Twitter’s User Growth Stalled And Advertisers Don’t Care (Yet)

Creative opportunities and results, so far, appear to outweigh the lack of user growth. Moves into direct response pose new challenges, however.

After Twitter reported stagnant user growth in the fourth quarter — with a decline in US users and an overall global bump of just three percent year over year — share prices started sinking, and the doomsday press coverage churned. In all of this, a revenue story that might otherwise read as promising, if not meteoric, gets drowned out by stories of executive departures, a product that’s too complicated and riddled with bots and endless comparisons to Facebook.

There is, in fact, a pretty solid revenue growth story, but even that gets drowned out by comparisons to Facebook’s meteoric success. But remember those years before Facebook figured out mobile advertising? Ad product changes and inconsistent communication to advertisers led many to have serious doubts the company could make the transition. Then they figured it out. Whereas Facebook’s product was strong and attracted droves of users, it was having trouble monetizing those users. Twitter, on the other hand, has had a turbulent product history, to say the least (CTO Adam Messinger is now also heading product after Kevin Weil left for Instagram in January), but it’s been able to drive ad revenue despite its shortcomings. In Twitter’s case, the cart is outpacing the horse.

Twitter might not be the most intuitive service, but it continues to hold a unique position in the zeitgeist of live, real-time content. Even though the company hasn’t been able to tout native user growth for more than two years, ad revenue continues to grow, and brand advertisers join in at a healthy clip. In September 2015, Twitter announced its advertiser base had grown to 100,000, up from 60,000 a year before. (Yes, yes, Facebook has over one million.) This year, Twitter said 90 percent of 2016 Super Bowl advertisers also ran ads on Twitter.

As Twitter COO Adam Bain said in a Bloomberg West interview last month, “There were questions about our ability to monetize, we’ve proven them wrong over the past five and a half years and I look at the next five and a half years as a chance to prove them wrong again.”

The next planned phase of growth is to come from direct response advertisers — a very different beast from brand advertising. In a phone interview with Twitter VP Matt Derella, who heads up US ad sales and global agency relations, we discussed what he has been hearing from brands and agencies and what efforts he believes will pave the way for revenue growth. Derella joined Twitter in 2012, after five and a half years running agency business development at Google.

Bets On Video

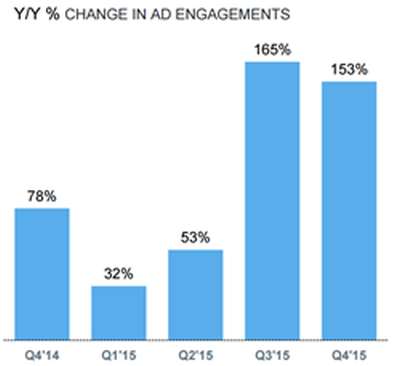

In the past two quarters, Twitter has reported significant year-over-year increases in ad engagement — the number of times users click, expand, watch and so forth on promoted content. Ad engagements jumped 165 percent year over year in Q3 and 153 percent in Q4.

On Twitter itself, Derella pointed to two key developments that have made that happen: relevancy and new creative formats and deployments — namely, video. In its annual report for 2015, Twitter noted the leading role autoplay video in late 2015 had on ad engagements.

The autoplay rollout includes Vines and GIFs; advertisers are charged when a video is in view for at least three seconds. With both Vine and Periscope in its portfolio, Twitter should have many more opportunities to tap the estimated $7.7 billion market for online video ads in the US alone.

HP, for example, turned a series of branded Vines into a 30-second ad spot after seeing the engagement metrics on the short videos. In January, Twitter made the move to enable Periscopes to show up in tweets, rather than living only in the standalone Periscope app, paving the way for promoted Periscope tweets.

To that end, there is a lot of anticipation around Periscope video ads — Periscope videos that can be promoted on Twitter. Promoted Periscopes have a lifespan of 24 hours, just like non-promoted Periscopes.

Derella expects live video to be very popular with marketers. “The creative community is over the moon about this. Live video has always been something marketers love. This is the next evolution. Creative directors and CMOs get really excited about this.”

Promoted Periscopes are in beta now, and Derella says they are learning, together with brands, what gets users to take notice. A handful of brands have been testing the format. Doritos promoted behind-the-scenes Periscopes ahead of the halftime show at the 2016 Super Bowl.

Brands continue to make up the bulk of Twitter’s advertising base, as it’s where the company focused first. Verizon, Pepsi, Doritos, Beats, Star Wars and Shock Top are all brands that have recently used Twitter to launch new campaigns, tie in with live events and extend television campaigns onto the social network.

“They know it works and drives return,” says Derella, noting that Twitter has measurement down for brands.

“Personalization At Scale”

This is the kind of scale that brands are happy see. Asked whether Twitter’s user growth has affected how Unilever looks at investing on Twitter, Gail Tifford, Vice President, Media and Digital Engagement of Unilever North America, said in an email, “We’re watching all developments closely around Twitter and how the platform evolves. Ultimately, our main objective is to deliver worthwhile brand experiences to our audience and continue to focus on the performance of our campaigns.”

“In order to harness the true power of Twitter, a brand needs to deliver powerful experiences to its relevant users. It’s not about generic broadcast media but, instead, driving personalization at scale. Twitter is the place where brands should play on their personality,” said Tifford, pointing to Dove’s #speakbeautiful campaign as an example of one of the company’s Twitter campaigns that delivered the brand’s point of view and drove real-time action from users.

Post one thing you love about a friend.

YOU can start a positive domino effect.#SpeakBeautiful – Dove & @Twitter pic.twitter.com/BAtraTjBqW

— Dove (@Dove) February 23, 2015

TellApart’s Role In Getting Direct Response Right

What quickly becomes clear in talking to Twitter executives is how important Twitter’s acquisition of TellApart in April 2015 has become for Twitter. “We’ve been focused on relevancy,” said Derella, “A big part of the TellApart acquisition was to deliver and target right message at right time.”

TellApart specializes in predictive ad targeting and cross-device retargeting and measurement solutions. It’s driving Twitter’s dynamic retargeting ads for retailers and efforts to improve targeting and attributing conversion actions back to Twitter when actions occur farther down the customer journey.

TellApart has become the foundation for building up Twitter’s direct response ad business.

In addition to helping to serve more relevant ads via TellApart’s machine learning, the company has also started measuring attribution lift from Twitter ads when actions occur off of Twitter with DoubleClick.

The DoubleClick deal goes beyond just a standard integration, says Derella. “DoubleClick has been historically desktop-centric in showing attribution. Mobile gets almost no attribution in these models. Now we can do cross-device measurement that will give Fortune 1000 advertisers insights into mobile contribution. Early feedback is really, really encouraging, and giving mobile insights into the customer journey for the first time.”

It’s Not The Scale, But The Tools That Matter Now, Say DR Advertisers

Whether Twitter can succeed with direct response advertisers is still a big question. “The down funnel opportunity is massive. [Direct response] is the fastest growing segment of advertisers, but it’s still small compared to brand,” Derella says. Those unique creative canvases that appeal to brands don’t mean as much to performance advertisers as getting the right people to take an action — and being able to measure the impact of those actions on the bottom line.

John Lee, Managing Partner of Clix Marketing, has been involved in Twitter advertising since it was in beta with both B2C and B2B clients. Lee says that it’s still a sell to get clients to try Twitter. That said, clients that have been advertising on the network for a year are running at similar or higher spending levels. “We’ve continued to sell clients on Twitter and have additional activity there, making our investment as an agency higher [than a year ago],” said Lee by email.

“Twitter is a unique blend of social and display features. On one hand you have the demographic/interest/behavior targeting and custom audience/lookalike audience targeting that aligns with Facebook,” says Lee, “On the other you have keyword targeting for a contextual match against the content of a user’s profile and feed. The blend of these makes Twitter a compelling channel.”

For its own prospecting efforts, AdStage, a cross-network ad platform (and Twitter partner), says it has increased investment on Twitter, along with other social networks. Both Lee and AdStage’s demand generation team say Twitter’s user growth story isn’t affecting current investment decisions. However, Lee says, “Should the trend continue and the decline in users has a serious impact on ad performance and reach — then the difficult conversations/decisions will start.”

The AdStage team added, “While reaching more ideal prospects is important, Twitter is already home to many thought leaders and decision makers.”

They’d like to see Twitter focus more on B2B. That’s a sentiment echoed by Lee, who hopes to see the ability for B2B advertisers to target by industry, job types and other dimensions available from LinkedIn, as well as an enhanced lead gen card interface as specific areas Twitter should focus. Facebook’s lead ads have supplanted the benefits of Twitter’s lead gen cards by offering the ability to capture greater detail from users, he says.

And that’s where Twitter is going to start having to show clear results for direct response marketers.

“We have tremendous amount of runway to work with clients,” Derella noted, meaning in many ways, they are just getting started. “Our growth is grounded in driving results.”

Contributing authors are invited to create content for MarTech and are chosen for their expertise and contribution to the search community. Our contributors work under the oversight of the editorial staff and contributions are checked for quality and relevance to our readers. MarTech is owned by Semrush. Contributor was not asked to make any direct or indirect mentions of Semrush. The opinions they express are their own.

Related stories

New on MarTech