Seizing The Mobile Opportunity For The Holiday Season

Contributor Benjamin Vigneron explains how you might use estimated cross-device conversion data to adjust your mobile ad spend for the holidays.

About a year ago, AdWords introduced Estimated Cross-Device Conversions to give advertisers a better sense of what different device types bring to the table in paid search, as well as on the Google display network.

While those cross-device numbers should be seen as mostly directional (as they only reflect what those users who have previously signed into Google do), search marketers can definitely look for insightful historical trends and adjust their mobile strategy accordingly.

Here are some thoughts as of how you might want to slice cross-device data in order to improve your mobile strategy for the busy season.

What Are Cross-Device Conversions?

As we seek insight on cross-device conversions, it helps to understand some basic terminology first.

Converted Clicks Vs. Conversions. Converted clicks refers to the number of clicks that led to a conversion action (purchase, phone call, lead form submission, download, etc.) within your defined conversion window, while conversions refers to the total number of conversions across all tracked conversion actions.

So, for example, if a customer clicks on your ad and makes two purchases, this counts as two conversions but only one converted click.

Estimated Conversions. In AdWords, estimated conversions are intended to provide “insight into how your ads influence new conversion types, such as phone calls, store visits and conversions that are completed after a customer uses more than one device or browser.” The number in the Estimated Total Conversions column combines actual, recorded Conversions with these estimated conversion types (such as cross-device conversions), though no breakdown is provided.

It is important to note that phone conversions are not accounted for if you do not use call extensions with Google forwarding numbers. Additionally, in-store visits don’t seem to be included; currently, Google’s help page simply says, “Stay tuned for updates.”

So it seems that, currently, cross-device conversions are essentially cross-device and cross-browser assists and will also include phone assists if you are using call extensions with Google forwarding numbers. This is an important first step in order to clarify what’s included and what’s not, and you’ll get a better approximation of the “true” mobile revenue.

Measure How Mobile Devices Assist Computer & Tablet Devices

Here is an example of how you might want to look at the data as a summary. This advertiser does not use call extensions, so the “total est. conversions” column strictly refers to cross-device and cross-browser conversions here.

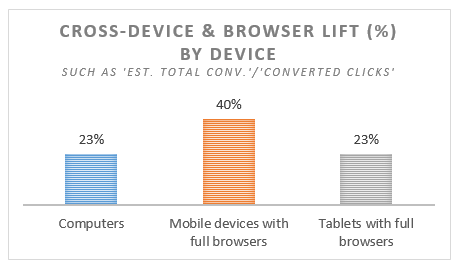

Also, the cross-device and cross-browser lift was calculated such as ‘Est. total conv’/’Converted clicks’ and represents those incremental cross-device conversions as a percentage of the converted clicks:

Cross-Device & Browser Lift by Device

In this case, we’re seeing that all of device types brought some cross-device or cross-browser conversions, with mobile devices bringing the highest proportion of assists — unsurprisingly. More specifically, on average:

- 100 converted clicks on computer devices brought a total of 123 conversions across all devices and browsers

- 100 converted clicks on tablet devices brought 123 conversions across all devices and browsers

- 100 converted clicks on mobile devices brought 140 conversions across all devices and browsers

Another way to go about it is to compare mobile devices vs. computer and tablet devices combined since mobile bid adjustments can be set relative to those computer/tablet base bids, in which case:

Computer+Tablet vs. Mobile Cross-Device Lift

- 100 converted clicks on computer or tablet devices brought 123 conversions across all devices and browsers

- 100 converted clicks on mobile devices brought 140 conversions across all devices and browsers

So in this case, mobile devices brought 68% more cross-device assists than computer/tablet devices (that is, 40%/23%). And, since one can legitimately assume there must be some double counting going on between devices, at least you can use this latter ratio — which we will name “Relative mobile lift” for the sake of this post — as a guideline for measuring the relative role of mobile devices vs. computer+tablet devices, and use it to tweak your mobile bid adjustments.

Identifying Cross-Device Patterns Over Time

Now that we have a better understanding of what different devices bring to one another based on Google’s data, we might still argue that those numbers are not fully reliable as they only reflect what Google account users do. That might be true; however, the trends over time should make some kind of sense. For instance, if you pull a report by campaign by device by month with those cross-device conversions, you can look at the following:

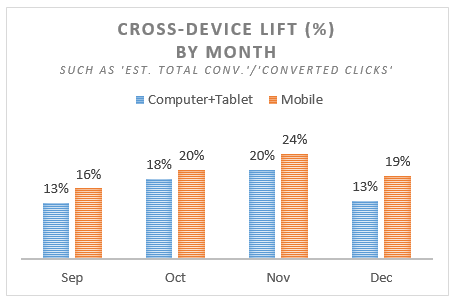

Cross-Device Lift by Month

So, for this particular advertiser:

- The month of November showed the most cross-device and browsers conversions, reflecting more intense usage of multiple devices at that time of the year

- The most cross-device lift occurred on mobiles, especially in November (+24%), while October (+20%) and December (+19%) are high, too.

- Computer and tablets also brought a significant number of cross-device conversions, especially in October (+18%) and November (+20%), then slightly less in December (+13%)

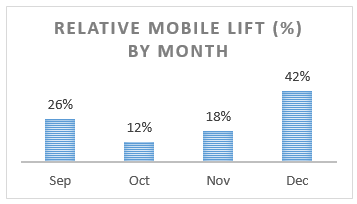

You might want to consider those numbers when adjusting your mobile bid adjustments over time. Also, getting back to the relative contribution of mobiles compared with computers and tablets, the month of December shows the most opportunity in terms of relative mobile lift — that is how much more likely mobile clicks are likely to convert across devices or browsers.

So, if November is the month with the most interactions between devices, December is when mobile devices helped other devices or browsers the most – at least for this particular advertiser. Again, you might want to layer those numbers on top of your mobile strategy and set more aggressive mobile bid adjustments in December.

Relative Mobile Lift by Month

Identifying Cross-Device Assists By Product Categories

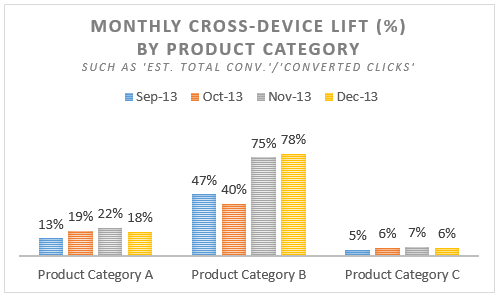

Not all product categories have the same characteristics when it comes to cross-device and cross-browser paths. In general, those high average order value (AOV) product categories typically need more time for conversions to occur.

A $1,000 product might need 30 days whereas a $10 just needs 2 days; hence, more chances of having multiple touch points across devices and browsers for higher AOV products. So, looking into relationships between AOV and cross-device assists, you should be seeing more cross-device assists for those higher AOV product categories too.

In the below example, I am seeing significant differences between product categories:

- Product Category A show fairly normal numbers on average and by month – quite a lot of cross-device conversions just like the rest of the account

- Product Category B shows above-normal cross-device trends, with a huge cross-device lift in November (+75%) and December (+78%)

- Product Category C shows below-normal cross-device assists, most likely reflecting either a shorter buying cycle and/or a lower AOV

Now that we’ve spotted those product categories with significant cross-device lift over time, we can fine-tune our mobile bid adjustments at the right time of the year, and prioritize those product categories where you’re expecting the most cross-device lift.

Conclusion

While there are lots of ways to improve your mobile strategy in paid search — such as those mobile-preferred ads and sitelinks, as well as click-to-call extensions — aggressive mobile bid adjustments are obviously crucial for increasing your market share on mobile devices.

That’s precisely why cross-device assists should definitely be part of the equation when determining your paid search budgets and mobile strategy so you can justify more spend going through mobile devices despite poorer short-term profitability.

Of course, you first want to make sure AdWords’ cross-device numbers apply to your business and potentially try to test for yourself, but in the absence of any alternative, there is plenty to learn, at least directionally.

Contributing authors are invited to create content for MarTech and are chosen for their expertise and contribution to the search community. Our contributors work under the oversight of the editorial staff and contributions are checked for quality and relevance to our readers. MarTech is owned by Semrush. Contributor was not asked to make any direct or indirect mentions of Semrush. The opinions they express are their own.

Related stories