IAB expects digital advertising growth to slow considerably this year

Lack of ad spending for the Olympics and elections cuts growth to 7.3%, down from last year's 11.8%.

U.S. digital advertising will see a 7.3% increase over last year’s spend, according to the latest IAB forecast. This growth is notably lower than the 11.8% 2024 projection.

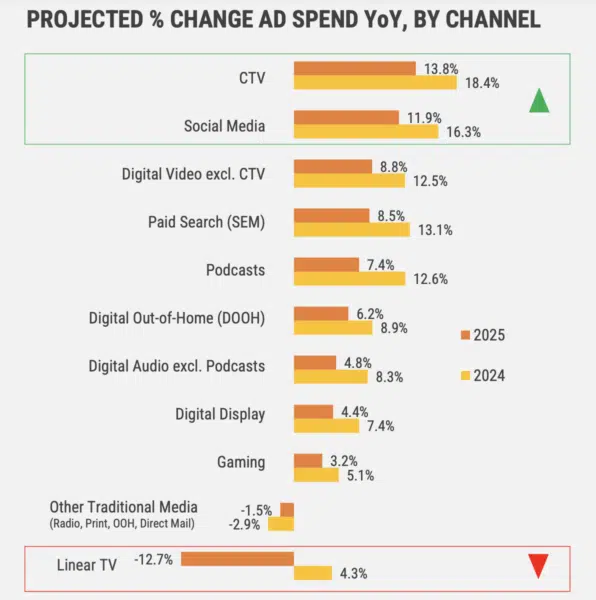

Retail media networks (up 15.6% year-over-year) CTV (+13.8%) and social media (+11.9%) all expect double-digit growth, according to the study, “2025 Outlook: A Snapshot into Ad Spend, Opportunities and Strategies for Growth.”

Slowdown. The study indicated that 2024 accelerated on ad-heavy events like the Paris Olympics and national and state elections.

This year, advertisers will be more selective, focusing on emerging high-growth channels like RMNs and CTV.

“This report clearly shows that budgets are being focused at points where consumers, commerce and video converge — where advertisers can leverage the power of sight, sound, and motion and consumers can engage and transact,” said IAB CEO David Cohen in a release.

Growth by channel. Indeed, the highest-growth channels in the 2025 projections deliver video and full-funnel opportunities from branding to commerce.

Dig deeper: Social media and influencers: 2025 predictions

Here is a breakdown of growth by channel.

Dig deeper: Retail media networks continue to grow: 2025 predictions

Priorities for advertisers. Performance-driven media and measurement and attribution capabilities are top priorities for advertisers, according to Mediaocean’s 2025 Advertising Outlook Report.

Sixty-two percent of marketers said performance-driven paid media was most critical to their plans. Coming in second, measurement and attribution was critical to 50% of marketers.

Brand advertising came in third at 45%, down from 57% in a previous study conducted in summer 2024. (The most recent study asked marketers these same questions in November, 2024.)

GenAI-powered media planning. Marketers are adopting genAI tools to help with media planning, the IAB study found. A full 42% are currently using this technology for media planning and/or activation. Another 36% are exploring the technology.

Mediaocean found genAI the most important trend marketers are watching in 2025. Here are the top ways marketers in the study are using genAI:

- Data analysis (47%).

- Market research (38%).

- Copywriting (32%).

- Image generation (22%).

- Customer service (14%).

Why we care. It’s understandable expectations would be lower following a boom year in 2024. Due to immense competition, marketers are pursuing digital ad channels at the cutting edge of consumer engagement. As a result, traditional media like linear TV will see lower, or negative, growth — although they remain an important part of a full media plan moving forward.

More about the IAB study can be found here. (Membership required to access the full report.)

Contributing authors are invited to create content for MarTech and are chosen for their expertise and contribution to the martech community. Our contributors work under the oversight of the editorial staff and contributions are checked for quality and relevance to our readers. MarTech is owned by Semrush. Contributor was not asked to make any direct or indirect mentions of Semrush. The opinions they express are their own.

Related stories

New on MarTech