Holiday Mobile Orders Shot Up 50 Percent In 2013; Social Commerce Remains Negligible, Organic Still Dominates

More than one in four US ecommerce orders this holiday season came from mobile devices. Custora released its complete Ecommerce Pulse data for the 2013 holiday season, an update of its post-Cyber Monday report that showed record sales in the US. This final analysis looks at ecommerce performance between November 1st through December 31st, highlighting […]

More than one in four US ecommerce orders this holiday season came from mobile devices. Custora released its complete Ecommerce Pulse data for the 2013 holiday season, an update of its post-Cyber Monday report that showed record sales in the US. This final analysis looks at ecommerce performance between November 1st through December 31st, highlighting Black Friday, Cyber Monday and online’s last-minute rush period between December 12 through 18.

Overall, holiday online orders are estimated to be up 12 percent over 2012, compared to just three to four percent growth estimated for total US retail sales, on a traffic increase of 15 percent year-over-year. Cyber Monday saw order growth peak at 19 percent year-over-year. Black Friday ecommerce orders were up 15 percent, and last-minute rush orders rose 12 percent compared to 2012.

Mobile Orders Grew 50 Percent

Overall, mobile ecommerce grew 50 percent year-over-year to account for 29 percent of holiday ecommerce orders. Mobile devices continued to take even greater sales share from desktop after Cyber Monday. Tablet share of ecommerce orders over the holiday period grew from 8 percent in 2012 to 11 percent in 2013. Smartphone orders rose by 17 percent from 12 percent in 2012 to 18 percent in 2013. Desktop saw its share shrink from 80 percent in 2012 to just 71 percent this year.

Holiday Ecommerce Orders By Device

During this period, iOS devices made up 83 percent of mobile ecommerce sales, with devices on the Android platform accounting for 16 percent. Android devices had hit 20 percent of mobile ecommerce sales on Cyber Monday, and overall that platform’s holiday sales share grew from 13 percent in 2012 to 16 percent in 2013. The iOS platform’s share of holiday ecommerce sales fell from 86 percent to 83 percent year-over-year.

Organic Still Dominates Channel Sales, Email Rises While Social Remains Inconsequential

Looking at sales by channel, organic generated 26 percent of holiday ecommerce orders, up from 25 percent in 2012. In a sign that email continues to hold its own as a conversion driver, paid Search (CPC) became the third largest contributing channel (not counting direct), supplanted by email which saw its share of sales grow from 13 percent in 2012 to 16 percent this season. Paid search share rose from 14 percent to 15 percent year-over-year.

Social commerce is still not a contributing factor for ecommerce during the holidays. Social networks including Facebook, Twitter, Pinterest and Instagram, generated just under two percent of direct ecommerce sales during the holiday season, which was similar to performance in 2012. That puts social slightly ahead of display advertising, which held steady at one percent of attributable online orders over the holidays.

Sluggish Conversion Rates In The Last-Minute Rush Period Stymie Early Season Growth

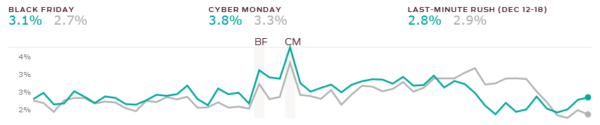

The ecommerce conversion rate ticked up just slightly from 2.4 percent in 2012 to 2.5 percent in 2013. Conversion rates on both Black Friday and Cyber Monday had solid growth, rising from 2.7 percent to 3.1 percent and 3.3 percent to 3.8 percent, respectively year-over-year. Yet conversion rates fell behind 2012’s performance during the last-minute rush period.

Ecommerce Conversion Rates

The data are from over 70 million anonymized online shoppers and over $10 billion in ecommerce revenue from over 100 US-based online retailers. The complete report can be found here.

Contributing authors are invited to create content for MarTech and are chosen for their expertise and contribution to the martech community. Our contributors work under the oversight of the editorial staff and contributions are checked for quality and relevance to our readers. MarTech is owned by Semrush. Contributor was not asked to make any direct or indirect mentions of Semrush. The opinions they express are their own.

Related stories

New on MarTech