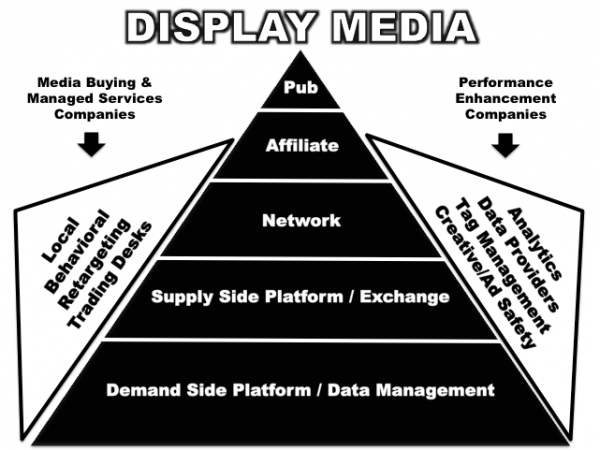

Display Advertising: Who’s Who And What’s What In This Ever-Changing Space

I am sure you have heard the expression “the only constant in life is change”. If you make a living buying, selling and evaluating online display advertising then you understand this all too well. The days when companies in the ad tech industry fit into simple-to-define silos seem to be behind us. Company capabilities continue […]

I am sure you have heard the expression “the only constant in life is change”. If you make a living buying, selling and evaluating online display advertising then you understand this all too well.

The days when companies in the ad tech industry fit into simple-to-define silos seem to be behind us. Company capabilities continue to expand through innovation and acquisition while sales teams advocating their value multiply. The end result is that those individuals left trying to make the best decisions about their display budgets are genuinely more confused than ever.

The lines are far less blurry for those of us who have been working within the ecosystem for years.

One glance at the most recent DISPLAY LUMAscape gives you a fair grasp of the playing field. However, brand and agency media buying professionals on the front lines genuinely seem to struggle with how all of the moving pieces fit together.

This brief article is a display media buying Festivus for the rest of us.

Publishers

Publishers

Netcraft’s March 2012 website survey discovered 644,275,754 active websites operating on the web.

Huge portions of these websites are content-driven and contain a significant number of display ad units for sale.

Many large publishers in fact, maintain their own sales teams. Almost all make large portions, or their entire inventory, available through other channels described in this article. Commonly recognized publisher names include sites such as: WebMD, CNET, Weather.com, Pandora, etc.

Affiliates

Many times publishers will give some of their advertising space to advertisers for free provided the publisher is paid a commission should the ad unit result is a sale or registration.

The companies who specialize in marketing this performance-based inventory to advertisers are referred to as affiliates or affiliate networks.

Commonly recognized affiliate networks are companies such as: PepperJam and Commission Junction.

Networks

Networks are generally brokers between web site publishers and advertisers. Larger ad networks aggregate sites into general categories so that they can offer advertisers targeted buys.

Until recent years, the majority of banner advertisements on the Internet were sold and served by ad networks. Sometimes the network is a collection of owned publisher sites while many are not.

Commonly recognized ad networks include: Advertise.com, Google Display Network, Yahoo!, Casale Media, Undertone, etc.

Supply Side Platform (SSP)/Exchange

An SSP is a technology that allow suppliers of online ads inventory (publishers) to place their advertising inventory into an ad exchange to capitalize on demand to sell their space faster and at the highest price the market will allow.

A Supply Side Platform (or SSP) allows the larger web publishers to automate and optimize the selling of their display inventory with controls that allow them to define what inventory they want to sell, to whom, at what minimum price and more.

The SSPs plug the publishers directly into one of many ad exchanges who connect the publishers’ supply via real time bidding (RTB) to demand typically generated via advertisers buying display via DSP (demand side platform) technology.

Recognized SSPs include: PubMatic and AdMeld. Examples of ad exchanges include: AdECN and Right Media.

Demand Side Platform (DSP)

A DSP is a platform that allows advertisers to buy and optimize display campaigns across multiple ad exchanges and data exchanges through one interface. The bidding is done via real time auctions. Marketers can manage their bids, and manage pricing for the data they are layering onto their campaigns’ target audiences.

DSPs are unique in that they offer large access to inventory with many targeting options while serving, tracking and optimizing performance. Pricing is almost always transparent, meaning advertisers can see the actual media cost on publisher sites and pay fees as a percentage of media spend for this access.

DSPs are often self-service via a user interface or API (application programming interface), however almost all offer fully managed campaign services as well, which has lead to an increasing number of brand and agency buys.

In recent years, the growth in number of campaigns run on DSPs has been so significant that many ad networks now make their inventory available to DSPs via their own exchange to capitalize on increasing demand.

There are essentially two kinds of DSPs. The first kind is a traditional DSP which relies heavily on third-party or client first-party data built into fixed data segments. The second kind of emerging DSPs are those who specialize in unstructured data collected by the DSP directly or brought into the platform for element-level media buying and optimization instead of grouped into fixed segments.

Common Demand Side Platforms are companies like MediaMath, Turn and Simpli.fi.

Media Buying And Managed Services Companies

While I will admit it is a gross oversimplification to lump all behavioral targeting, local targeting, retargeting and media buying specialty companies into a single category; I do so because they share some very common characteristics.

First, these companies offer reach, and handle the media buying for their clients. Some of them behave like a DSP without the transparency, in that they have technology that taps directly into multiple exchanges to acquire inventory at one price while marketing their services at another price.

Others build their business in a similar way, but leverage their buying power across multiple ad networks and DSP partners.

Second, part or all of their pricing layers in value-added services on top of media buying, such as building creative, providing dynamic or recommendation engine-based ad serving, optimization and analytics services across the many traffic sources they buy media from.

Third, these firms often specialize in, and perfect specific tactics for, the channels they represent and are able to demand a premium price in exchange for their expertise and consolidation of services under one roof.

Recognized specialized companies include companies such as Reach Local, Fetchback, MediaForge and Retargeter.

Performance Enhancement Companies

This is another group of companies who perform many varied functions, but share a basic common characteristic. These companies exist to provide some added layer of protection or performance enhancement to display ad buys.

This is a broad range of companies that generally fall into one of the following categories: brand safety (AdSafe, DoubleVerify) , analytics & attribution management (Convertro, C3 Metrics), creative creation and optimization (Adacado), ad serving (Mediaplex, Dart, Atlas), tag management (BrightTag) and data providers (BlueKai, Datonics).

Many of these companies are partners layered into the managed solutions offered by specialty targeting organizations, DSPs, and ad networks.

In the end, change is inevitable and the neat buckets I have constructed for you are beginning to leak. Companies are evolving to meet the demands of media buyers while maintaining relevance and a competitive advantage.

You remember the law of competitive advantage from economics 101. If you build a hot dog stand on the corner and it’s profitable then you will soon have a competitor on the other corner who found a way to make the hot dog cheaper or taste better, or throw in a free cookie. One must evolve or die.

Therefore, I challenge any display media buying professional to continue asking questions, peel back the onion when selecting vendors and remain open to something new. In our industry, something new is likely the next call or email you receive.

Contributing authors are invited to create content for MarTech and are chosen for their expertise and contribution to the search community. Our contributors work under the oversight of the editorial staff and contributions are checked for quality and relevance to our readers. MarTech is owned by Semrush. Contributor was not asked to make any direct or indirect mentions of Semrush. The opinions they express are their own.

Related stories