Lessons learned from Black Friday and Cyber Monday: Retailers must be open to change

Look at how consumers really feel about Black Friday and take their sentiments into account for your rest-of-the-season marketing. Columnist John Donnelly III shares social media insights related to the annual brick-and-mortar mainstay.

It’s almost hard to remember at this point, but it wasn’t long ago that Black Friday took place on a single, in-store day.

It’s almost hard to remember at this point, but it wasn’t long ago that Black Friday took place on a single, in-store day.

Today, driven by online shopping’s steady growth and inherent flexibility, Black Friday can feel like an entire season; brands are launching sale days in advance and wrapping Cyber Monday into the same campaigns.

However, although many brands have pivoted from the Black Friday strategies of the past, the day is still a mainstay and requires consideration for every retail marketer.

How do consumers really feel about Black Friday, and how should marketers respond this holiday season? Below are three takeaways from a report my company (Crimson Hexagon) put together to reveal social media insights (registration required).

1. Some shoppers are losing interest in Black Friday

Since 2012, there’s been a 72 percent decrease in social media conversations about Black Friday, although it remains the busiest shopping day of the year.

While this number should be taken with a grain of salt — 2015 still racked up 782,000 mentions of the event, with 74.2 million participating shoppers and average consumers spending $300 each — the decline in social mentions may indicate waning interest among consumers.

On the same timeline, interest in Cyber Monday also peaked in 2012 and has since decreased, albeit on a smaller scale. This shift shouldn’t concern marketers, however; consumers are still interested in the factors that drive Black Friday weekend sales, but their preferred shopping habits are changing.

Volume of conversation about Black Friday on social media

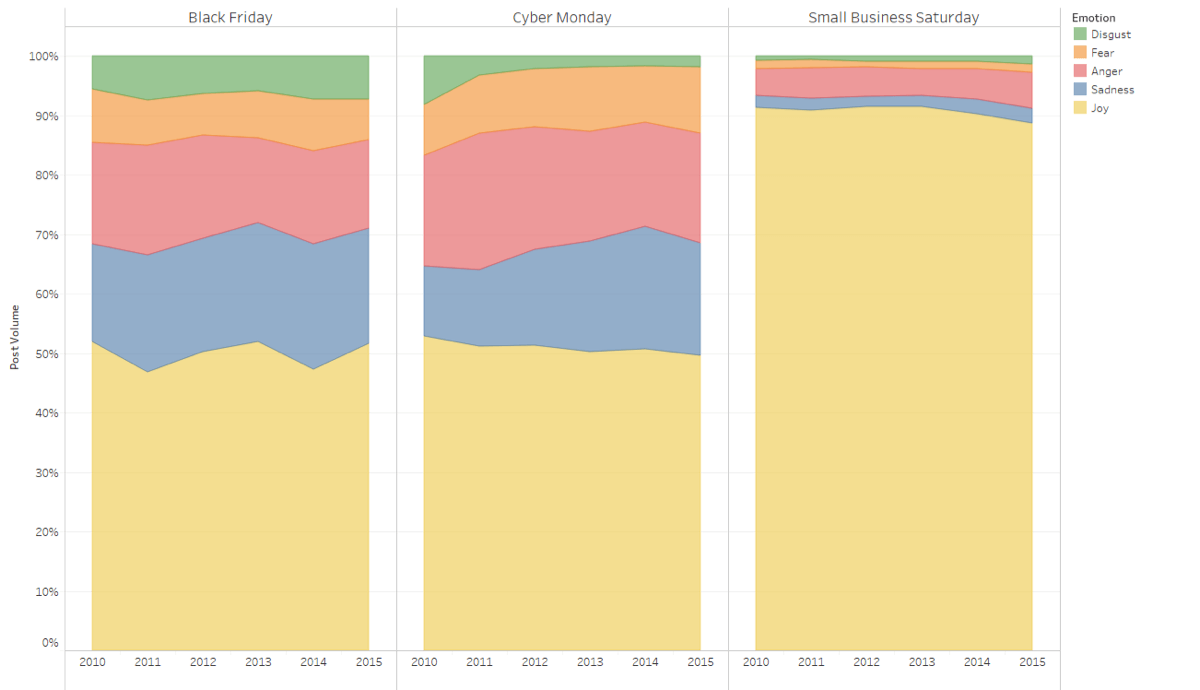

2. Overall feelings about Black Friday are negative, but they’re positive for Small Business Saturday

More than half of the conversations on social media surrounding Black Friday have a negative connotation, expressing sentiments like anger, sadness, fear and despair. Millennials are also more likely to express negative sentiments than older generations.

Distress over fighting with other consumers for merchandise and Black Friday shopping interfering with Thanksgiving causes many participants to stay home. While some consumers express excitement about the discounts available, others feel they simply aren’t more valuable than everyday sales — especially if Black Friday deals require participation in the day’s madness.

Ugh….Black Friday makes me sick. People becoming stupidly violent over merchandise….that makes SO much sense! Hurray humanity! 😑

— Gamermd83 (@gamermd83) November 27, 2015

Cyber Monday follows a similar trend in terms of negative connotations on social media, but more than 90 percent of conversations about Small Business Saturday are dominated by one emotion: joy.

Marketers for retailers of any size should consider how they can work with local small businesses, potentially through partnerships or fulfillment opportunities, to tap into this consumer sentiment.

Consumers’ emotions toward Black Friday

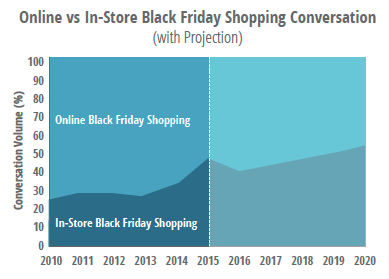

3. Black Friday is moving online

Cyber Monday may have started as a way to extend Black Friday sales into the online realm, but the move from in-store to online sales is now overtaking the entire weekend.

Each year, the percentage of people discussing shopping online for Black Friday increases in relation to those posting about shopping in brick-and-mortar stores. According to our research, by 2020, more than half of Black Friday conversations will likely refer to online sales, compared to just 25 percent in 2020.

Volume of social media conversations about Black Friday shopping online and in-store

Walmart, Amazon, Kohl’s, Best Buy and Target are the brands dominating social conversations about Black Friday, and even though four out of five on the list are traditional big-box retailers, they’re increasingly investing in online sales. For example, Walmart’s acquisition of online marketplace Jet allows the company to compete head-to-head with Amazon.

To keep up and meet consumers on the platforms and channels they prefer, other brands should make their online shopping experiences as seamless and user-friendly as possible.

In many ways, Amazon’s rise has changed the retail game. The growing number of people opting to shop online represents Amazon’s growing share of voice in the market. Of course, it hasn’t taken over completely, and it is unlikely to do so as long as traditional retailers are listening to their customers, updating their marketing and outreach strategies to appeal to user preferences and remaining open to evolving within a changing market.

As consumer interests and habits shift, Black Friday is simply losing some of its shine. However, retailers should jump at the market opportunity created as shoppers move online.

By 2020, it’s likely that more consumers will be talking about online Black Friday deals than the experience of camping in front of their local big-box stores. Holiday shopping will remain a major event and source of revenue for retailers, and those who use social analytics to adapt to customer interests will stay ahead of the game.

Contributing authors are invited to create content for MarTech and are chosen for their expertise and contribution to the search community. Our contributors work under the oversight of the editorial staff and contributions are checked for quality and relevance to our readers. MarTech is owned by Semrush. Contributor was not asked to make any direct or indirect mentions of Semrush. The opinions they express are their own.

Related stories