The Tech Investment Metric System — A New Type Of “Gram”

Instagram sold for $1 billion! Slideshare is being purchased for $118 million! Facebook about to go public for $100 billion! Apple’s on its way to being worth $1 trillion dollars! A tech bubble? Who cares. With valuations like these, we need a new way of measure the worth of a company. Allow me to introduce […]

Instagram sold for $1 billion! Slideshare is being purchased for $118 million! Facebook about to go public for $100 billion! Apple’s on its way to being worth $1 trillion dollars! A tech bubble? Who cares. With valuations like these, we need a new way of measure the worth of a company. Allow me to introduce a new type of “gram,” one used to value companies.

I can’t claim the credit here. Last week, I was talking with Google distinguished engineer Matt Cutts. Most known for his role as head of Google’s web spam team, Cutts is also an investor himself, as well as a pretty witty observer of all things tech. He joked to me that he was now measuring acquisitions in terms of instagrams.

Funny. I ran with it today tweeting about how the Dodgers sold for 2 instagrams, prompting Cutts to tweet that SlideShare just went for “119 milli-Instagrams.” That got me thinking more. Milli-instagrams sounded awkward. What if we had an investment system where everything was based on a “gram,” in a way that it could work up to an instagram being $1 billion.

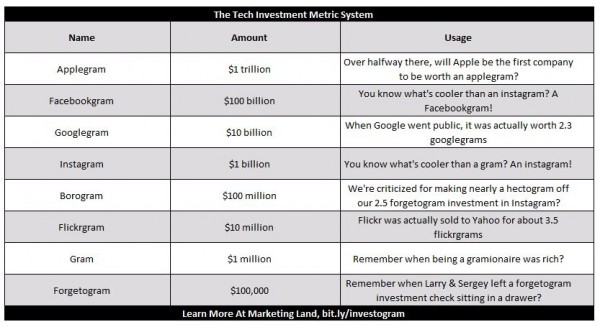

And so, for better or worse, I give you The Tech Investment Metric System:

Feel free to use the image if you like, but a link back would be nice. Below, some annotations of what’s on the chart.

Forgetogram ($100,000): Google cofounders Larry Page and Sergey Brin didn’t actually forget about their initial $100,000 investment check from Andy Bechtolsheim. They just hadn’t formally created the company Google that the check was written out to, so it really did sit in a drawer for about two weeks.

Gram ($1 million): As I said, this seemed a good base unit for the chart.

Flickrgram ($10 million): I was looking for a tech company that would be recognizable as a big deal when it sold in the $10 million range at the time. Flickr was actually speculated to go for more than that, around $30 to $35 million.

Borogram ($100 million): I was pretty amazed myself when Andreessen Horowitz seemed to take flack in the New York Times and a few other places for only making $78 million off of Instagram off a $250,000 investment. Could I please make such mistakes? Given that making nearly $100 million these days seems almost boring, I’ve dubbed that figure to be a “borogram.”

Instagram ($1 billion): The now famous amount, of course, that Instagram went for. As for the usage, didn’t you see The Social Network? I’d put the clip up, but Sony hasn’t put an official one out that I can find, and linking over to them at YouTube, well, that’s like a guarantee they’ll disappear.

Googlegram ($10 billion): As with Flickr, I wanted some name to match up to this valuation to help contrast it against the newer ones. After Google went public, it was valued around $23 billion. That seemed a good contrast against Facebook’s impending IPO that will value it at around $100 billion. Google, of course, is valued much more now than when it went public and above what Facebook’s initial public value will be).

Facebookgram ($100 billion): Since this is around the expected valuation of Facebook, when it goes public on May 18, I gave it this name.

Applegram ($1 trillion): Right now, Apple is worth around $600 billion, the most valuable company on earth. It’s worth a little less on this chart from the Economist from earlier this year, but be sure to check that out. It gives the relative size of other companies like Google, Amazon and McDonald’s, along with facts like number of employees. If only we could get the wealth of Apple to transform the lives of some of those employees at McDonald’s

Contributing authors are invited to create content for MarTech and are chosen for their expertise and contribution to the martech community. Our contributors work under the oversight of the editorial staff and contributions are checked for quality and relevance to our readers. MarTech is owned by Semrush. Contributor was not asked to make any direct or indirect mentions of Semrush. The opinions they express are their own.

Related stories

New on MarTech