Internet advertising up 7.3%, reaching record high in U.S.

U.S. internet advertising climbed to $225 billion in 2023, with double-digit growth from retail media, CTV and audio ads, according to IAB/PwC report.

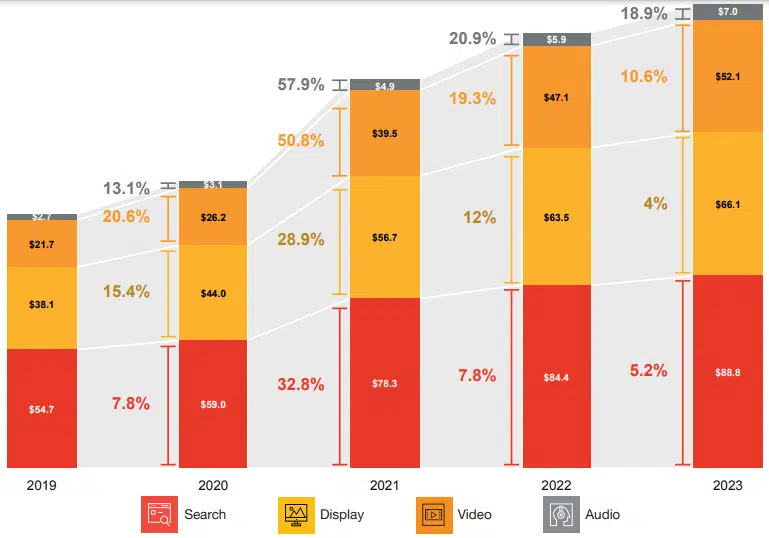

U.S. internet advertising reached a record $225 billion in 2023, a 7.3-percent increase year-over-year, according to the latest IAB report on U.S. ad revenue, conducted by PwC.

Digital ads boomed in the fourth quarter when the growth rate spiked to 12.3% — in 2022 the growth rate for the quarter was 4.4%.

Top channels included CTV, retail media and audio, which all saw double-digit growth in 2023.

“Despite inflation fears, interest rates at record highs, and continuing global unrest, the U.S. digital advertising industry continued its growth trajectory in 2023,” said IAB CEO David Cohen, in a release.

Why we care. The digital ad ecosphere has met challenges due to snowballing privacy regulations and the deprecation of third-party cookies. But advertisers, facing competitive pressures, still see digital ads as an effective way to reach customers at all stages in their journeys and therefore continue to increase their digital spend.

Dig deeper: Google’s Privacy Sandbox: What you need to know

Video. Video advertising saw 10.6% YoY growth in 2023 as revenue rose to $52.1 billion. Forty-two percent of the revenue came in CTV and OTT, according to “IAB/PwC Internet Ad Revenue Report, FY 2023.”

Although growth was down marginally from 2022, CTV is expected to drive video up in the coming years with added inventory from ad-supported subscription tiers introduced by major streaming services like Netflix.

Retail media. Even higher growth came from retail media networks (RMNs), which saw a 16.3% increase in revenue YoY, reaching $43.7 billion. RMNs are an attractive way for advertisers to reach customers because of the quantity of first-party data retailers have and the tech solutions available to leverage the data in a privacy-compliant way.

Other non-retail consumer brands are creating similar ad media platforms. Recently, JP Morgan Chase announced Chase Media Solutions, the first bank-led platform of this kind.

Dig deeper: Why we care about retail media networks

Digital audio. Although relatively small compared to other channels, digital audio saw the highest growth of any channel — 18.9% YoY. In 2023, revenue reached $7 billion.

The report cited new ad-supported tiers from audio subscription services, as well as AI-powered personalization, as contributors to future growth in the channel.

Social rebound. Social media ad revenue rose 8.7% YoY to reach $64.9 billion in 2023.

Much of the growth came in the second half of the year, which saw $4.1 billion of the $5.1 total growth.

Longer view. After huge growth in 2021, following the first year of the COVID-19 pandemic, digital advertising spending cooled in 2022. The 2023 numbers show areas of promising double-digit growth and some sign of normalcy in otherwise turbulent times.

“With significant industry transformation unfolding right before our eyes, we believe that those channels with a portfolio of privacy-by-design solutions will continue to outpace the market,” said Cohen. “For 2023, the winners were retail media, CTV, and audio which saw the highest growth.”

Report. The “IAB/PwC Internet Ad Revenue Report, FY 2023” report (registration required) was commissioned by the IAB and conducted by PwC Advisory Services LLC. It uses data and information reported directly to PwC from companies selling advertising on the internet, as well as publicly available corporate data. Released quarterly, “IAB Internet Advertising Revenue Report” was initiated by the IAB in 1996.

Contributing authors are invited to create content for MarTech and are chosen for their expertise and contribution to the martech community. Our contributors work under the oversight of the editorial staff and contributions are checked for quality and relevance to our readers. MarTech is owned by Semrush. Contributor was not asked to make any direct or indirect mentions of Semrush. The opinions they express are their own.

Related stories