3 behavioral stats for retailers to supercharge your holiday strategy

Columnist Andrew Waber takes a look at consumers' retail search activity to give you insight into the keywords and product content that will give your brand a leg up during the holiday season.

At the company I work for, Salsify, we analyze aggregate retail search activity, and we’ve discovered it grows more widely distributed during the shopping period leading up to the holidays. We’ve recently conducted research (registration required) on the keywords that shoppers use around the holidays and we’ve identified important opportunities for brands to expand their keyword lists. Leading brands are also dramatically boosting the pace of their product content updates to capitalize on the opportunity throughout the season to win market share.

Let’s run through the top three takeaways from our study:

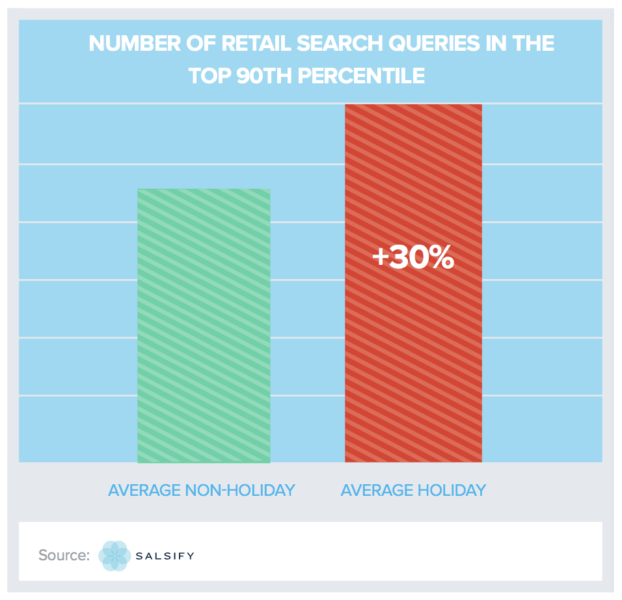

1. The 2016 holiday season drove a 30 percent increase in the number of top retail search terms — those in the 90th percentile or above in terms of search frequency.

Consumers aren’t just searching more during the holiday season; they are also searching across a much wider variety of terms. An analysis of all retail searches run across several of our company’s retail partners between January and December 2016 showed that the universe of “popular search queries” expands considerably in November and December.

What this means for brands is pretty evident: You need to be responsive to this change in behavior. Just to be found, let alone bought by your target customers, your product content on Amazon, Walmart and other channels needs to reflect relevant, holiday-oriented terms as the season gets under way.

If your product fits the description of a “stocking stuffer” or a “great gift for kids,” for example, it’s vital that you add in language during the month of October or early November — just as consumers are switching into gift-buying mode.

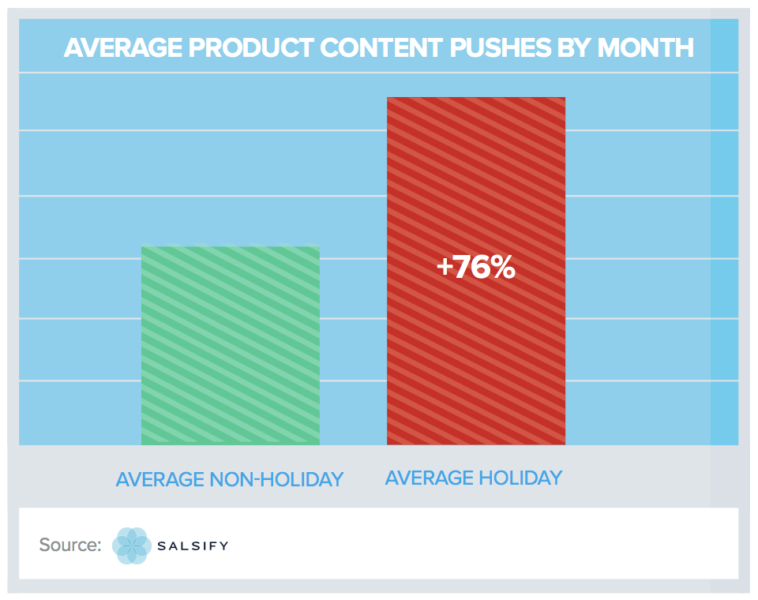

2. Seventy-six percent more product detail page content updates were pushed during an average holiday month versus an average non-holiday month.

Brands are indeed taking a substantially more active role in their product content leading into the holiday season.

We examined six full months of product content pushes and updates across more than 50 large retailers in the apparel, toys, home and garden and associated industries (all of them were our company’s customers). Collectively, the brands included in this sample oversee the management of more than 10 million SKUs.

Across this same-advertiser set, an average holiday season month in 2016 had 76 percent more product content pushes occurring across retailer sites as compared to the prior six-month average. These numbers reverted back to non-holiday levels in January and February.

There’s a reason for this, and it’s the same reason more and more online retailers are investing in APIs and direct connections with brands. Consistently updated and relevant product content has a meaningful impact on sales.

The holiday season is a time for marketers to spur their efforts here, but it underscores the opportunity for brands throughout the rest of the year. Online shopping habits experience seasonal changes at other points on the calendar. Keeping product content responsive to these trends and changes will help boost sales prior to Q4.

3. Most brands and retailers incorporate holiday terminology in product pages in November, not December.

When it comes to getting holiday-oriented copy in product content, the lesson to marketers should be “Think of November as too late.”

Examining six months of product content pushes across a subset of our largest customers, product content pushes including holiday terminology (e.g., Christmas, holiday, stocking stuffer, new year, santa) rose by more than 25x in November compared to the prior four-month average.

The subsequent slight drop in December is likely due to the fact that brands are pushing their holiday product content earlier to capitalize on the entire shopping season.

So, how can you outflank competitors? Embed those key terms in product content as soon as consumers start thinking about purchasing holiday gifts. It’s well worth doing so in October, or even earlier if it’s appropriate. That way you aren’t hamstrung if a product update takes a while to hit the actual product page on a retailer’s site.

You’ll also position yourself for better rankings on those key terms throughout the rest of the season, thanks to retailer algorithms. This is particularly important for new, seasonal-oriented products.

This is a strategy you can extend to other periods of the year for the same reasons: to help drive discovery and win more market share.

Contributing authors are invited to create content for MarTech and are chosen for their expertise and contribution to the martech community. Our contributors work under the oversight of the editorial staff and contributions are checked for quality and relevance to our readers. The opinions they express are their own.

Related stories

New on MarTech