Holidays deliver on record-setting ecommerce expectations

U.S. consumers spent $241.4 billion, up 8.7% YoY, according to Adobe Analytics.

The 2024 holidays delivered on, and in fact surpassed, record-breaking projections for ecommerce. U.S. consumers spent $241.4 billion online between Nov. 1 and Dec. 31, 2024, up 8.7% from 2023, according to Adobe Analytics.

Ahead of the holidays, Adobe projected $240.8 billion in ecommerce sales, up 8.4% year-over-year.

Dig deeper: 2024 holiday sales live up to record-breaking projections

Inflation. The record-setting holidays were a result of strong consumer spending, not higher prices. Adobe’s Digital Price Index showed consumer prices have fallen for 27 consecutive months and were down in November 2.6% from the previous year. Apparel was down nearly 8% YoY in November 2024, according to the Index.

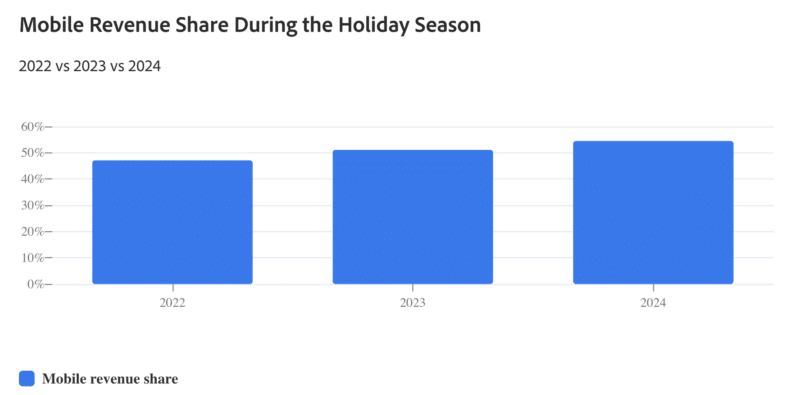

Mobile transactions. The 2024 holidays were the most mobile ever, according to Adobe. Smartphones drove 54.5% of online purchases.

Additionally, 79.1% of Buy Now, Pay Later (BNPL) orders were made on a smartphone.

AI agents. Traffic to retail sites driven by genAI-powered chatbots increased 1,300% YoY, according to Adobe.

An Adobe survey of 5,000 consumers found seven in 10 respondents who used genAI-powered assistants found them helpful.

Dig deeper: Will AI agents conduct the martech orchestra in 2025?

Top categories. Three categories accounted for over half (54%) of all ecommerce:

- Electronics: $55.3 billion, up 8.8% YoY.

- Apparel: $45.6 billion, up 9.9% YoY.

- Furniture/home goods: $29.2 billion, up 6.8% YoY.

The highest-growing category for ecommerce was grocery, up 12.9% YoY and accounting for $21.5 billion in sales. Second was cosmetics, up 12.2%, with $7.7 billion in sales.

Why we care. The sales data showed discounts contributed to strong holiday performance. For instance, the highest-selling category, electronics, benefited from the highest peak discounts — 30.1% off the listed price.

The broader story beyond the holidays is how consumers are taking advantage of discounts and mobile shopping experiences to purchase product categories not associated with gift-giving — groceries and furniture. Holiday shoppers aren’t just purchasing with the holidays in mind, so these trends apply year-round.

More Adobe Analytics data from the holidays can be found here.

Contributing authors are invited to create content for MarTech and are chosen for their expertise and contribution to the martech community. Our contributors work under the oversight of the editorial staff and contributions are checked for quality and relevance to our readers. MarTech is owned by Semrush. Contributor was not asked to make any direct or indirect mentions of Semrush. The opinions they express are their own.

Related stories