Video ad spend expected to rise 16%, surpassing linear TV this year

IAB's Video Ad Spend study projects $63 billion in video ad spending with more going to digital video than linear for the first time.

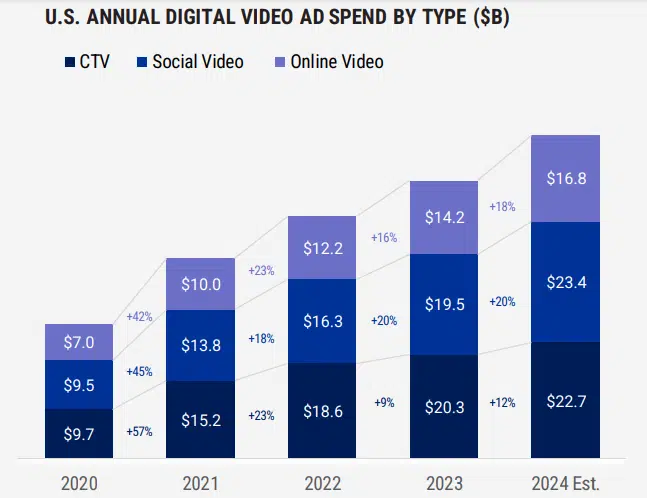

U.S. digital video ad spend is expected to hit $63 billion in 2024, a 16% increase from the previous year, according to projections from IAB’s “2024 Digital Ad Spend & Strategy Report.”

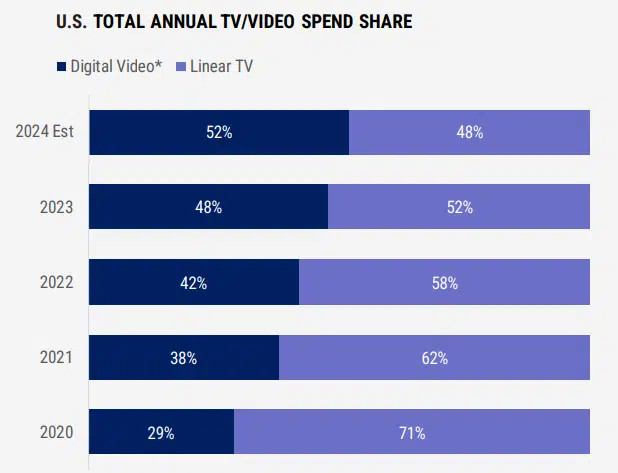

For the first time, digital video — which includes CTV, social video and online video — will claim a higher share of budgets than linear TV.

Why we care. CTV and other digital video channels have long promised better addressability and measurement than traditional linear TV. However, the number of cable subscribers remained sizable enough for digital video to remain in a supporting role for ad budgets. That situation has now changed.

Cutting the cord. Cable subscriptions have continued an annual decrease of around 6% in recent years. Major providers lost 5 million subscribers in 2023, after losing 4.6 million in 2022, according to the report.

As a consequence, CTV and other digital video formats, combined, have gained on linear TV. 2024 is projected to be the first year where more spend is committed to digital video than linear TV.

CTV shift. CTV is projected to grow to $22.7 billion, up 12% YoY.

For those marketers increasing CTV spend this year, here’s a breakdown of where they said those funds are shifting:

- Reallocated from linear TV (40%)

- From other non-video digital ads (40%)

- From other types of traditional ads (39%)

- From social media platforms (34%)

- From other types of digital/mobile video (32%)

Thirty-one percent of marketers said increased CTV spend came from an expansion of the ad budget.

CPG and retail are major categories spurring the growth in investment in CTV. CPG investment is expected to grow 20% YoY this year, retail 30%.

Social video. Video ads on social platforms are expected to see the ad type’s second consecutive year of 20% growth. Social video is projected to reach $23.4 billion, slightly higher than CTV.

“Among the largest ad spenders, CTV (69%) and social video (70%) are considered ‘must buys’ because of their ability to deliver both scale for branding at the top of the funnel and performance outcomes at the bottom of the funnel,” said Chris Bruderle, VP, industry insights and content strategy, IAB, in a release.

Report. IAB partnered with Guideline, which drew on ad billing data and market estimates for the report. Qualitative research was supplied by Advertiser Perceptions. The full report can be accessed here. The research is based on ad spend and produces some minor deviations from IAB’s reports on ad revenue.

Dig deeper: Internet advertising up 7.3%, reaching record high in U.S.

Contributing authors are invited to create content for MarTech and are chosen for their expertise and contribution to the martech community. Our contributors work under the oversight of the editorial staff and contributions are checked for quality and relevance to our readers. MarTech is owned by Semrush. Contributor was not asked to make any direct or indirect mentions of Semrush. The opinions they express are their own.

Related stories

New on MarTech