Apple Earnings: $42.1 Billion, Driven By Nearly 40 Million iPhones Sold

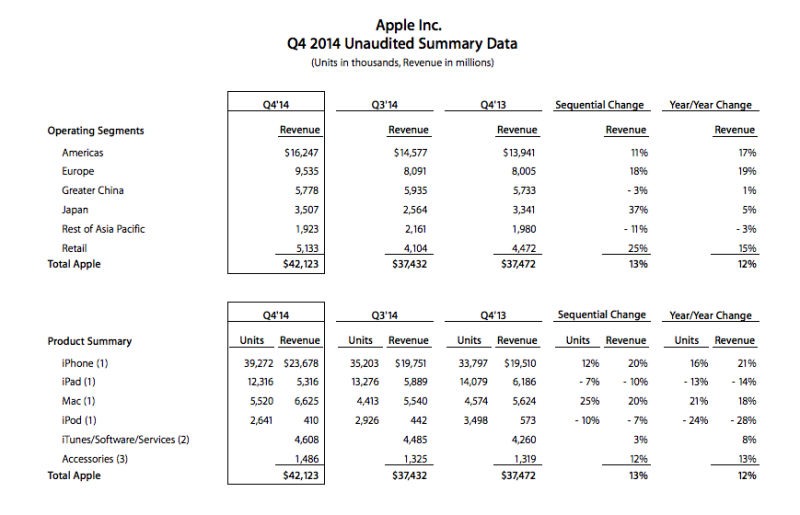

Apple announced very strong fiscal Q4 results. The company beat expectations with $42.1 billion in revenue and profit of $8.5 billion. A year ago Apple’s quarterly revenue was $37.5 billion. Apple is up in after-hours trading. The company said that 60 percent of its revenue was from outside the US. Here are the top-line hardware numbers: iPhone sales: 39.3 million units iPads: […]

Apple announced very strong fiscal Q4 results. The company beat expectations with $42.1 billion in revenue and profit of $8.5 billion. A year ago Apple’s quarterly revenue was $37.5 billion.

Apple is up in after-hours trading.

The company said that 60 percent of its revenue was from outside the US. Here are the top-line hardware numbers:

- iPhone sales: 39.3 million units

- iPads: 12.3 million units

- Macs: 5.52 million units

- iPod: 2.64 million units

The company beat analysts consensus revenue estimates and earnings per share, largely on the basis of strong iPhone sales. Once again iPad sales came in somewhat under estimates. Gross margin was 38 percent.

China contributed nearly $5.8 billion to Apple’s revenues during the quarter. Apple also made $4.6 in sales associated with iTunes.

The iPhone generated 56 percent of Apple’s total quarterly revenue. It’s not clear how much the iPhone contribution was because of the iPhone 6. Next quarter should also see record iPhone sales and revenue. Indeed Apple raised its end of calendar-year guidance.

CEO Tim Cook opening remarks celebrate hardware sales and revenue numbers:

- “Demand for the iPhone has been staggering”

- “Strongest revenue growth rate in seven quarters . . . a new record for Apple’s September quarter”

- Especially proud of Mac results, especially vs. rest of industry . . . achieved quarterly PC market share record

- App store revenue grew 36 percent over last year

- 437 Apple retail stores around the world

- Developing markets: $50 billion in revenue in fiscal 2014

- Company made 20 acquisitions in fiscal 2014

- 2014 the company’s best year on the books

CFO Luca Maestri:

- Mac growth was 21 percent year over year. Strongest demand was for Macbook Pro and Air. “These results are truly remarkable given the contraction in the PC market.”

- iPad sales were less than last year, though “consistent with [Apple’s] expectations.” However in Japan sales were up 46 percent vs. last year

- iPad has 90 percent share of the US education tablet market

- 41 percent of Apple stores are outside the US

- Average revenue per store is $11.9 million, 18K visitors per store per week

- $155 billion in cash and equivalents at end of quarter

- Outlook: $63 to $66 billion expected in the upcoming quarter despite unfavorable exchange rates

The company is going to report Apple Pay revenues under a new category “services,” which will also include iTunes and other software sales. Apple will report iPod and Apple Watch sales in a new category called “other products.” Retail store revenues will be reported in the geographic areas in which the stores are located. Otherwise business is: Macs, iPhones, iPads.

Analyst questions:

- Q: What is the business model for Apple Pay, will it become a stand-alone business over time?

- Tim Cook: Apple Pay is intended to deliver “an incredible consumer experience . . . We do think we will sell more devices because we think it’s a killer feature.” Apple makes money from the participating banks, not on the merchant or consumer.

- Q: About iPhone demand vs. supply and when balance will be achieved?

- Tim Cook: Demand is far outstripping supply.We’re not close to achieving demand-supply balance. At this point it’s difficult to gauge what the true demand is. We’re seeing every country with a marked improvement in demand over the previous year.

- Q: There have been a couple of questions about exchange rates and corresponding “headwinds” (not going to reproduce responses).

- Q: Has the iPhone 6 accelerated the iPhone replacement cycle?

- Tim Cook: I still see a fairly large opportunity in people buying their first iPhone ever — with the 6 and 6 Plus that opportunity increases. Regarding the upgrade market . . . that number is huge. That will go on for some time. We’re still in the early going, and we’re selling everything we’re making. “I’ve never felt so great after a launch before.”

- Q: Regarding the mix of sales between 6 and 6 Plus

- Tim Cook: We can’t accurately assess demand now. It is clear we will see a difference in screen-size preference by geography (suggesting Asia and other markets will prefer 6 Plus).

- Q: Regarding Mac sales (strength) and iPad (weakness)

- Tim Cook: Absolutely “stunning” Mac sales. For iPad: I know there’s a lot of negative commentary on the market on this . . . but if you back up — we’ve sold 237 million in four years — that’s 2X vs. the iPhone in its first four years. I view it as a speed bump not as a “huge issue.” That said, we want to grow. We don’t know that the upgrade cycle is for people yet; we’ve only been in this business for four years. Enterprise is a key market for iPad.

- Q: Why is the Apple Watch in the “other” category? Does this say something about sales expectations?

- Tim Cook: It says nothing about our expectations. In the future we might decide something different. He says he doesn’t want to break out Apple Watch to give competitors any insights into product performance. (However it is strange.)

Contributing authors are invited to create content for MarTech and are chosen for their expertise and contribution to the search community. Our contributors work under the oversight of the editorial staff and contributions are checked for quality and relevance to our readers. MarTech is owned by Semrush. Contributor was not asked to make any direct or indirect mentions of Semrush. The opinions they express are their own.

Related stories