Thanksgiving Weekend 2015: The Stats That Mattered

Columnist Andrew Waber looks at data from Facebook ecommerce advertising activity during the Thanksgiving shopping period and discusses what it will mean for marketers moving forward.

With so many retailers vying for a piece of the purchase-ready consumer base, the weekend after Thanksgiving remains one of the most intense periods for online ecommerce advertisers. Increased demand for inventory drives up prices, and many advertisers pull out all the stops on the creative front to drum up attention and purchase rates.

With so many retailers vying for a piece of the purchase-ready consumer base, the weekend after Thanksgiving remains one of the most intense periods for online ecommerce advertisers. Increased demand for inventory drives up prices, and many advertisers pull out all the stops on the creative front to drum up attention and purchase rates.

This kind of proverbial arms race doesn’t really slow down until after Christmas, but the trends observed over the Thanksgiving weekend provide a kind of window into what can be expected moving forward.

The data outlined below was drawn as part of my work at Nanigans, and it is focused squarely on Facebook ecommerce advertising activity and associated same-day purchase events. You can find more on ecommerce trends during the Thanksgiving weekend in Marketing Land’s weekly Online Retail Shopping Report.

Mobile Hits A High Point

Traditionally, ecommerce advertisers have focused on desktop, thanks to historical returns. In aggregate, this advantage is slowly eroding, particularly during the holiday season.

According to IBM, 2015 is the first year that consumers have done more shopping on mobile devices than on desktops or laptops. Not surprisingly, then, ecommerce advertisers have made changes to better match market behaviors.

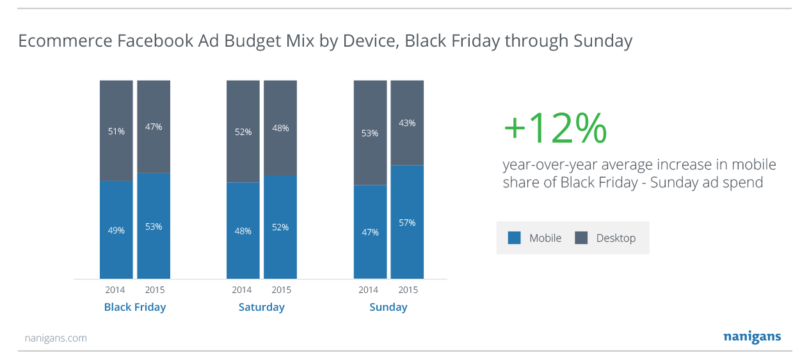

Mobile ad spending over the Thanksgiving weekend went up 12 percent year over year, constituting the majority of ecommerce Facebook spend on Black Friday, Saturday and Sunday.

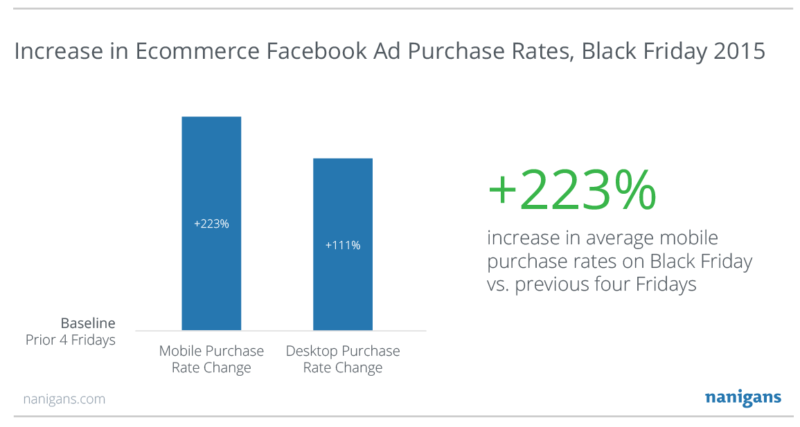

This change in behavior is also reflected in purchase rates, which showed a much greater increase on mobile, as compared to desktop.

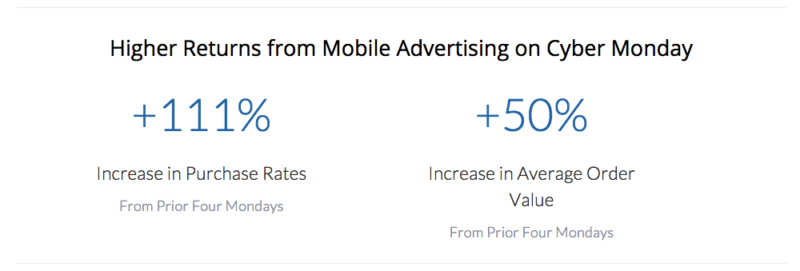

Downstream metrics during Cyber Monday also showcased the kind of dramatic improvements that are associated with this more recent extension of the holiday weekend:

The more than doubling of mobile purchase rates can largely be expected, but the average order value increase was particularly notable. Sales are understandably one of the main draws of Cyber Monday, but across our aggregate ecommerce advertiser base, we saw consumers spending 50 percent more money at checkout, specifically while on their mobile phones.

While some of these increases can be attributed to a sizable portion of the population being on the go over the Thanksgiving weekend, it also speaks to the improvement in direct response ad products from Facebook and other channels.

These newer units, Dynamic Product Ads being one example, make it a few-click process for users to go from Facebook to purchasing a specific product they see within an ad. This quick turnaround helps limit issues like cart abandonment, which can be a huge problem for online retailers.

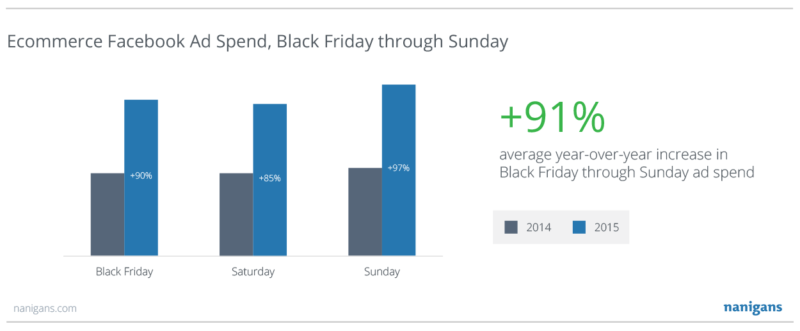

Higher Stakes In Social

At a 91-percent increase in average budgets, ecommerce advertisers dramatically ramped up their spending on Facebook compared with the same period one year prior. Substantial purchase rate increases across both desktop and mobile, which we’ve observed historically, characterize these high-traffic periods, and advertisers seem more than willing to spend extra in order to take advantage.

Expect this to continue throughout the remainder of the holiday season.

Pricing Fluctuations More Of The Same

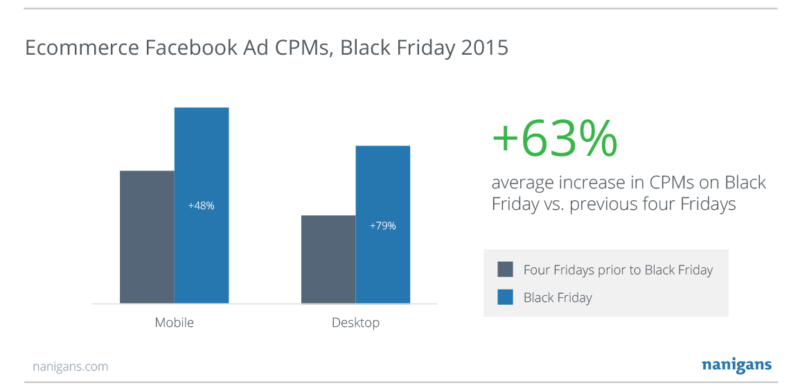

Naturally limited inventory, paired with a dramatic spike in demand, drove prices on ecommerce Facebook ad inventory to increase by a sizable percentage during Black Friday and the subsequent weekend.

While these increases can be expected to subside to some degree over the coming weeks, the price jumps are largely in line with what was observed over the course of the 2014 holiday season. As such, advertisers need to be willing to spend more in order to reap the benefits of the holiday season on Facebook — namely, dramatically increased purchase rates.

The Big Takeaways

Mobile has always been a kind of two-way street for ecommerce advertisers — click-through rates are much better than on desktop, but prices are higher, and mobile users tended not to purchase quite as frequently.

This argument is increasingly becoming flawed, with desktop prices rising and mobile users being more willing than ever to purchase while on their phones.

As the 2015 holiday season rolls along, ecommerce advertisers shouldn’t neglect desktop, but they would be wise to invest strategically in direct response mobile campaigns that fit their target markets.

Contributing authors are invited to create content for MarTech and are chosen for their expertise and contribution to the search community. Our contributors work under the oversight of the editorial staff and contributions are checked for quality and relevance to our readers. MarTech is owned by Semrush. Contributor was not asked to make any direct or indirect mentions of Semrush. The opinions they express are their own.

Related stories