Shy of 100MM, survey finds Amazon Prime membership growth has flattened in US

Quarterly member growth has slowed to less than 2 percent, according to CIRP.

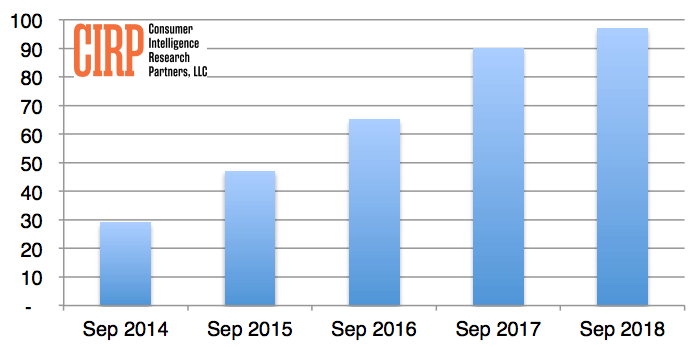

Consumer Intelligence Research Partners (CIRP) has tracked the growth of Amazon Prime in the US over the past several years. Until very recently, Amazon has seen double-digit growth in the number of Prime memberships.

Nearing 100 million US members. CIRP says that today Amazon Prime has 97 million US members, which is up from 90 million members a year ago. That represents 61 percent of total US Amazon customers. Amazon itself said in April that it had “exceeded 100 million paid Prime members globally,” in a letter to shareholders. That suggests that the CIRP estimates might be aggressive.

US Amazon Prime Members (millions)

Growth slowing considerably. Annual growth of Prime is roughly 8 percent but sequential growth is now 1 to 2 percent. However, Prime members are a massive group of Amazon shoppers and spend more, more often than non-Prime Amazon customers.

According to CIRP data:

- Prime members spend an average of $1,400 per year vs. $600 for non-Prime customers

- Prime members shop on Amazon 26 times per year vs. 14 times for non-Prime customers

- Prime members spend $55 per visit vs an average of $42 per visit for non-Prime customers

- Prime members purchase 2.2 items on average per visit vs. 2 items for non-Prime customers

Total spending by Prime members in the US, then, would be $1.36 billion dollars.

What it means for marketers. It’s not clear how many third-party sellers are using Prime two-day shipping but my guess is that they’re reaping some of the same spending benefits CIRP identifies above.

Regardless of whether they’re using Prime shipping, Amazon sellers will be spending more on Amazon ads for improved visibility. It’s now the third largest ad platform after Google and Facebook.

Notwithstanding slowing growth for Prime, Amazon is the dominant online shopping destination for a large majority of American consumers. Surveys indicate that Amazon will be the place they go first online for holiday shopping — by a large margin, even over Google.

Contributing authors are invited to create content for MarTech and are chosen for their expertise and contribution to the martech community. Our contributors work under the oversight of the editorial staff and contributions are checked for quality and relevance to our readers. The opinions they express are their own.

Related stories

New on MarTech