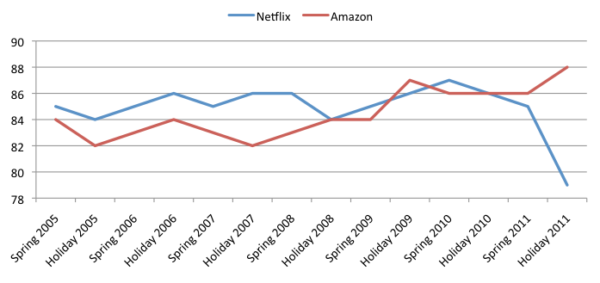

E-Retail Index Shows Amazon, Netflix Diverging In Satisfaction Scores

ForeSee Results, which surveys consumers about their online experiences and customer satisfaction, released another “E-Retail Satisfaction Index” following the xmas holiday online shopping frenzy. (As an aside, comScore reported this week that holiday ecommerce was up 15 percent vs. last year to $35.3 billion.) ForeSee Results uses the methodology of the American Customer Satisfaction Index […]

ForeSee Results, which surveys consumers about their online experiences and customer satisfaction, released another “E-Retail Satisfaction Index” following the xmas holiday online shopping frenzy. (As an aside, comScore reported this week that holiday ecommerce was up 15 percent vs. last year to $35.3 billion.) ForeSee Results uses the methodology of the American Customer Satisfaction Index (ACSI) to calculate its scores.

Among the key findings were the following:

- Amazon emerged as the top company in the “E-Retail” category, with 88 points vs. the category average of 79. Apple scored an 83.

- Netflix, which had been tied last year with Amazon, was punished for its missteps and policy changes and lost 7 points.

- ForeSee said that consumers were less price sensitive this year: “American consumers were less price sensitive during the 2011 holiday shopping season than they were last year.” (While this statement is seemingly contradicted by all the aggressive discounting that went on to stimulate demand, it’s probably good sign for the economy as a whole.)

Here are a selection of the comparative E-Retail Index scores:

ForeSee Results says customer satisfaction scores matter because they’re predictive of future consumer behavior. In the case of Netflix in particular, the decline in customer satisfaction means Netflix’s business will continue to suffer, according to ForeSee Results:

Customer satisfaction is a proven predictor of critical future behaviors that have a direct impact on the bottom line. As a result of Netflix’s 8% drop in satisfaction, it also registers a 9% drop in future brand commitment, a 10% drop in customers’ likelihood to use Netflix the same time they purchase a similar product, an 11% drop in customers’ likelihood to recommend the company, and a 5% drop in customers’ likelihood to return to the website again.

On the ground the picture is somewhat more complicated. For example, the ForeSee Results’ measurements as applied to search engines have not proven to be predictive of market share changes in the past.

It also appears to me that rather than a leading indicator of future behavior the ACSI/E-Retail data are something of a lagging indicator of established consumer sentiment. These data more likely record and capture what is already true for consumers rather than indicating an emerging trend that will manifest in sales or word of mouth in the future. It may well also be true that they’re predictive of future behavior — to the extent the company in question doesn’t change course and address the problems identified.

Source: ForeSee Results

Take Netflix as an example. Nothing significant changed about the Netflix website or online user experience. What happened over the course of this year was that the company made some very high-profile screw-ups, led by its price increases in July. In punishing Netflix in the index above, consumers are thus expressing their very self-conscious disapproval and dismay with the company’s past actions and policy changes rather than simply reacting to user experience issues on the website.

The failure of the search-engine satisfaction scores to translate into market share changes also indicates to me that these data are more retrospective than predictive.

If Netflix were to somehow address and rectify consumer discontent with lower prices, more streaming titles and/or offer credits to users, the score next time in all likelihood would recover. If Netflix does nothing the bad sentiment will probably linger and translate into future performance issues. In this sense past is prologue.

Regardless of whether the data are predictive or backward looking, however, they’re an interesting barometer of consumer sentiment and useful to track progress (or a lack thereof) over time.

Contributing authors are invited to create content for MarTech and are chosen for their expertise and contribution to the martech community. Our contributors work under the oversight of the editorial staff and contributions are checked for quality and relevance to our readers. MarTech is owned by Semrush. Contributor was not asked to make any direct or indirect mentions of Semrush. The opinions they express are their own.

Related stories