Report: By end of 2017 there will be more than 30 million voice assistants in US homes

Voice app retention turns out to be a bigger problem on intelligent assistant devices than on smartphones.

Investment research firm Consumer Intelligence Research Partners (CIRP) has estimated that there are now 8.2 million US homes with Amazon Echo/Alexa devices. Independently, voice analytics company VoiceLabs asserts that Google has sold somewhere between 400,000 and 500,000 Home devices since launch.

Not counting Siri, Cortana and the Google Assistant on smartphones, Echo and Home together make a market approaching nine million “voice-first devices,” according to these two estimates from CIRP and VoiceLabs. The latter has just released a report seeking to describe and quantify what it calls the emerging “voice-first ecosystem.”

VoiceLabs estimates that 24.5 million voice-first devices will ship this year, which will mean more than 30 million total voice-powered intelligent assistants in US homes by the end of the year. While that remains to be seen, there is clearly a large market here, and a growing number of developers are trying to get in front of it.

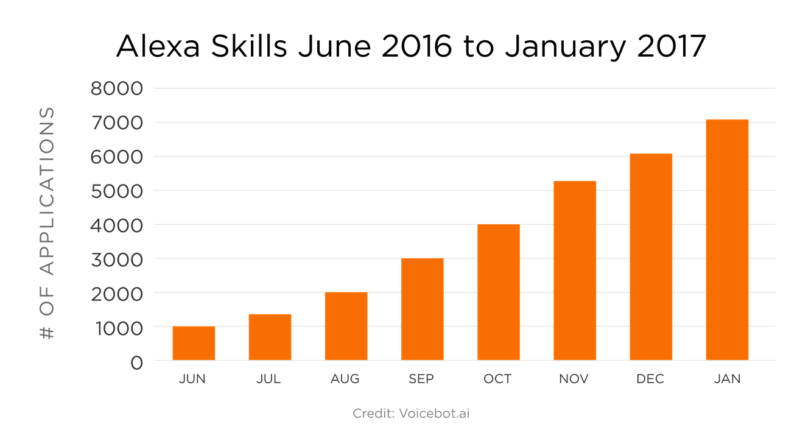

There are already more than 7,000 Alexa skills (voice apps) according to Amazon itself. There are problems, however, of quality and discovery. In addition, there’s a significant user retention problem, much more acute than with smartphone apps.

VoiceLabs reports, “When a voice application acquires a user, there is only a 3 percent chance that user will be active in the second week.” That’s because most skills aren’t particularly useful, interesting or entertaining. That should improve in the relatively near future.

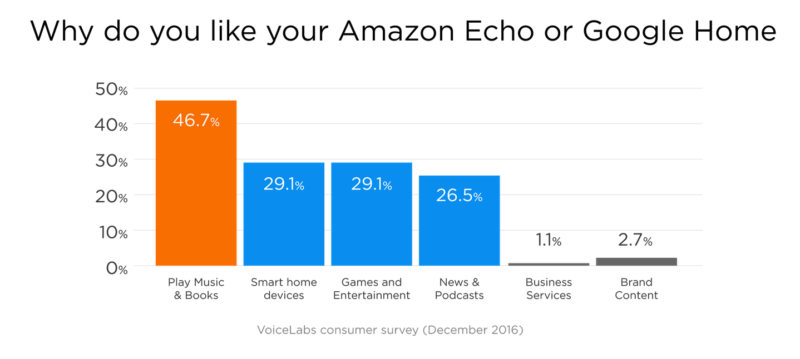

The dominant use cases currently involve listening to music or audio content, followed by smart-home device control. Business services and branded content represent a tiny minority of offerings and usage today, though that, too, will change over time.

One of most interesting findings in the report is that most people who have an existing device — either Google Home or Amazon Echo — are highly unlikely to buy a competing one:

VoiceLabs surveyed consumers who already own a Google Home or Amazon Echo, and currently only 11 percent of respondents will also buy a competing device.

Accordingly, the company argues that while the voice-first market is not winner-take-all, it will be “winner take entire household.” (I have both Home and Alexa devices.) If that’s accurate, it probably means that Amazon already has a significant advantage over competitors.

VoiceLabs also offered some interesting predictions for 2017 in the report. Among them, voice assistant devices will enable calling or messaging for “direct person-to-person communication.” This is a natural, and I agree it will happen soon.

Another area of speculation is the business model. Currently, there is no direct monetization — transactions or “radio ads” are possible — but VoiceLabs also predicts that the market will seen the introduction of new voice-first monetization capabilities this year.

Contributing authors are invited to create content for MarTech and are chosen for their expertise and contribution to the martech community. Our contributors work under the oversight of the editorial staff and contributions are checked for quality and relevance to our readers. The opinions they express are their own.

Related stories