Why Meeker sees ecommerce, digital ad revenues slowing down

The rise in global internet adoption means more fragmentation across the consumer spectrum, which ultimately amounts to less concentrated growth.

New data from famed internet analyst Mary Meeker suggests online advertising and ecommerce growth may be slowing, but that doesn’t make these channels any less important for marketers to maximize.

Online Advertising

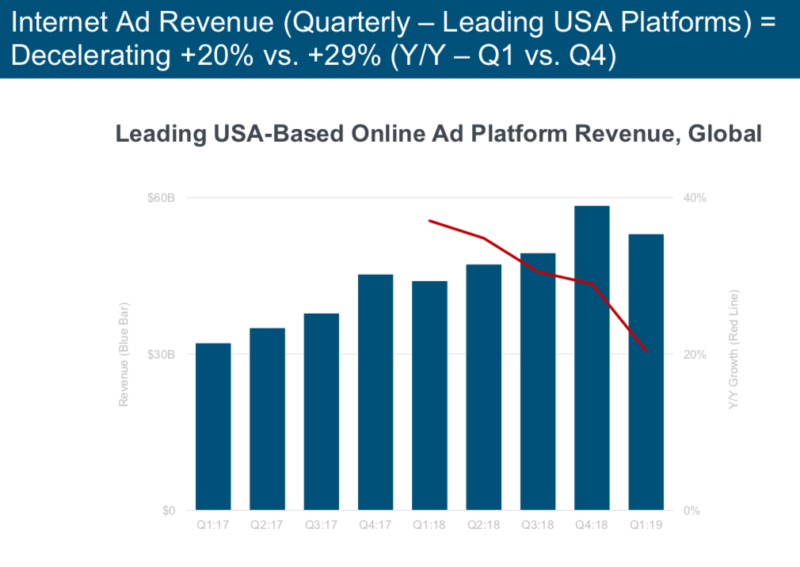

According to Meeker’s Internet Trends 2019 report, year over year growth in internet ad revenue on the top US platforms — Google, Facebook, Twitter, Amazon, Snapchat and Pinterest — has been slowing since the first quarter of 2018.

Google still reigns supreme — by a wide margin — in terms of ad platform revenue, with Facebook following in second. Ad revenue on smaller platforms — Amazon, Twitter, Snap

Programmatic ad buying has seen rapid adoption, growing from 10% of ad spend in 2012 to 62% in 2018. Meeker said the growth in programmatic has put downward pressure on ad display ad pricing.

Meeker pointed to specific factors driving ad share for Facebook (audience customization for targeting), YouTube (machine learning-powered Bumper Machine), Pinterest (shoppable catalogs) and Twitter (high-relevance promoted tweets).

Ecommerce

Although ecommerce sales now account for 15% of all retail purchases, Meeker reported that the growth rate is slowing down when stacked against previous years. Ecommerce as a whole saw revenue growth barely inching up year-over-year, with the first quarter of 2019 showing a 12.4% growth rate – as opposed to the 12.1% growth rate of last year.

Ecommerce continues to see faster growth at 12% year over year than

Direct -to-consumer brands are capitalizing on rich consumer data with deeper personalization, resulting in more innovative strategies and a higher consumer satisfaction than ever before. But even so, the cost of customer acquisition is climbing to unsustainable levels.

Still crucial, despite slowing down

Despite flattening trends in ad spend and revenue growth, make no mistake: ecommerce (and digital advertising, by extension) will still remain a crucial factor in the marketing mix for brands and retailers. In our connected digital ecosystem, new technologies, innovative media, and the rise in global internet adoption means more fragmentation across the consumer spectrum, which ultimately amounts to less concentrated growth.

Audiences and business goals vary from brand to brand, but ecommerce marketers and advertisers should still be looking at long-term strategies through the lens of the online trends as a whole.

Contributing authors are invited to create content for MarTech and are chosen for their expertise and contribution to the search community. Our contributors work under the oversight of the editorial staff and contributions are checked for quality and relevance to our readers. MarTech is owned by Semrush. Contributor was not asked to make any direct or indirect mentions of Semrush. The opinions they express are their own.

Related stories

New on MarTech