4 ways brands can win the digital shelf in 2018

Innovators like Amazon keep upping the ante in online retail. Contributor Andrew Waber helps retail marketers catch up with insights into what consumers want.

What drives shoppers to buy in the current retail environment?

To find out, my company surveyed more than 1,000 US consumers who shopped online at least once in 2017, and some clear lessons for brands emerged from the results.

1. Have at least 3 photos for every product you sell

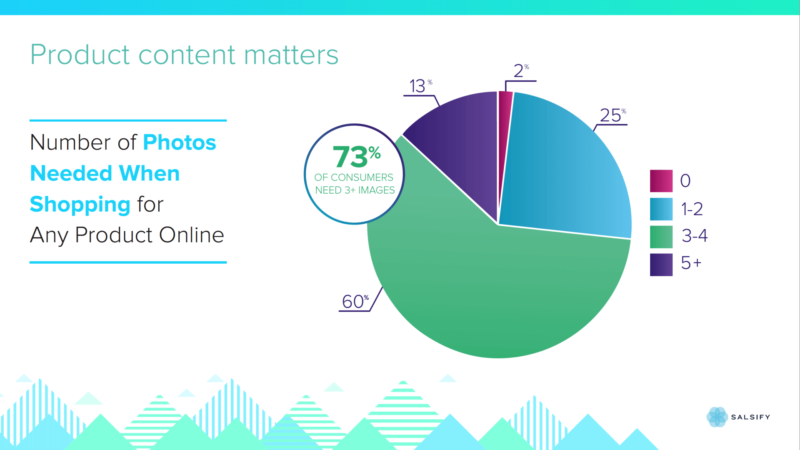

In the same way that consumers want to touch and feel products on the physical shelf before they buy, they are becoming similarly discerning online. Seventy-three percent of consumers indicated that they need to see three or more images of a product of any kind before buying online.

Increasingly, consumers search for a product category rather than a specific branded term (example) and then self-select specific classes of products based on personal preference or requirements, such as size, color and price.

This increases the value of those first impressions your brand makes with above-the-fold product images — it’s easier to make a consumer decide to buy if you give a clear window into your product’s qualities.

Having more images also helps convert consumers more often, and rank higher on retailers like Amazon. My analytics department colleagues proved this by analyzing hundreds of thousands of product listings on Amazon back in January 2018. They found that 53 percent of the time, a product with more images would convert at a higher rate and outrank that product’s top competitor on the search results page.

2. Make your product trustworthy if you want customers to pay a premium

Consumers have always looked for external validation before purchase, especially for more considered purchases.

The difference is that thanks to robust review platforms on retailer sites themselves, consumers now have the advantage of quickly mining an infinitely larger trove of buyer feedback, and they value this information to a substantial degree. So much so that “better reviews” was the most selected reason for springing for a higher-priced item online.

This fact also bears out in behavioral data. The same Amazon study found that 58 percent of the time, a product with more reviews would convert at a higher rate and outrank that product’s top competitor on the search results page.

Getting review counts up isn’t likely to be a quick process. It requires actively soliciting them from recent purchasers through marketing automation programs and similar customer relationship management techniques.

It’s absolutely worth the effort in terms of best positioning a product for increased sales over the long term.

3. Address your target buyer’s personality in your product content

The concept of true shopping personalization is like the Maltese Falcon of retail — there is a general vision of what it looks like and an incredible desire for it on the part of consumers, brands and retailers, but for now, it remains “the stuff that dreams are made of.”

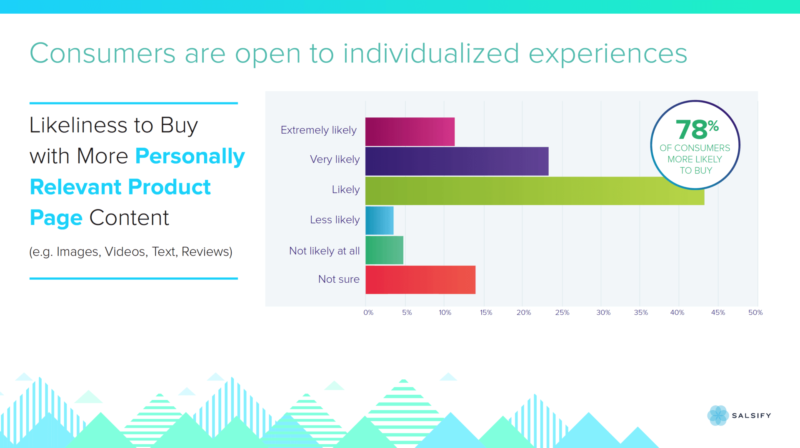

Yet creative brands are already using the natural differentiators of each product in their catalogs to better speak to specific portions of their target audience. Personalization will assuredly get more granular in the future because it’s what consumers want — 78 percent of consumers surveyed responded that more personally relevant product content makes them more likely to buy.

Brands need to rise to this challenge by producing product content that speaks to the specific type of consumer for a given product. Even something as simple as having more family-oriented terminology and photos to accompany bulk packaging is a good place to start.

Demographic and behavioral data can help you make some of these decisions, but you should never sacrifice product content consistency across retail outlets (so one product is not described in vastly different ways on Walmart vs. Amazon).

4. Piggyback on Amazon’s success

You know why Amazon currently dominates online retail? Because they are great at delivering shopping experiences that, over time, mean that consumers trust them substantially more than brands themselves, or even Google.

While underscoring the challenge for manufacturers, this should also be seen as an opportunity to use Amazon to associate that trust level with your brand. If one or more of your key products can win, or come close to winning, applicable search terms on Amazon, it creates a virtuous cycle of additional conversions, driving higher search ranking, which drives additional conversions and more.

Doing this across your entire product catalog all at once is a nearly impossible task, but we’ve seen successful brands win by right-sizing the effort initially, and it’s a process that marketers should take to heart.

How to get started

We see that the most sophisticated brand manufacturers we work with aren’t concentrating on investing equally across their whole catalog. Instead, they identify either the highest-margin or highest-volume products in their catalog. First, identify the products your customers love.

Then, identify the high-volume searches that are most important for those products and determine which competitors you need to beat. The Amazon search bar is a great place to start to find those keywords, and as a tip, you can use ‘#’ as a wildcard to discover additional terms. There are also a number of tools out there that can help identify key search terms for you.

With this information, you have a more reasonable number of winnable battles within the “hand-to-hand combat” that is winning on Amazon, and you can better address these latest consumer wants and needs on key product pages.

Contributing authors are invited to create content for MarTech and are chosen for their expertise and contribution to the search community. Our contributors work under the oversight of the editorial staff and contributions are checked for quality and relevance to our readers. MarTech is owned by Semrush. Contributor was not asked to make any direct or indirect mentions of Semrush. The opinions they express are their own.

Related stories

New on MarTech