Report Says Facebook’s Organic Reach Will Hit Zero. Our Response? Of Course It Won’t.

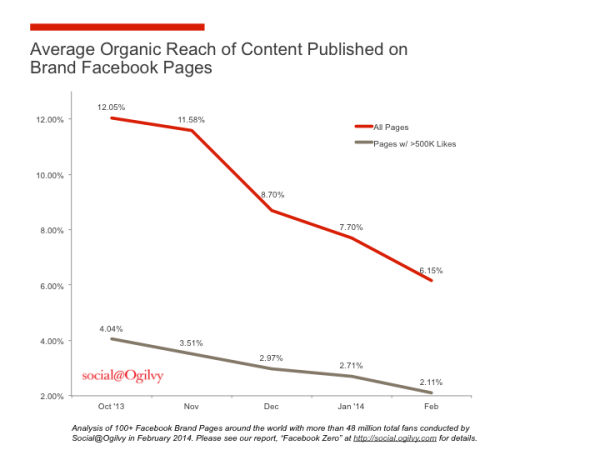

A recent report from social@Ogilvy warns of a world with no organic reach for any brand pages where all brands have to pay to play. Dubbed “Facebook Zero: Considering Life After the Demise of Organic Reach” the study paints a grim picture for the free marketing that brands can harness on Facebook. While the statement […]

A recent report from social@Ogilvy warns of a world with no organic reach for any brand pages where all brands have to pay to play. Dubbed “Facebook Zero: Considering Life After the Demise of Organic Reach” the study paints a grim picture for the free marketing that brands can harness on Facebook. While the statement may instill fear and doubt into the minds of marketers, the survey instills more questions than answers in our minds.

It’s quite certainly true that the overall reach of Facebook Page posts has dropped. However, a drop does not equate to a statistically relevant deduction that organic reach will not exist. The assumption that a decline automatically equates to total eradication is foolish. This is comparable to a quarter of NYSE monthly losses and the proclamation that all stock values will be non-existent.

While the study does not list any specific facts supporting that Facebook organic page reach will be zero, it does mention that “Facebook sources were unofficially advising community managers to expect it to approach zero in the foreseeable future.”

Firstly, this doesn’t make a lick of sense for marketers. Why curate a page and content if there is no way to reach a user? Why even have a page unless using for customer service (as the study accurately points out). Yes, Facebook Page reach is declining. No, having zero reach is not a good for Facebook. They want active brands on the network and they want goodwill to gain more marketing dollars.

Secondly, when a drop occurs it helps to debunk by analyzing the surrounding variables. Let’s take Facebook for example. The following post types have been on the rise:

- Ads – The overall Facebook ad revenue has been up 76% in Q4 2013

- News – Facebook has made a major push to become the best source for socially aggregated news

- Links – More prominence has been put on quality content and link shares

- More Pages – As of last summer there were 18 million pages with 1 million more added each month

Also add in Instagram activity, trending activity, friend activity, and with the coming page activity there is simply more going on within the Facebook environment that there used to be. Could that play a role in the decline in Page reach? Possibly. Does this mean that organic reach will be zero? No.

This study does a great job highlighting the decreased Facebook reach, but jumps to many conclusions in the statement that Facebook Pages will have no reach. While we aren’t convinced of Facebook Zero, the study does highlight a very salient point — not to over-commit to a single platform. Facebook reach is shrinking and may very well continue to shrink. Those who have cultivated their own community outside of Facebook or have diversified their social footing are now reaping the benefits.

For the full report, head on over to social@Ogilvy for the full report.

Postscript From Danny Sullivan: We are checking with the report’s author for some follow-up, but to add to what Greg Finn has written above, the report may not make sense from another perspective. If you take the current figures as proposed, where organic page reach is only 6%, then that suggests 94% of Facebook’s news feed is made up of something else. What is that something else?

It’s not ads. Anyone with a Facebook account can easily verify that 96% of what you see isn’t ads. That leaves three key possibilities:

1) A few pages are getting “richer,” that certain publishers are being greatly rewarded far beyond what they used to get.

2) Many more pages are getting visibility than before — perhaps in the past, only a relatively few pages got that double-digit visibility, not more are getting visibility, but since there’s only so much space, all of it drop.

3) Facebook has greatly increased the amount of non-Page content it is showing, say status updates, personal pictures, RSVPs to events and so on, so that page content has less visibility.

The study seems to have looked at the number of impressions that Facebook reports a particular page post has received, divided that against the page’s overall audience and come up with a percentage of reach (which is typically low). But the problem with that is looking at a per-post metric doesn’t give a stat of what’s happening in the news feed as a whole — where some of the factors above might be coming into play.

Postscript 2: Heard back from the report’s author Marshall Manson who emailed:

Let’s agree (if we can) that there are 3 kinds of content that get served into FB users’ news feeds.

(1) Content published and delivered as a result of organic reach from brand pages that the user has chosen to follow. Let’s also include here content from brand pages that arrives as the result of shares or other viral behavior from the users’ friends.

(2) Paid content from brands.

(3) everything else — updates, news, cat videos, etc that users see from their friends.

My view is that Facebook is shrinking the first, holding steady or slightly increasing the second and limiting the third.

Even if the net content hole for organic content is staying the same size, there are undoubtedly more brands publishing, so it’s understandable that less gets through.

But I don’t know of anyone, outside of Facebook itself, who could confirm my suspicions for us with hard data. (And in happy to be wrong about that. If there is someone, I’d love to see the data.)

All that said, I don’t think that our failure to address this constitutes a flaw in the work. We made a conscious choose only to address the organic home, so our point is much more straightforward — whether it’s because the organic hole is getting smaller or because there’s more brand competition to fill it — there is less organic content getting through to brand fans. That’s what the data shows — and incidentally, every single page we look at showed a net decline. The question, therefore is what brands should do about it.

For the moment, switching into the paid hole makes sense. We know that brands can achieve their objectives, each their fans, and drive engagement and advocacy. Succeeding will require different ways of working for many brands. And that’s really the point of the paper.

I bolded the key part, to me. I love the idea of there being an “organic hole,” that is, a chunk of space that brands are all vying for where they appear within Facebook for free. This is very similar to what you could call the organic or SEO hole with Google.

And as with Google, as more brands all vie for the top 10 spots with the most visibility, it gets harder to gain those as more brands and more content comes into the space.

That seems more likely as to what’s happening here. More and more brands are competing with more and more posts for the same space — or perhaps slightly less space, as ads have grown and as other content has also increased. Getting any particular post more visible might be harder. However, if more posts are going out, it’s also possible that overall traffic for some brands might be rising.

Contributing authors are invited to create content for MarTech and are chosen for their expertise and contribution to the martech community. Our contributors work under the oversight of the editorial staff and contributions are checked for quality and relevance to our readers. MarTech is owned by Semrush. Contributor was not asked to make any direct or indirect mentions of Semrush. The opinions they express are their own.

Related stories

New on MarTech