For Product Brands, Paid Search On Retailers’ Sites Pays Off

Last year, Google made what was to some a surprising announcement: its previously free Google Product Search would become Google Shopping, which would ask a fee of product brands and retailers that wanted to be included in new Product Listing Ads. I can’t say that I disagree with Google’s decision. The company has hit on […]

Last year, Google made what was to some a surprising announcement: its previously free Google Product Search would become Google Shopping, which would ask a fee of product brands and retailers that wanted to be included in new Product Listing Ads.

I can’t say that I disagree with Google’s decision. The company has hit on a solid way to increase both its revenue and its visibility as a retail platform, and the shift to pay-to-play has been considered successful — particularly for Google, but for ecommerce retailers as well.

It’s less beneficial to product brands.

Shoppers get on Google and other search engines to figure out where to buy something. It’s a quick way of sorting out the cheapest products, not unlike the comparison shopping engines (CSEs) like Shopping.com and Shopzilla that preceded it.

Let’s say a consumer was looking for a specific electric drill she had seen advertised during Modern Family and turned to Google Shopping to look for it. Multiple marketplaces that pay to list with Google Shopping will show up in her search results. The drill’s manufacturer might appear as well, if the manufacturer offers direct sales through its website.

In a case like this, where the product brand already won the consumer’s consideration, does it necessarily make sense for the manufacturer to pay more to compete against its own channels? Or is the next dollar better spent competing against other product brands?

What To Buy Vs. Where To Buy

Most consumers turn to the internet to research a product before they buy. But while search engines play a role in directing traffic to research channels, the bulk of customer research actually happens on retail sites, where customers can compare options and dig into deep content about the products.

Retailers are where customers actually decide what to buy. Yet, so often when product marketers talk about their search strategies, they ignore these sites in favor of investing in search engine results and sections within search engines, like Google Shopping, where customers are more concerned with deciding where to buy.

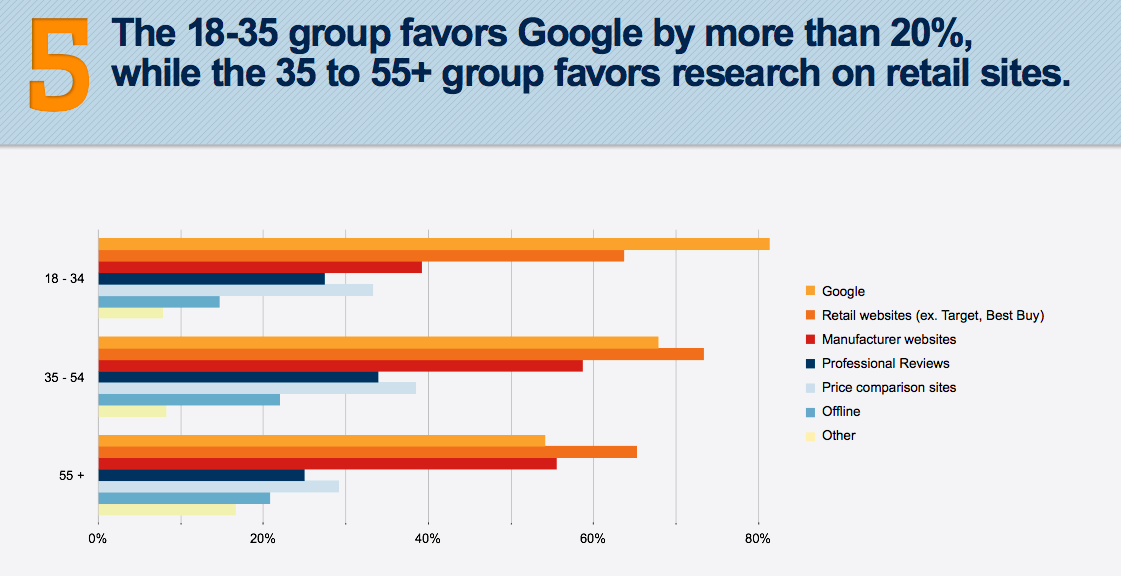

In fact, many customers skip Google altogether and start their search at retailers. Wealthier shoppers 36 years of age and older tend to visit a retailer site first, as we learned recently when we commissioned a survey of the American public from online research leader Toluna. The younger crowd, 18-to-35-year-olds, visits Google first, then retailers. (For full survey results, click here.)

Regardless of how they start their search, though, it’s on retail sites that customers actually decide what to buy.

Paid Search On Retailers

Rather than spend big on Google Shopping or a similar platform, product marketers should move budgets onto ecommerce sites, where the competition is most often between competing brands rather than retail channels. The practice is well-established at brick-and-mortar stores, where manufacturers pay for premium product placement to have their items displayed prominently.

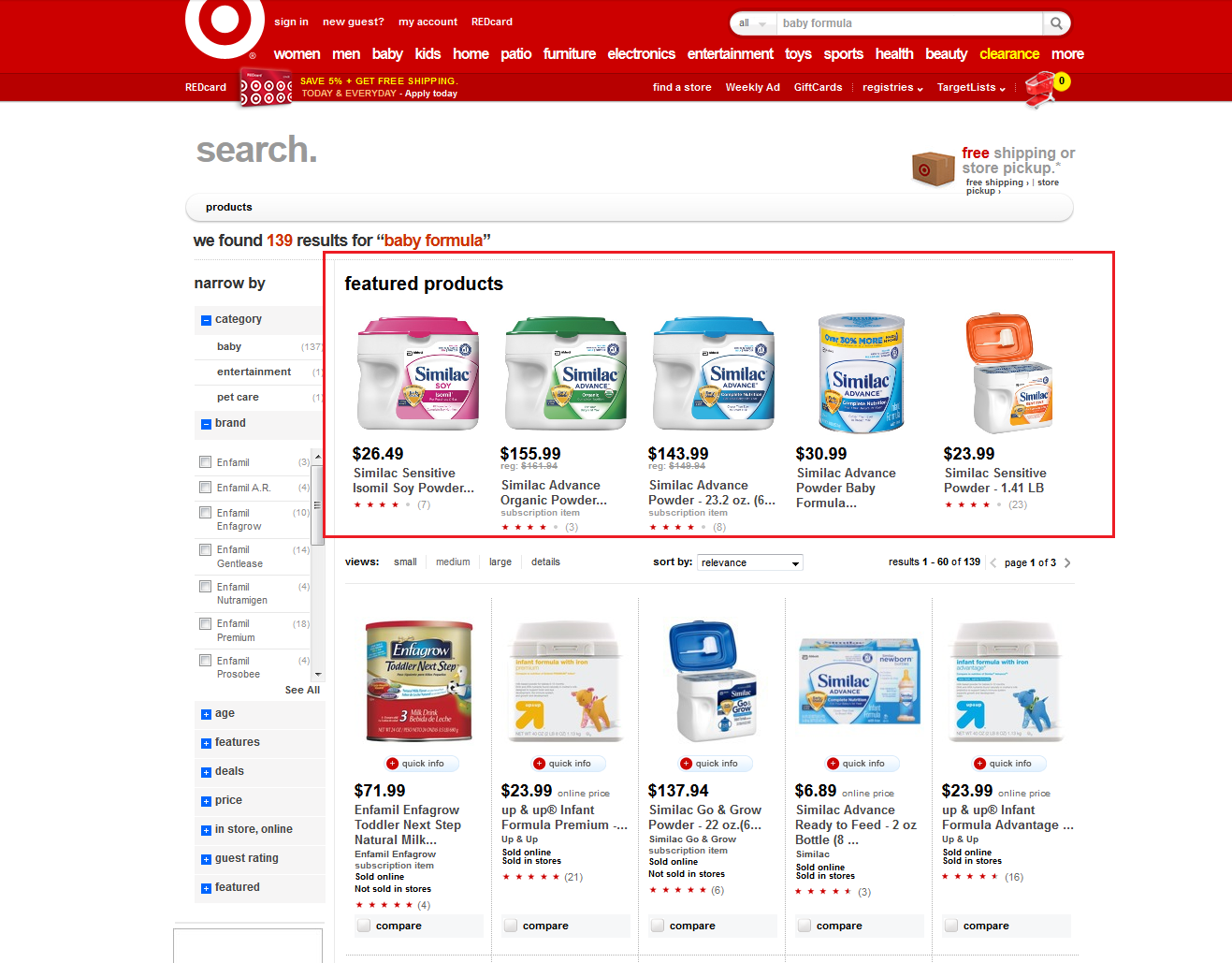

Just like in a brick-and-mortar supermarket or bookstore, consumers visit ecommerce sites because they intend to make a purchase, but they might not have an exact brand in mind. Through top-placement made possible with paid search programs on these retail sites, product brands can influence customers at the key “what-to-buy” stage. In fact, being selected within a retail site often leads to a “where-to-buy” comparison at the likes of Google Shopping.

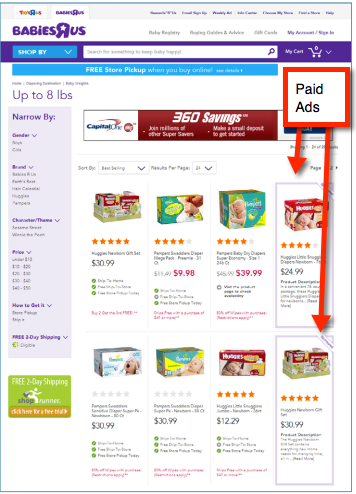

Retail paid search programs are becoming more prevalent on several leading big box and online retailers, such as Toys R Us, Target, Sears, BabyAge, and Overstock.com. Amazon.com also offers a number of media programs for product brands, although so far Amazon Product Ads, a strong rival to Google Shopping, is focused on retailers and manufacturers competing for clicks that leave Amazon.com for other websites. (Disclosure: HookLogic, the company I lead, offers a service that enables product brands to bid for preferred placement on multiple top retail sites.)

Manufacturers may still make an economic choice to compete against their channels on Google Shopping, Amazon Product Ads and CSEs, but I would argue that the first marketing dollars should be used to compete against other product brands. Winning “where-to-buy” may add a few pennies to margin, but winning “what-to-buy” makes factories busier.

Becoming Interactive

In traditional marketing, brands go out in search of the consumer. Television, radio, and print advertisements were employed to find consumers. But with paid search and some other formats of digital advertising, it’s the consumer finding the brand. Much has been made in the last few years about using social media to respond to customers, but nobody talks about interaction at the point of research or purchase.

Interaction in search can be a rapid-fire, two-way dialogue. Let’s say that instead of immediately researching the drill she just saw advertised, our Modern Family fan waits until the next day. She can’t remember the exact name of the product, so she goes to her ecommerce site of choice and enters a few keywords. If a marketer has bid on search placements that correspond to this behavior, that brand’s products will appear top-of-search — showing the consumer what she wants, when she wants it.

This is not a prediction of what the customer might want next, but a real-time interaction based on the customer’s first contact — what she is looking for right now. The prominently placed search ad that results from this query can lead to an immediate sale, cutting out the many other steps encountered on search engines.

Be Where The Shoppers Are

Just because somebody looks for book reviews on a search engine doesn’t mean he’s going to buy the book. But if he has navigated to an online marketplace and searched for that book, he is probably looking to buy it. In the first place, we have curiosity; in the second, intent. The choice on where to invest search dollars is obvious: Spend your money where competition is low, intent is high, and interaction is almost immediate.

Google Shopping has its purpose — but that purpose doesn’t always coincide with the best interests of product brands.

Contributing authors are invited to create content for MarTech and are chosen for their expertise and contribution to the martech community. Our contributors work under the oversight of the editorial staff and contributions are checked for quality and relevance to our readers. MarTech is owned by Semrush. Contributor was not asked to make any direct or indirect mentions of Semrush. The opinions they express are their own.

Related stories