Amazon Getting Ready To “Fork” Market With Free Smartphone

Former Wall Street Journal writers Amir Efrati and Jessica Lessin are reporting that Amazon is considering offering its forthcoming “forked” Android handset(s) for free. According to the article: There are many unanswered questions about the plan and what strings will be attached for customers. One of them is whether Amazon would require its smartphone owners […]

Former Wall Street Journal writers Amir Efrati and Jessica Lessin are reporting that Amazon is considering offering its forthcoming “forked” Android handset(s) for free. According to the article:

There are many unanswered questions about the plan and what strings will be attached for customers. One of them is whether Amazon would require its smartphone owners to pay for services such as Amazon Prime, the company’s loyalty program. But the people familiar with the matter said that Amazon wants the device to be free whether or not people sign up for a new wireless plan at the same time. (Wireless carriers typically discount the price of devices if customers sign up for a one- or two-year wireless contract.)

The article goes on to speculate about how a free Android smartphone (or phones plural) would impact the market and other competitors, especially Apple. The conventional wisdom is that it would be devastating. It’s not clear that’s true however.

According to various sources the just-released Moto X costs roughly $225 to produce (in the US). The iPhone costs just under $200 to produce (in China).

If Amazon were to offer a reasonably good Android-based smartphone it wouldn’t cost much less than $150 to make at the very rock bottom (if it could be done). The original Kindle Fire cost $201 to manufacture according to iSuppli.

Amazon rocked the tablet market when it introduced the device for $199 and forever lowered the bar for 7-inch tablet pricing. For example, the original 7-inch BlackBerry playbook had been priced at $499.

Since the first Kindle Fire, multiple tablets have been introduced by Amazon. You can now buy a 7-inch Kindle Fire (basic model) for $159, which is likely below cost.

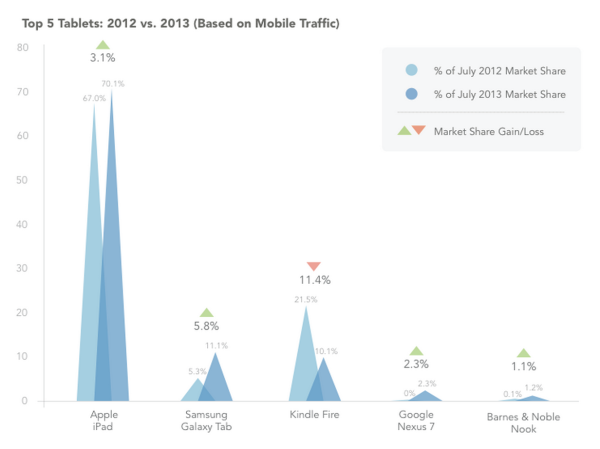

Source: Jumptap

Amazon has been able to make money on these devices through a combination of ads, increased sales and content (apps, movie and music). However if Amazon were to “eat” a huge amount like $200 (or $150 even) per device — and they were as popular as the free pricing is intended to make them — it would take a big bite out of Amazon’s earnings.

While never revealing specific numbers, Amazon has touted the success of the Kindle Tablet. Indeed, it achieved second position in the US market after the iPad (though behind it by a wide margin). However there’s new evidence that Kindle Fire’s momentum has stalled. According to a recent report from mobile ad network Jumptap, (graphic above) Kindle tablets saw their US traffic drop by 50 percent vs. last year.

In other words the subsidized cost has carried the device this far but possibly not much further in an increasingly competitive market. Indeed, the original Kindle Fire was an inferior product to the iPad and Nexus 7. Kindle tablets 2.0 remain inferior to the iPad but have improved. Samsung is churning out new and improved devices by the week practically and putting global marketing campaigns behind them.

Amazon’s success in the smartphone market, even with a free or low-cost device, is far from assured. The central dilemma for Amazon is this: it will be difficult for the company to differentiate its device on specs and design. Thus it’s using aggressive pricing (in the extreme) to grab attention and potential market share. But if the phone is a, “piece of crap” many people may obtain them but not use them.

If the phone is truly competitive from a design and hardware perspective then Amazon (still assuming the “free” pricing) will be swallowing huge costs that it won’t be able to make back on content sales and ads. It may be thinking this phone will penetrate markets such as China and India and be a Trojan Horse for Amazon’s other services, radically expanding the company’s overall share and transaction volume in those markets.

Homescreen or idle screen ads on an Amazon smartphone, which would almost be guaranteed, could prove an annoying disincentive for anyone who could afford a more conventionally priced smartphone.

Overall it seems very unlikely that Amazon could, through a mix of revenue streams, entirely compensate for the lost manufacturing costs with ads or content sales — even if it were to require a Prime membership ($75 per year). For this reason I don’t think we’ll see a free smartphone from Amazon.

But we may see Amazon handsets priced under $100 unlocked. That would still rock the smartphone world.

Contributing authors are invited to create content for MarTech and are chosen for their expertise and contribution to the martech community. Our contributors work under the oversight of the editorial staff and contributions are checked for quality and relevance to our readers. The opinions they express are their own.

Related stories