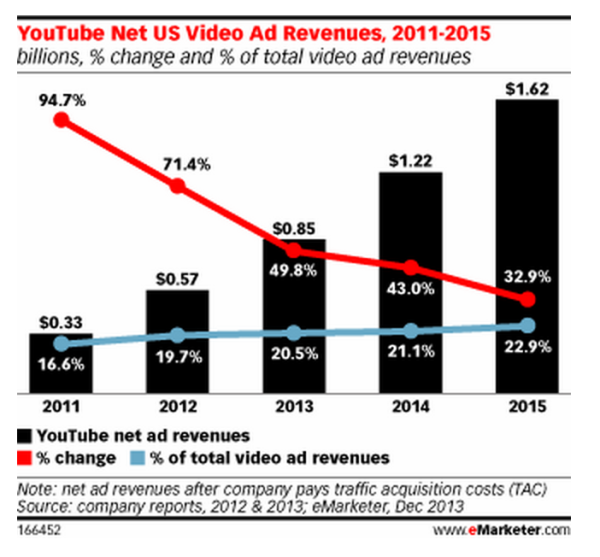

According to an analysis performed by eMarketer, YouTube will make $5.6 billion in gross ad revenue in 2013. Of that figure, YouTube will see $1.96 billion in net ad revenue this year. Net ad revenues for YouTube in the US will be just over $1 billion, which represents about 6.3 percent of Google’s 2013 US net ad revenue according to eMarketer.

According to USAToday Google recently reorganized its ad business into two primary units: “a performance advertising group and a brand advertising group.” Formerly product-specific groups (i.e., search, display, social, mobile) are now subsumed under these broader categories. YouTube and video are at the center of Google’s renewed push into brand budgets.

It’s smart for Google to think about advertiser objectives rather than ad platforms. It will help internal coordination across platforms and also offer more of what agencies and advertisers want — simplification.

Google’s rivals, Facebook, Yahoo and Twitter, are also using video as a way to grab more brand dollars. According to an estimate from eMarketer digital brand advertising will be worth $18 billion this year, growing to $31 billion by 2017. Overall brand advertising (including TV and other traditional media) may be worth between $200 and $300 billion in the US on an annual basis.

Contributing authors are invited to create content for MarTech and are chosen for their expertise and contribution to the search community. Our contributors work under the oversight of the editorial staff and contributions are checked for quality and relevance to our readers. MarTech is owned by Semrush. Contributor was not asked to make any direct or indirect mentions of Semrush. The opinions they express are their own.

Related stories

New on MarTech