The Shifting Landscape Of Mobile

If you’ve been keeping your eyes open, the shift to a mobile-first world should come as no surprise. Even beyond the data itself, all you need to do is take a walk outside, step into a Starbucks line, or take a trip on a bus to see how many eyes are glued intently to mobile […]

If you’ve been keeping your eyes open, the shift to a mobile-first world should come as no surprise. Even beyond the data itself, all you need to do is take a walk outside, step into a Starbucks line, or take a trip on a bus to see how many eyes are glued intently to mobile devices.

Not surprisingly, advertisers have started to shift their strategies to think about how to best use the mobile channel.

We took a look at search, social, and display advertisers in the Marin Global Online Advertising Index to understand just how advertiser spend has adapted to the shifts in consumer behavior.

What did we find? Advertisers have begun making large shifts away from desktop and spending more on the mobile channels — big shocker there.

The Role Of Mobile Within Search

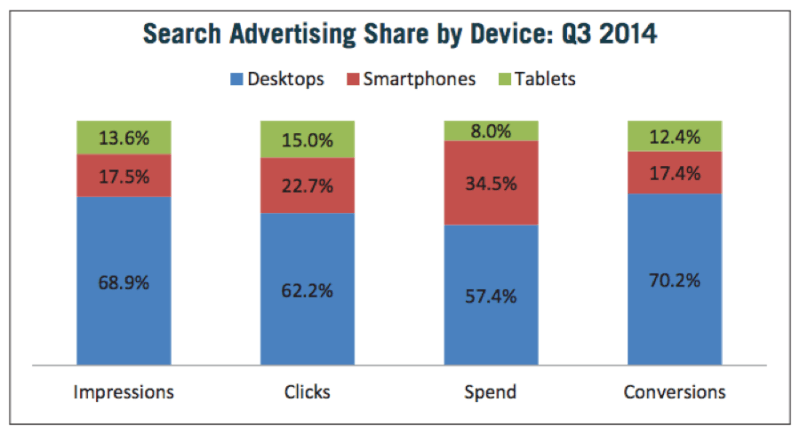

On search, mobile device (smartphone and tablet) share has increased significantly in the past year, with smartphones capturing the lion’s share of the growth. Year-over-year (YoY), desktops have lost 8.5% click share, with smartphones snapping up 6.1%.

However, while eyeballs and clicks may have been migrating more to mobile, consumer wallets have been slower to follow. Advertisers devote over 42% of all spend on mobile devices, but mobile conversions only make up about 30% of search conversions.

However, while eyeballs and clicks may have been migrating more to mobile, consumer wallets have been slower to follow. Advertisers devote over 42% of all spend on mobile devices, but mobile conversions only make up about 30% of search conversions.

What’s going on here?

Advertisers are struggling to either convert a mobile search click to a mobile conversion, or they’re potentially under-attributing the value of assistive mobile conversions (or perhaps both).

Additionally, the value of the assistive conversion becomes more significant because consumers are still not as comfortable converting on mobile as they are on desktops.

The attribution story becomes more complex when you consider the importance of offline conversions. For example, many customers use mobile devices to research products, often in-store, and then complete the purchase in-store (a practice known as reverse showrooming).

In this scenario, if you’re not tying in your offline revenue data and solely relying on last-click conversion, then it looks like your mobile marketing spend has been a waste. Alternatively, the user may start their research on mobile and then complete their purchase on a desktop or tablet, where it’s more convenient for them to pull out their wallets and type in their passwords.

This leads to an interesting finding. You’ve probably seen data on the conversion power of tablets in multiple places, but we found the same data within the Marin advertiser set.

Tablet devices make up only 8% of ad spend, but 15% of clicks and 12.4% of conversions. So if you’re looking for a Moneyball market inefficiency to potentially arbitrage, look towards the tablet sect. It’s settled in to find a lucrative position somewhere between the ubiquity of the mobile phone and the convenience of a desktop.

Mobile Display Trends Align Closely With Mobile Search

We observed similar characteristics from search within the display channel as well, except with an even more pronounced preference toward spending on mobile.

Mobile impression, click, spend, and conversion share amongst display advertisers grew at a significantly higher rate YoY than search. Desktops have lost over 10% click share, and almost all of that has migrated over to smartphones.

There is a much heavier mobile device focus for display than there is for search. Almost half of all display spend in Q3 was on mobile devices, and over half of clicks.

And again, similar to search, there’s a Moneyball opportunity within tablets, as clicks on tablet outpace tablet spend, and vice versa for smartphones.

Mobile Social Is On Speed… Except When It’s Not

Now, if any channel should reflect this shift towards mobile, it should be social. Think about the last ten times you’ve checked out your Facebook or Twitter feed. How often did you check them on your smartphone? Compare that to what you were doing two years ago, or even this time last year.

Don’t worry, you’re not alone. In September, it was reported that the Facebook app had crossed the one billion downloads threshold on the Google Play store. And whatever the exact number is, you can probably more than double it to account for the iOS downloads.

So, what do the data say?

The results do not disappoint. In Q3, over half the impressions, clicks, and spend on social channels were on mobile devices. And where the eyeballs and nubby finger presses go, so follows the spend.

Advertisers have followed this explosion of social mobile usage by pouring money into this channel. However, the same conversion caveats from search and display still apply to social. Social conversion share by device is still mostly desktop-focused, with 65% of all social conversions happening on a desktop computer.

In fact, the share of social mobile conversions is lower compared to the conversion share in display, even though social mobile’s click and spend share are far greater than display’s.

This seems to reinforce social’s role as a more assistive channel. Consumer intent on social networks does not center on finding products and services, which makes them less likely to convert.

This is in contrast with consumer intent on search, where the very act of searching is when they are directly looking for specific items that increase chances of engagement and conversion on ads.

Mobile Success & Proper Attribution Are Inextricably Tied

It’s clear marketers are rethinking their marketing mix and starting to consider a reality that revolves around mobile-first.

If you think of display and social as being more assistive channels to search’s conversion-oriented status, then mobile display, social, and search also act as additional assistive levers further up the funnel.

Accordingly, marketers have shifted significant ad spend towards smartphones and tablets. Consumer behavior also varies drastically by platform and understanding the intersection between channel and device is crucial for the smart marketer to reach their audience and guide them towards conversion.

An additional consideration is that with the increasing focus on mobile, getting attribution right is increasingly important.

Mobile likely drives a greater variety of conversions than any other device or channel. Whether it’s through online conversions through other non-mobile devices, or real-time offline conversions from in-store visits or phone calls.

Until advertisers can properly attribute these conversions back to the initial mobile click, mobile conversions will continue to be underrepresented and eventually undervalued.

For more insight and recommendations, including how the shift in advertising patterns have affected consumer behavior and how it should impact your marketing practices, check out Marin’s full Q3 2014 Performance Marketer’s Benchmark Report.

Contributing authors are invited to create content for MarTech and are chosen for their expertise and contribution to the search community. Our contributors work under the oversight of the editorial staff and contributions are checked for quality and relevance to our readers. MarTech is owned by Semrush. Contributor was not asked to make any direct or indirect mentions of Semrush. The opinions they express are their own.

Related stories