Retailers: Priority Is Mobile But Spending “Modest,” Apps “On Back Burner” [Survey]

A new survey based report from Shop.org and Forrester Research, The State of Online Retailing, identifies retailers’ key initiatives and spending priorities for the coming year. Among the roughly 70 retailers surveyed, mobile emerged as the top priority. Yet other findings in the survey simultaneously reflect caution, inertia or ambivalence about mobile. Indeed, the survey revealed that […]

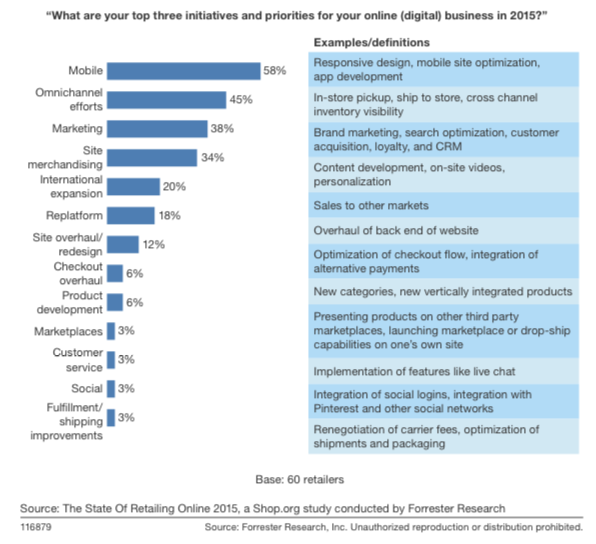

A new survey based report from Shop.org and Forrester Research, The State of Online Retailing, identifies retailers’ key initiatives and spending priorities for the coming year. Among the roughly 70 retailers surveyed, mobile emerged as the top priority.

Yet other findings in the survey simultaneously reflect caution, inertia or ambivalence about mobile. Indeed, the survey revealed that despite the priority placed on mobile, retailers were deemphasizing apps because of the high cost of development and the challenges of getting consumers to adopt and retain them.

The report asserts, “As a result, many companies have quietly opted to put apps on the back burner.” Nearly 60 percent (56 percent) of the respondent retailers said apps are “not a key component of their mobile strategy to consumers.”

Given all the data about app usage — nearly 90 percent of mobile time is spent in apps — this turning away from apps is striking, especially for retailers. But it makes some sense from a market-reach standpoint.

Instead, retailers are emphasizing mobile websites according to the survey. Seventy seven percent of retailers said they had a mobile optimized site and 46 percent (a subset of the former group presumably) were using responsive design.

Another somewhat paradoxical finding is that despite the recognition of mobile’s importance most retailers’ mobile spending is “modest.” Nearly half of the surveyed retailers’ traffic is coming from mobile devices by their own recognition. However 32 percent of respondents said they were spending less than $100,000 on mobile development and the great majority (68 percent) were spending less than $1 million.

Although $1 million is a good deal of money, for larger retailers even $1 million is quite small in terms of annual sales. Still, the large majority of survey respondents said they would increase smartphone-related budgets this year by at least 20 percent. (It remains to be seen.)

There’s a significant opportunity cost and even brand implications to not acting quickly and decisively when it comes to mobile. It seems amazing to me that even after all the impressive holiday 2014 mobile metrics that many retailers are still moving cautiously.

See our related story on the general ecommerce findings in the report: 2014 Ecommerce Sales Up 10% Or More For Majority Of Online Retailers.

Contributing authors are invited to create content for MarTech and are chosen for their expertise and contribution to the martech community. Our contributors work under the oversight of the editorial staff and contributions are checked for quality and relevance to our readers. MarTech is owned by Semrush. Contributor was not asked to make any direct or indirect mentions of Semrush. The opinions they express are their own.

Related stories