Navigating The Modern Ad Serving Stack, Part 1: Direct Orders

Confusion in ad tech abounds, especially around the various forms of ad buying and ad serving. In this series, we shine some light on the fundamentals of modern ad serving, and how each of the buying methods fit into the big picture.

It is universally acknowledged that the ad tech industry is complex. Some would say overly complex. As a result, you will often hear people in the advertising world throw around terminology in embarrassingly incorrect ways.

I don’t want you to be one of those people, so I’m writing this series to shine some light on the fundamentals of modern ad serving. My goal is to provide some clarity as to how most of the phrases we hear today — like programmatic direct, private marketplaces, open auctions, and so on — fit into the big picture.

Since ad serving is where the rubber meets the road, it seems like a logical place to start our journey. It helps to view the ad-serving world from the point-of-view of the publisher; after all, they ultimately call the shots when it comes to how their ad inventory is served from a technology and priority perspective.

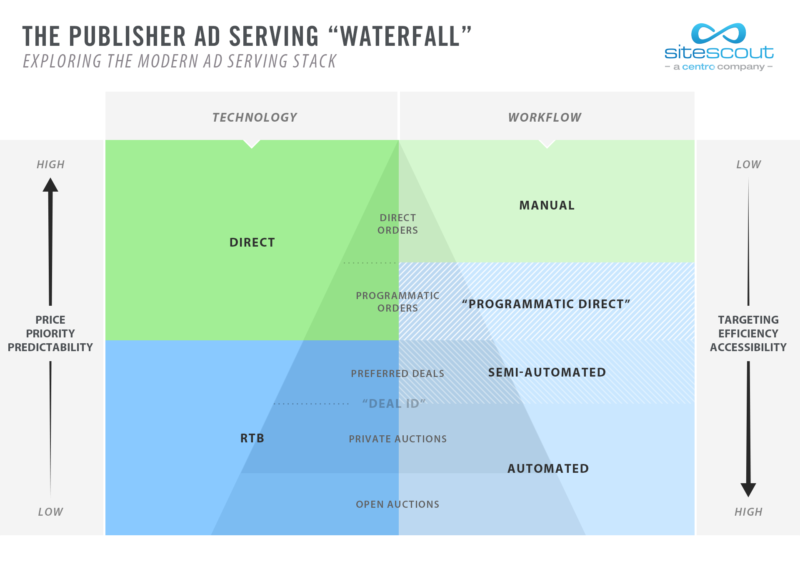

The diagram below illustrates how modern publishers prioritize delivery within their ad serving stacks to capitalize on business from both direct orders and programmatic channels (the so-called ad serving “waterfall”).

How modern publishers typically structure the priority of their ad servers.

So, how do the various pieces of the publisher’s ad serving technology “stack” fit together, and what does it mean as you move down the waterfall? Let’s start by examining “Direct Orders.”

Direct Order Technology

“Direct Orders,” as the name implies, are purchases of ad space by advertisers directly from a publisher’s sales force. Roughly 50% of online display advertising dollars are transacted via such directly negotiated orders and, of those, most are still transacted manually using the “insertion order” process.

An insertion order is a contract between the advertiser and publisher that outlines the parameters of the media transaction. It is the oldest way of buying and selling media online — pioneered in 1994 by Wired Magazine’s online property, HotWired.

On a technical level, there are two defining characteristics of direct orders:

- a direct relationship with the publisher; and

- a direct campaign, or line item, on the publisher’s ad server.

If these conditions are not both met, it is not a direct order. It’s most likely that the impressions are coming from a third party, like an ad network or demand-side platform, who either have their own direct orders or are piggybacking off someone else (e.g., an exchange).

Direct orders are especially useful for negotiating non-standard types of deals. For example, Pepsi might negotiate a homepage takeover on ESPN.com, where the whole site would appear Pepsi-branded. This type of campaign would be executed using direct ad serving technology, and would generally appeal to a large brand that wants to promote a new product to a specific target audience, by proxy of a relevant publisher.

Advertiser Benefits

Why would an advertiser want to purchase advertising in a direct manner? There are a host of benefits, including:

- Ad Serving Priority: In the ad serving hierarchy, direct orders receive the highest priority. This means that if a user visits a site, those advertisers going through direct channels will have “first look” at the earliest impressions, allowing their ads to be seen first. As a visitor continues to click through and visit more pages on the site, achieving higher session depths and exhausting the frequency caps of direct advertisers, they will begin to see the lower priority ads from the exchanges. As per the diagram above, direct deals sit at the top of the waterfall; it is only when they “pass” on an impression that it gets cascaded down to other advertisers.

- Guaranteed Inventory Volume: Publisher ad servers, like Google’s DoubleClick For Publishers (DFP), have forecasting functionality that allow publishers to “reserve” inventory for direct deals. As a result of this guarantee, publishers can justify premium rates for inventory ordered in this manner. In return, advertisers and agencies gain a high level of predictability that their campaign goals will be met and their budgets will be spent.

- Custom Creative Opportunities: There are some types of creative campaigns (let’s call them “high impact”) that can only be executed through direct orders. High impact creative opportunities include: roadblocks, page takeovers, custom site skins, interstitials, and other forms of sponsorship. These opportunities are used to further justify premium CPM rates. Combined with the fact that they are unavailable for purchase in any other manner also gives publishers more leverage.

- Human Relationship: A large part of the allure behind direct orders is still the one-on-one human relationship between advertisers and publishers. It’s the feeling of knowing that you are not just a number to each other. The feeling that it’s more than just a transaction. For brands and agencies, this relationship comes with a price tag attached, but it often includes all the perks one would expect from a relationship with so much material gravity: concert tickets, 3-Martini lunches, fancy dinners, and other incentives for repeat business.

Advertiser Drawbacks

While there are a number of benefits to executing advertising deals in a direct manner, there are also a few drawbacks:

- Manual Process: The workflow required to buy media directly requires a great amount of clerical work. Numerous phone calls, emails, faxes, contractual negotiation, administrative work in spreadsheets, and so much more. It’s a highly inefficient process (PDF download), both operationally and economically. For direct orders, a publisher must manually plug a campaign in their ad server for each advertiser and/or agency with whom they work, along with a heap of other administrative minutiae.

- Limited Targeting: There is often very little targeting applied to direct buys. Targeting is usually limited to specific placements on the website and the geography of the visitors, with frequency caps and “even delivery” being negotiable clauses in the contract. This is generally a by-product of selling inventory in a bulk manner, which ties into our next point.

- Bulk Inventory: Publishers care about selling as much of their inventory as possible. Unsold inventory is worth very little to publishers, which is why they aim to sell as much of it as possible. The metric used to track this goal is “sell-through rate”. The more picky or narrow an advertiser is about their targeting, the smaller the potential inventory pool becomes, which means fewer impressions are sold.

- Premium Prices: Buying through a direct deal almost always costs more than buying on an exchange. For the privilege of being able to secure a predictable, guaranteed amount of inventory, and for the opportunity to serve high-impact, custom creative, an advertiser must pay a higher CPM rate and often a minimum order size in the thousands or tens of thousands of dollars. As explained above, there are many benefits to purchasing in this manner; however, pricing can make direct deals prohibitive to all but the largest brands and agencies. A corollary to paying higher CPMs: if a campaign aims to achieve aggressive performance goals, premium CPM rates can very well make those goals unfeasible.

Technology Alignment: Publishers

At this point it should be no surprise that publisher ad servers — the technology products that facilitate direct orders — are primarily aligned with the interests of publishers. This means that they optimize towards the publisher’s benefit: selling as much of their inventory as possible and receiving top dollar for it. It also gives them full control over who can advertise on their properties.

But, it is a double-edged sword. There is a great deal of human effort required to coordinate the logistics to fulfill orders, often requiring a dedicated ad operations team, in addition to the sales people required to sell the ad space in the first place. In addition to these inefficiencies, the cost of training and maintaining a staff can easily eat away at profits.

Next Up: Programmatic Direct

The primary drawback in the world of direct orders is the terrible amount of inefficiency inherent in selling and executing such buys. However, that does not mean that direct orders are doomed to remain manual forever. There have been great strides in the last few years to bring the automation and efficiency of programmatic advertising to direct buys.

According to estimates from eMarketer, spending via “programmatic direct” will surpass $8 billion dollars by 2016. It also happens to be the next stage in the ad server waterfall, as well as one of the industry’s most commonly-misused terms. My next installment in this series is a deep dive into the programmatic direct arena, exploring the benefits and drawbacks, and how it fits into the larger picture.

See other installments in this series:

Contributing authors are invited to create content for MarTech and are chosen for their expertise and contribution to the martech community. Our contributors work under the oversight of the editorial staff and contributions are checked for quality and relevance to our readers. MarTech is owned by Semrush. Contributor was not asked to make any direct or indirect mentions of Semrush. The opinions they express are their own.

Related stories