EU Files Antitrust “Statement Of Objections” Against Google On Shopping Search, Also Targets Android

As expected, the European Commission has filed a “Statement of Objections” against Google. These are formal antitrust charges against the company. Somewhat unexpected, however, is the fact that the Statement only concerns the category of comparison shopping. Simultaneously, the Commission has opened a formal investigation into claims of market abuse regarding the Android operating system. This was […]

As expected, the European Commission has filed a “Statement of Objections” against Google. These are formal antitrust charges against the company. Somewhat unexpected, however, is the fact that the Statement only concerns the category of comparison shopping.

Simultaneously, the Commission has opened a formal investigation into claims of market abuse regarding the Android operating system. This was long expected.

The Commission says that it continues to “actively investigate Google’s conduct as regards the alleged more favourable treatment of other specialised search services.” But for now, at least, charges have not been filed regarding local search, maps or travel — areas that have been vigorously promoted as areas of abuse by competitors such as Yelp, Kayak and others.

Below are the Commission’s “preliminary conclusions” regarding Google search results and comparison shopping (emphasis in original):

- Google systematically positions and prominently displays its comparison shopping service in its general search results pages, irrespective of its merits. This conduct started in 2008.

- Google does not apply to its own comparison shopping service the system of penalties, which it applies to other comparison shopping services on the basis of defined parameters, and which can lead to the lowering of the rank in which they appear in Google’s general search results pages.

- Froogle, Google’s first comparison shopping service, did not benefit from any favourable treatment, and performed poorly.

- As a result of Google’s systematic favouring of its subsequent comparison shopping services “Google Product Search” and “Google Shopping”, both experienced higher rates of growth, to the detriment of rival comparison shopping services.

- Google’s conduct has a negative impact on consumers and innovation. It means that users do not necessarily see the most relevant comparison shopping results in response to their queries, and that incentives to innovate from rivals are lowered as they know that however good their product, they will not benefit from the same prominence as Google’s product.

These are conclusions that Google now gets a chance to rebut. Unlike in a U.S. antitrust scenario, Google and the Commission will not be making adversarial arguments before an independent third party tribunal. The Commission is the entity to which Google will be making its defensive case, so it’s unlikely Google will be especially persuasive to the Commission. It might still be possible to settle, but on considerably different terms than the prior “rival links” proposals.

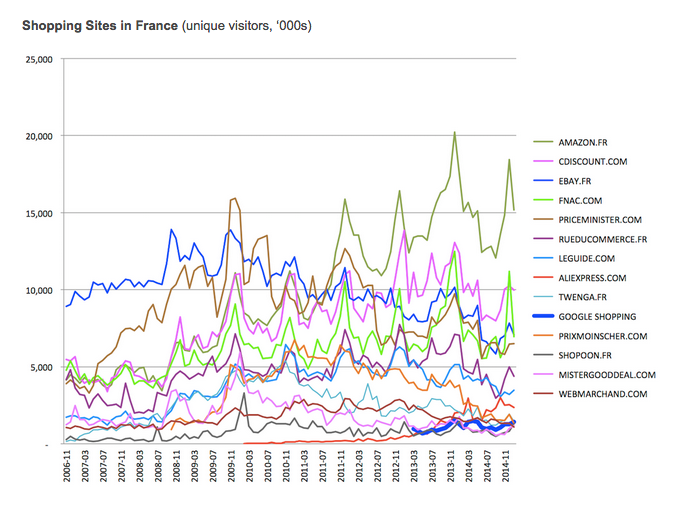

Google issued a strongly-worded rebuttal to the formal shopping search charges and Android investigation in two separate blog posts (EU Statement of Objections, Android). The company cited traffic data from shopping sites in France, Germany and the U.K. to argue that Google is far from the dominant shopping site, and faces strong competition across Europe.

Further, Google says the market is highly competitive in the online shopping sector across Europe. An internal FTC report regarding the U.S. market, made public after being inadvertently disclosed by the agency, asserted that Google specifically targeted shopping competitors and demoted them in search results. The FTC ultimately declined to file an antitrust case against Google.

Regarding Android, Google makes a range of arguments about how it has helped rather than harmed market competition, increasing choice and lowering prices for consumers. Regarding Google’s “anti-fragmentation agreements” (a specific area of focus for the Commission), Google says that this is pro-competition, too:

Anti-fragmentation agreements, for example, ensure apps work across all sorts of different Android devices. (After all, it would be pretty frustrating if an app you downloaded on one phone didn’t also work on your eventual replacement phone.) And our app distribution agreements make sure that people get a great “out of the box” experience with useful apps right there on the home screen (how many of us could get through our day without maps or email?). This also helps manufacturers of Android devices compete with Apple, Microsoft and other mobile ecosystems that come preloaded with similar baseline apps. And remember that these distribution agreements are not exclusive, and Android manufacturers install their own apps and apps from other companies as well. And in comparison to Apple—the world’s most profitable (mobile) phone company—there are far fewer Google apps pre-installed on Android phones than Apple apps on iOS devices.

My guess would be that Google will be compelled to relax some of its Android OEM requirements and Google app pre-installation rules. This is not unlike Microsoft’s bundling of the IE browser with Windows, which was the source of major fines for Redmond several years ago.

Given that the Statement of Objections comes in the context of a very anti-Google political climate in Europe and that it is the result of a five-year process and investigation, it is very unlikely that Google will escape without making significant concessions, paying fines or both.

Also see our related story: Problems & Solutions: Analyzing The EU’s Antitrust Charges Against Google Over Shopping Search

Contributing authors are invited to create content for MarTech and are chosen for their expertise and contribution to the search community. Our contributors work under the oversight of the editorial staff and contributions are checked for quality and relevance to our readers. MarTech is owned by Semrush. Contributor was not asked to make any direct or indirect mentions of Semrush. The opinions they express are their own.

Related stories

New on MarTech