Holiday shopping to ‘peak’ early, be more mobile and less social — survey

Deloitte survey polled more than 4,000 consumers in the U.S. about intended holiday spending.

The onslaught of holiday shopping surveys has begun. And consultancy Deloitte is out of the gate early with its 2019 holiday retail survey.

Keep in mind that consumer surveys are aspirational and don’t always align with real-world behavior. Still, they reflect consumer intent and are worth paying attention to as a directional indicator of important trends.

Experiences will consume roughly a third of budgets. Retailers can expect consumers to spend roughly $1,500 this holiday season, according to the Deloitte survey of 4,400 U.S. adults, conducted in September. Yet, more than a third of that spend will be devoted to “experiences”: entertaining at home, traveling and eating at restaurants.

More online spending, but offline still dominates. As in the past, the share of consumer spending devoted to ecommerce will grow — up two points to 59% of holiday shopping this year. In-store spending will be flat at 36% of the total, according to the survey.

However, contradicting the broader implications of this finding, ecommerce spending in the U.S. in Q4 2018 was just 10.1% of total retail sales, according to U.S. government data. Ecommerce will not be 59% of total Q4 retail sales.

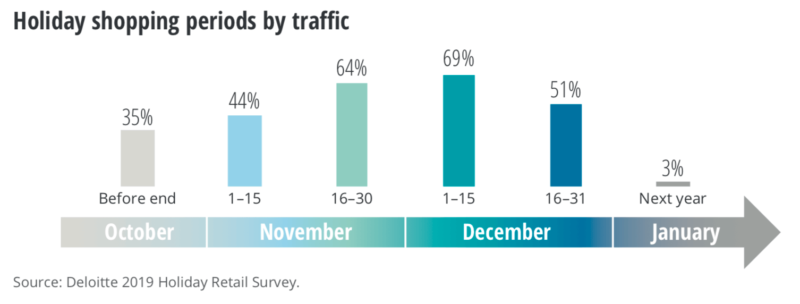

Early shopping. Deloitte also found that holiday shopping is “expected to peak” in early to mid-December, driven largely by early deals and the Black Friday-Cyber Monday shopping week. The firm also said that, “Cyber Monday has eclipsed Black Friday in terms of importance across all generational cohorts, though Gen Z and millennials rely most on Cyber Monday deals.”

Another interesting data point is that consumers prefer free shipping to fast shipping. And most consumers are willing to wait between three and seven days for packages to arrive. Those who preferred fast shipping want their packages in less than two days. Amazon has trained consumers to expect this and now we’re moving to one-day shipping scenarios.

70% will shop on their phones. Consumers also anticipate buying more on their smartphones this year, with 70% saying they plan to shop and buy on mobile devices. Mobile retail traffic has eclipsed the desktop for the past couple of years, with mobile commerce sales growing significantly. However, the majority of ecommerce transactions still take place on PCs.

As in the past, Deloitte reports that consumers will be using multiple resources to help them with their shopping research and buying. The firm found, interestingly, that social media will not have as much influence over consumer spending this year as in the past. This sentiment may be a general statement of consumer disapproval of social media rather than any predictor of actual behavior.

Social ‘not a major driver of product research.’ Deloitte says, “Social and print media are not major drivers of product research and are wielding much less of an influence on consumers this holiday season. And the value of the in-store experience remains solid, especially for products that consumers want to see and touch before purchase. Fully half intend to find their inspiration in the store.”

Why we should care. Again, it should be stressed that what people report in surveys often doesn’t turn out to be what they do in practice. For example, marketers should not read the above chart and pull their social media spending. As in years past, it’s going to take a thoughtful, multi-channel approach to win.

However, as the survey recommends, retailers should front-load their promotions to catch early shoppers. They should also focus on mobile as an entry point for consumers but recognize transactions will still happen on PC and offline. And, as always, they should remove as much friction as possible from the checkout process.

Contributing authors are invited to create content for MarTech and are chosen for their expertise and contribution to the martech community. Our contributors work under the oversight of the editorial staff and contributions are checked for quality and relevance to our readers. The opinions they express are their own.

Related stories