Amazon’s high-flying advertising growth levels out

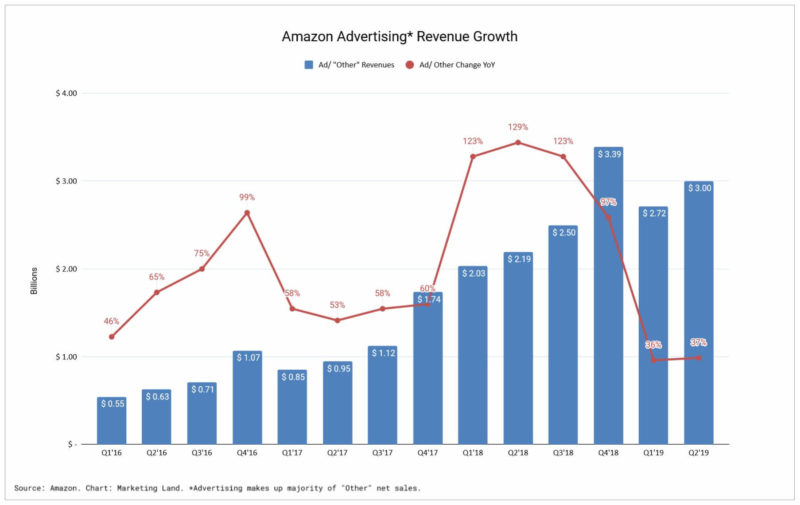

Amazon's advertising businesses grew around 36% year over year in Q2 2019.

Amazon’s advertising business had it’s second $3 billion quarter in the second quarter of 2019. (Or close to it — Amazon advertising revenues make up the majority of an “Other” revenue category in its earnings reports.) The first was the holiday fourth quarter last year.

While $3 billion in an off-holiday, non-Prime Day quarter is a milestone, growth is coming back down to earth. Second-quarter ad revenue increased 37% from the previous year, the second-straight quarter of relatively mild growth compared to the triple-digits Amazon recorded in much of 2018.

Not surprisingly, Amazon’s biggest advertising market continues to be North America, the only market where several of the latest advertising tools are available. But, the company is eyeing international advertising growth with product expansions and measuring “around improving relevancy on each of those geographic websites,” said Dave Fildes, Amazon director of investor relations, on the earnings call.

On the Sizmek acquisition. Amazon acquired Sizmek’s ad server and dynamic creative optimization in June. The acquisition will enable advertisers to use Amazon’s data from searches and purchases to target audiences beyond its own properties. Sizmek continues to operate independently, but executives said they’re looking long-term at the investment.

“We’re invested in the long-term success of Sizmek. And again, Amazon advertising and Sizmek has many mutual customers, so we know how valued these prudent solutions are to the customer base,” said Fildes. “So we’re looking forward to working with that team and we’ll share more updates as we invent and create new opportunities to serve advertisers in the future.”

That should mean more brand opportunities as Amazon makes more video supply available across its properties, including OTT video supply, the company said. That includes adding supply via Fire TV apps, IMDb TV, Amazon Publisher service integrations and simplifying inventory access for third-party apps, said Fildes.

Amazon’s video and display offerings across its owned properties and networks, can be targeted using Amazon data, and open up advertiser demand beyond Amazon vendors and sellers.

Contributing authors are invited to create content for MarTech and are chosen for their expertise and contribution to the search community. Our contributors work under the oversight of the editorial staff and contributions are checked for quality and relevance to our readers. MarTech is owned by Semrush. Contributor was not asked to make any direct or indirect mentions of Semrush. The opinions they express are their own.

Related stories