Survey: Android Pay most used payment app, security fears holding adoption back

Survey found that P2P payments were growing faster than in-store mobile payments, driven by Millennials.

At Apple’s WWDC yesterday, the company announced that it was extending Apple Pay to the mobile web. This was rumored earlier this year and only quickly mentioned by Apple Senior VP Craig Federighi during his keynote remarks.

The expansion of Apple Pay to websites (desktop and mobile) is potentially significant for ecommerce and for Apple Pay adoption. According to a recent consumer survey by PYMTS.com, 23 percent of iPhone owners had used Apple Pay, up from 17 percent last year.

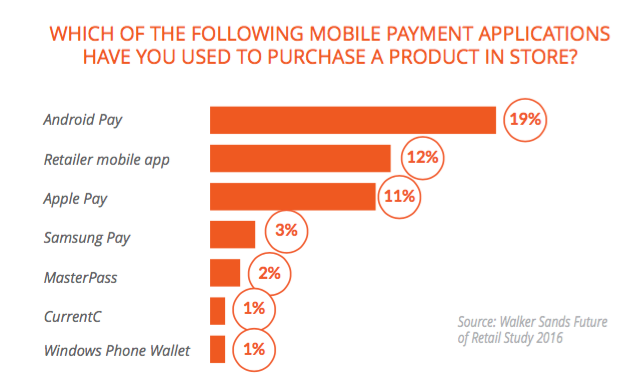

A more recent survey from PR firm Walker Sands found by comparison that only 11 percent of users had tried Apple Pay. The discrepancy probably results from different survey samples: iPhone users vs. mobile users generally.

In the Walker Sands survey data, Android Pay was found to be the most widely used mobile payment app (19 percent). That was followed by “retailer mobile apps.” Curiously, most retailers don’t have in-store mobile payments capabilities, though virtually all offer apps with ecommerce. A few larger retailers, such as Walmart with “Walmart Pay,” do have in-store mobile payments.

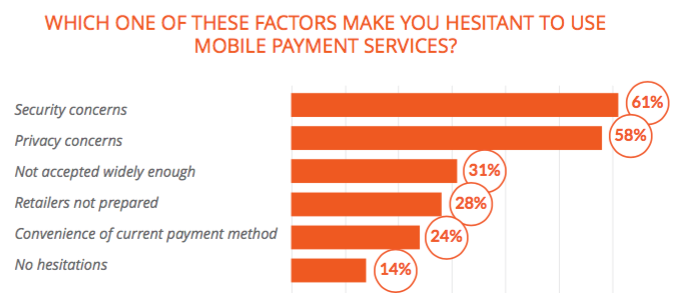

Security and privacy remain the main concerns holding consumers back from adopting in-store mobile payments. This is mostly a problem of education and consumer ignorance. Most mobile payment technologies, and certainly Android Pay and Apple Pay, offer better security than conventional credit card payments at the point of sale.

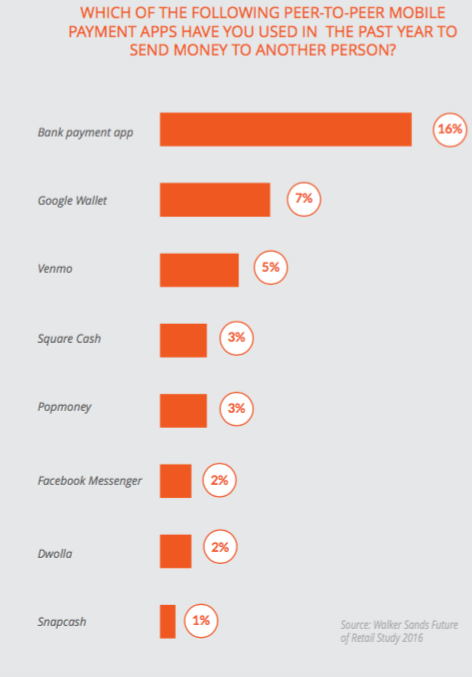

Interestingly, the survey found that peer-to-peer payments usage was gaining faster adoption than in-store mobile payments. Here, Google also had a leadership position:

Indeed, peer-to-peer payment (P2P) apps like mobile banking applications, Venmo and even Snapchat continue to be on the rise, led primarily by younger shoppers. While a third of consumers overall have used a P2P app in the past year, 44 percent of those ages 18 to 25 and 38 percent of those 26 to 35 have done so. That compares to only 17 percent of consumers ages 46 to 60.

Millennials are also most likely to have used any mobile payment app, with 64 percent of 18- to 25-year-old consumers making a mobile purchase over the past year, compared to only 25 percent of the 61 and older crowd.

These survey data are part of a larger report on retail shopping and are based on a February 2016 online survey of of 1,433 US adults. Additional survey data from the Walker Sands report can be accessed here (lead-gen form fill required).

Contributing authors are invited to create content for MarTech and are chosen for their expertise and contribution to the search community. Our contributors work under the oversight of the editorial staff and contributions are checked for quality and relevance to our readers. MarTech is owned by Semrush. Contributor was not asked to make any direct or indirect mentions of Semrush. The opinions they express are their own.

Related stories