Digital ad spend growth drops to 7.8% this year

The upside: CTV approaches 10% of digital budgets with 21% growth increase. Retail media networks (RMNs) are also on the rise.

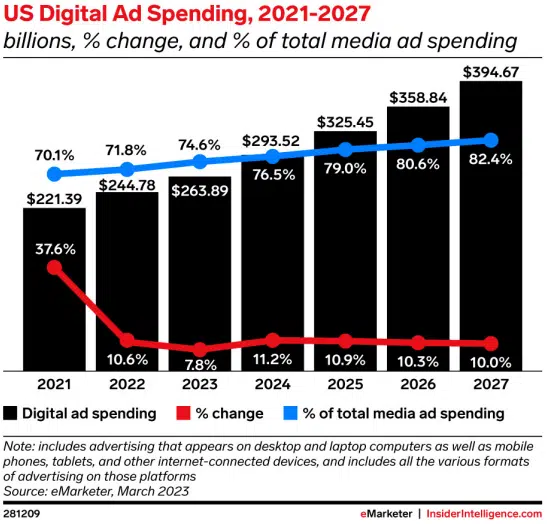

U.S. digital ad spend is only expected to increase 7.8% in 2023, dropping below 10% for the first time in 14 years, according to a new forecast from eMarketer.

It is projected to rebound to 11.2% growth in 2024, the forecast said. Yearly increases in digital ad spending are predicted to hover around 10% through 2027.

Digital ad spend saw a dramatic rebound in 2021 following the initial wave of the COVID pandemic — when it saw growth of 37.6%. In 2022, the numbers fell to back to earth with 10.6% growth.

Digital slice of the pie. Overall media spending is only expected to increase 3.8% this year as traditional media investments continue to migrate to digital.

Digital media should make up 74.6% of total U.S. media spend, which is expected to reach nearly $264 billion in 2023. The digital slice of total media spending is projected to grow about 2% annually in the coming years.

Display and CTV. Connected TV (CTV) advertising keeps charging ahead.

To give some perspective, over half (55%) of digital spending is in display ads whose revenue is expected to grow 7.9% this year. CTV’s projected growth for 2023, however, is 21.2% — nearly triple digital’s growth.

CTV ad spend is on pace to hit $25 billion this year and account for 9.5% of total digital ad revenue, according to eMarketer.

Social display, on the other hand, is projected to see a growth increase of only 3.4% in 2023. Social network display advertising is about a quarter of total digital spending.

Dig deeper: Why we care about CTV and OTT

Search and retail media. Paid search represents 41.8% of total digital spending and should reach $110 billion this year. If it does, its growth will remain slightly higher than digital overall, at 8.2%.

Within search, retail media networks (RMNs) are a rising star, with 18.7% growth in retail media search. This segment is projected to be near $30 billion in spending in 2023.

RMN digital ad revenue (not just in search) is on course to rise from $31 billion in 2021 to $45 billion this year. If spending continues at its current rate it should surpass $106 billion in 2027.

Dig deeper: How Home Depot and Kroger use RMNs to improve shopper ad experience

Why we care. The long view from these numbers shows that digital advertisers are pumping the brakes following a remarkable rebound in 2021. A more modest rebound may also in the cards for 2024.

Outliers to this narrative — CTV and RMNs — show that regardless of overall trends, there is a marketing imperative to meet customers where they are. When TV watchers cut the cord and shift to streaming services, brands have to shift their budgets accordingly. They are also taking advantage of RMNs that provide new opportunities for brands to get closer to customers when they are shopping.

Contributing authors are invited to create content for MarTech and are chosen for their expertise and contribution to the search community. Our contributors work under the oversight of the editorial staff and contributions are checked for quality and relevance to our readers. MarTech is owned by Semrush. Contributor was not asked to make any direct or indirect mentions of Semrush. The opinions they express are their own.

Related stories