Analyst Firm: $172 Billion In Mobile Payments This Year

The confusion and cacophony around mobile payments, it seems, grows louder with each new product release or startup. Most people would consider mobile payments to be in their infancy. However a report from Gartner projects mobile payments this year will reach a massive $171.5 billion on a global basis. Last year mobile payments were roughly […]

The confusion and cacophony around mobile payments, it seems, grows louder with each new product release or startup. Most people would consider mobile payments to be in their infancy. However a report from Gartner projects mobile payments this year will reach a massive $171.5 billion on a global basis. Last year mobile payments were roughly $106 billion according to the firm.

The confusion and cacophony around mobile payments, it seems, grows louder with each new product release or startup. Most people would consider mobile payments to be in their infancy. However a report from Gartner projects mobile payments this year will reach a massive $171.5 billion on a global basis. Last year mobile payments were roughly $106 billion according to the firm.

The definition of “mobile payments’ being used by the firm is extremely expansive. Hence the large number.

Gartner said that it expects “Web/WAP access to account for about 88 percent of total transactions in North America and about 80 percent in Western Europe by 2016. Near Field Communication (NFC) transactions will remain relatively low through 2015, although growth will start to pick up from 2016.” If that’s right it spells trouble for Google’s NFC-based Wallet, which has been struggling for consumer adoption.

Under the “mobile payments” heading, Gartner’s forecast includes a range of transaction types that are distinct. It includes “m-commerce,” mobile bill paying, SMS money transfers and mobile wallet-type in-store transactions.

Is a “one click” purchase transaction on the Amazon mobile app a “mobile payment”? Or should the notion be limited to the concept of mobile wallets, where the phone is used to pay in lieu of plastic cards or cash? Rather than “payments” a better term might be “mobile transactions.” In the end, however, this is about people shifting payment and buying behavior to mobile devices.

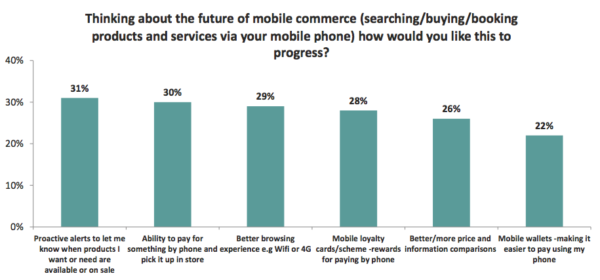

Reflected in the graphic above, a recent IAB study found that significant numbers of users were favorably inclined toward mobile transactions and mobile wallets. Nielsen also discovered, in the context of a multi-country survey, that “35 percent of online respondents worldwide say they are likely to make payments with their mobile phones.” Yet there are a number of competing survey examples, where people express concern about security or general indifference toward mobile wallets.

Make no mistake, however, mobile payments/wallets are coming. The only question is how long it will take to reach critical mass.

Google, mobile carriers, PayPal, Square, Intuit, LevelUp and soon Groupon, among others, are pushing mobile payment solutions to consumers and merchants alike. But while this frenzy of activity and product launches has the potential to accelerate awareness it also creates noise, competing platforms and systems and consumer confusion.

Contributing authors are invited to create content for MarTech and are chosen for their expertise and contribution to the search community. Our contributors work under the oversight of the editorial staff and contributions are checked for quality and relevance to our readers. MarTech is owned by Semrush. Contributor was not asked to make any direct or indirect mentions of Semrush. The opinions they express are their own.

Related stories

New on MarTech