How Long Before Mobile Payments Are Mainstream?

Mobile payments is one of the most competitive and dynamic segments right now. Mobile carriers, credit card companies, Google, eBay/PayPal, Square, Intuit and various other startups are offering a range of tools, platforms and apps for local business owners, retailers and consumers. The question is how long will it take for mobile payments to take […]

The question is how long will it take for mobile payments to take hold? Google Wallet, for example, is moving at a glacial pace in terms of consumer adoption.

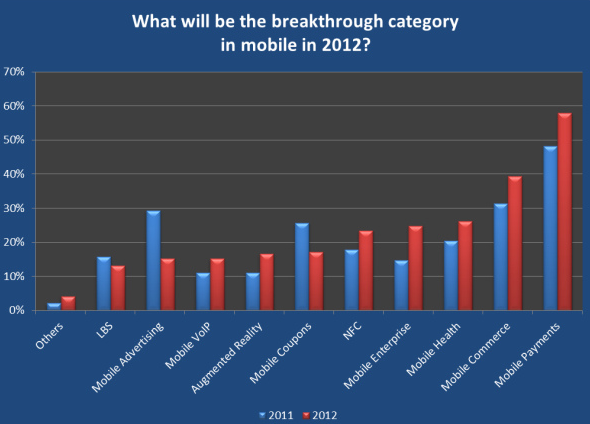

Earlier this year mobile industry consultant Chetan Sharma conducted a 2012 predictions survey among “executives, developers, and insiders (n=150) from leading mobile companies and startups from across the value chain.” Mobile payments was the “breakthrough” mobile category identified in the survey.

However it’s very unlikely that 2012 will in fact be a breakthrough year. It’s also unlikely that 2013 will see widespread adoption of mobile payments. It will probably take several years for mobile payments to gain mass consumer traction.

A new survey of a semi-random assortment of “experts and other Internet stakeholders,” by the Pew Internet & American Life Project, finds that a majority (65 percent) of respondents agree with the statement that by 2020 “most people will have embraced and fully adopted the use of smart-device swiping for purchases they make, nearly eliminating the need for cash or credit cards.” One third of respondents, however, were bearish, agreeing with a contrary statement that NFC and mobile payments will not have caught on by that date.

A 2012 consumer survey conducted by the US Federal Reserve and published in March found that 12 percent of respondents had made a “mobile payment” within the past year. However “payment” was broadly defined to include online bill paying, m-commerce, charitable giving and money transfers, among other transactions. Online bill paying was by far the most common “mobile payment” activity according to the survey.

Use of a mobile phone as a “virtual wallet” was only discussed in passing, almost as an afterthought. However “mobile wallet” is mostly what we mean when we discuss mobile payments.

Below are concerns identified by the survey that represent barriers to mobile payments adoption. Concerns over security and the absence of clear benefits are the top two obstacles according to the Federal Reserve survey:

(n=1,780)

Accordingly mobile payments vendors must guarantee security and provide “zero liability” protection assurances to consumers. As part of that education process they also need to offer incentives (i.e., rewards, deals, convenience) that encourage adoption.

Eventually mobile wallets/payments will be mainstream. But like everything else it will take a bit longer — at least in developed countries — than originally anticipated.

Opinions expressed in this article are those of the guest author and not necessarily MarTech. Staff authors are listed here.

Related stories