Just how black was ‘Black Friday in July’ for retailers not named Amazon?

The data show growth for other retailers, but Amazon captured the bulk of sales.

Amazon said this Prime Day (July 15-16) was “the largest shopping event in Amazon history,” with sales exceeding Black Friday and Cyber Monday combined. Indeed, Prime Day has established itself as a third online shopping mega-event (the others are Cyberweek and Labor Day), with online retail sales exceeding $2 billion according to Adobe Analytics.

$7 billion in sales. Internet Retailer, by contrast, estimated that sales on Amazon.com surpassed $7 billion, when including Amazon and all its marketplace sellers. That compares with just over $4 billion last year according to the organization.

Analysis from Adobe and Amazon present a fairly bullish assessment of online sales for other retailers (e.g., Target, Walmart, etc.). But there’s conflicting evidence on this point and some data suggests that retailers not named Amazon only benefitted modestly by comparison.

Good news for other retailers. Adobe Analytics earlier reported that “large retailers ($1B+ annual revenue) saw a 64% increase in sales versus an average Monday, compared to last year’s 54%.” Additionally, smaller retailers with less than $5 million in annual revenue saw a 30% increase in online sales. Day two of Prime Day, according to Adobe, saw a 72% increase in sales for large retailers, while niche retailers enjoyed a 25% bump.

Saleforce said that “just over half (51%) of retailers joined the Prime Day party through some type of promotion.” The company reported that non-Amazon ecommerce sites saw 37% year-over-year revenue growth (compared with 60% last year). It also said that 49% of orders and 65% of visits happened on mobile devices.

Other data suggest the retailers were ‘e-commerce losers.’ Edison Trends reported that overall sales were up 78% percent compared with Prime Day 2018 — qualified by the fact that Prime Day this year lasted 48 hours compared with 36 in 2018. On an hourly spend basis, sales were up 35% year-over-year.

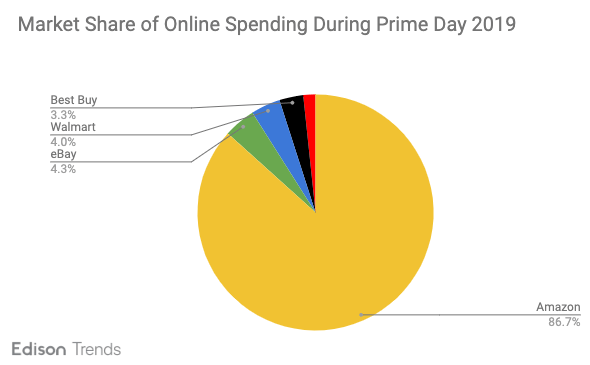

Now the bad news: according to Edison, among major retailers running sales during the same period, “Amazon took 87% of the market share of total spend when we aggregate sales from BestBuy, Walmart, eBay and Target’s rival flash sales on the same days.” That means these other retailers collectively brought in 13% of total online sales during July 15 – 16.

Separately, AppsFlyer found that “other Ecommerce platforms are taking an unprecedented hit during Amazon Prime Day.” AppsFlyer looked at data for the top 100 apps in the run-up to and during Prime Day, comparing “installs, in-app events and purchase events” in the U.S. and U.K.

The company concluded that other ecommerce sites were “clearly an afterthought” compared with Amazon. All three measures declined by double digits during the examined time frame.

Another win for Amazon: ad spending. Ad management platform Kenshoo reported that advertisers on its platform spent 3.8X on Amazon ads this year, related to Prime Day promotion. Kenshoo added that ad spending translated into almost 6X revenue growth. Spending on Amazon varied in specific categories:

- Toys & Games — 6.3X YoY

- Health & Beauty — 3.1X YoY

- Computer & Electronics — 2X YoY

- CPG –1.2X YoY

Why we should care. It’s possible that the Salesforce and Adobe numbers are accurate — there was meaningful sales growth YoY for other retailers — but that the real dollars still flowed to Amazon. Regardless, there does seem to be a halo effect from Prime Day that benefits other retailers to varying degrees. It makes sense, then, for retailers to continue to promote parallel sales. One question for consideration: what if they programmed their rival sales to precede or follow Prime Day; would that deliver more revenue?

Contributing authors are invited to create content for MarTech and are chosen for their expertise and contribution to the search community. Our contributors work under the oversight of the editorial staff and contributions are checked for quality and relevance to our readers. MarTech is owned by Semrush. Contributor was not asked to make any direct or indirect mentions of Semrush. The opinions they express are their own.

Related stories

New on MarTech