MoPub: Fortune 1000 Brands Spent More On In-App Ads Than Performance Advertisers In Q4

Increased participation in private marketplace transactions and added native and video ad supply helped propel brand spend.

MoPub reports that, for the first time, in Q4 2015 brand spending outweighed that of performance advertisers on the in-app ad exchange.

Fortune 1000 brands accounted for more than half of the ad spend on the MoPub exchange globally in Q4, and Fortune 500 brands generated a third of total spend. That’s according to the Q4 2015 Global Mobile Programmatic Trends report that the Twitter-owned ad exchange released on Wednesday.

More Ad Buys Happening Via Private Marketplace

The shift in brand spend stemmed in part from the higher number of private marketplace transactions where publishers can sell premium inventory programmatically to selected advertisers. Compared to the previous quarter, private marketplace deals rose 30 percent, and publisher revenue from private marketplaces increased 165 percent quarter-over-quarter in Q4 2015.

This growth follows the larger trend. According to eMarketer, private marketplace transactions are now the fastest growing method for buying mobile ads programmatically in the US. MoPub launched private marketplace buying on its exchange in 2012.

Native And Video Ad Supply & Demand Rose, Particularly In APAC And EMEA

A little over a year ago, the ad format that saw the steepest competition was the interstitial. Demand has since shifted to native and video ad formats.

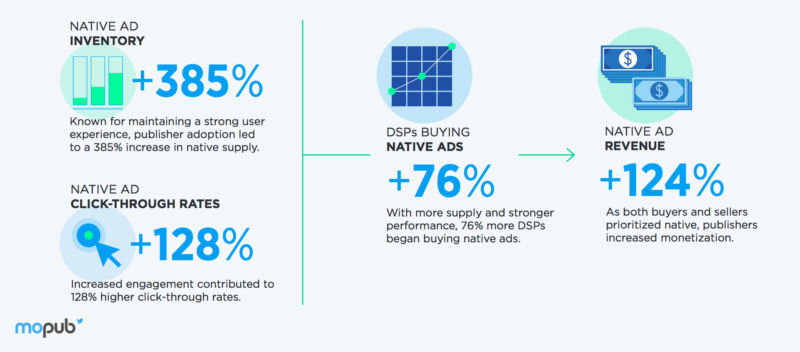

Native inventory on the exchange shot up 385 percent from a year ago as more app publishes adopted the format. Demand for native increased by 76 percent among demand-side platforms (DSPs) buying on the exchange. MoPub reports click-through rates on native ads also rose 128 percent from a year ago.

Demand from DSPs for video inventory doubled compared to Q4 2014. MoPub also reported video ads generate the highest click-through rates. With the added demand, publisher revenue from video ads more than doubled year-over-year as eCPMs rose 55 percent.

Driving the surge in video and native supply were app publishers in the APAC and EMEA regions. In APAC video inventory supply increased by 114 percent and native supply increased by 1,184 from a year ago. EMEA saw a 107 percent increase in video ad inventory and 138 percent increase in native ad inventory year-over-year.

Overall, MoPub reported a 25 percent increase in the number of DSPs and 115 percent boost in the number of advertisers buying on the exchange compared to Q4 2014, with total spend increasing 125 percent on the exchange year-over-year.

Social and gaming apps on the exchange continued to see demand increase among brand advertisers: eCPMs rose 200 percent for gaming app publishers and 139 percent for social apps in Q4 compared to the previous quarter.

The full report is available on SlideShare.

Contributing authors are invited to create content for MarTech and are chosen for their expertise and contribution to the search community. Our contributors work under the oversight of the editorial staff and contributions are checked for quality and relevance to our readers. MarTech is owned by Semrush. Contributor was not asked to make any direct or indirect mentions of Semrush. The opinions they express are their own.

Related stories