Salesforce sees a shorter, more competitive holiday season in 2024

Expect to see very soft growth in onlines sales in the upcoming holiday season — but here are some ways brands can win.

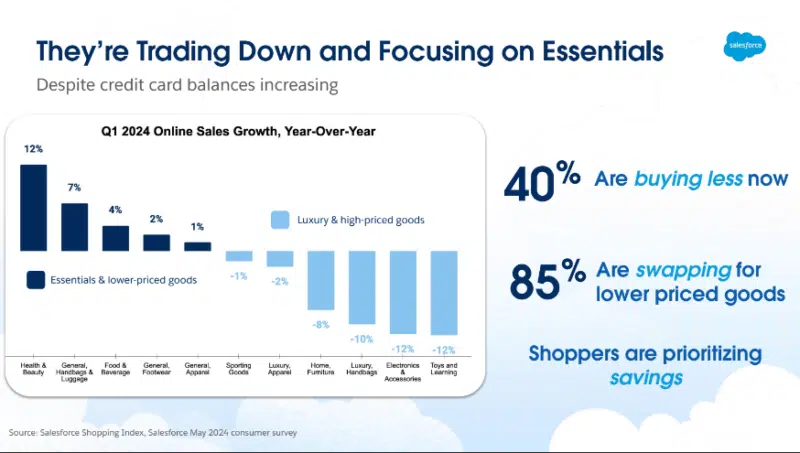

Salesforce expects the 2024 holiday season to be shorter and more competitive with brands facing the challenge of attracting consumers with less purchasing power. Based on global statistics, around 66% of shoppers plan to buy based on price this year, an increase of 20% since 2020. Also, 43% of shoppers are carrying more debt this year than they did in 2023. Additionally, challenges to the supply chain will continue to surface.

Brands also face the fewest days between Thanksgiving and Christmas since 2019 and fierce competition from the major cut-price Chinese shopping apps, Temu, Shein and AliExpress being joined by TikTok and its growing emphasis on shopability.

“Forty percent are buying less but spending the same,” Rob Garf said of consumers at a press briefing to unveil the forecasts. Garf is VP and GM of retail and consumer goods at Salesforce.

The forecast in figures

Here are the highlights of Salesforce’s predictions:

- YoY online sales growth is expected to be more sluggish than 2023, which itself showed only 3% growth YoY. Salesforce is predicting 2% growth, both globally and for the United States.

- Over 20% of purchases this holiday season will be made on Chinese shopping apps. Look out for TikTok which has seen a 24% growth in shoppers making purchases since April this year.

- Salesforce expects 18% of global orders during the 2024 holiday season to be influenced by a combination of predictive and generative AI, amounting to over $200 billion in global online sales. Over half (53%) of shoppers are interested in using AI to find products.

What brands can do

Salesforce has recommendations for addressing these market challenges:

- Leverage discounts. Two-thirds of consumers plan to wait for Cyber Week when they expect the discounts to be steepest. Prime Day in July saw meaningful discounts generate 3% more sales and a growth in sales volume.

- Use AI to power product recommendations and tailored promotions.

- BOPIS will be big, driving around a third of orders in the shortened pre-Christmas shopping season as consumers look to get orders filled fast and inexpensively.

Salesforce is anticipating a 28% average discount rate during Cyber Week. “Cyber Week itself has the potential to be a really big week,” said Caila Schwartz, director of consumer insights and strategy, retail and consumer goods.

The Salesforce forecast is based on aggregated activity data from more than 1.5 billion global shoppers across more than 64 countries.

The AI question

“This season will be competitive, intense, and no doubt focused on pricing and discounting strategies. It’s never been more important to leverage technology like AI and rely on your customer data for guidance and insight into marketing campaigns — especially the holiday promotional calendar,” said Schwartz in a release.

That makes sense. But despite much evidence that consumers have little trust in AI, Salesforce is also suggesting that using AI to help consumers find “the perfect present” is a good idea. It turns out there might be a very simple reason why both these things can be true.

“They don’t even know in most instances,” said David Oksman, VP marketing and DTC at Samsonite and a guest at the press briefing. “The consumer will never know it’s based off machine learning.” With an AI-powered recommendation engine embedded in search, the consumer is unlikely to know that the products are being surfaced by AI, Garf agreed. What’s critical is a friction-free shopping, ordering and delivery experience.

Contributing authors are invited to create content for MarTech and are chosen for their expertise and contribution to the martech community. Our contributors work under the oversight of the editorial staff and contributions are checked for quality and relevance to our readers. MarTech is owned by Semrush. Contributor was not asked to make any direct or indirect mentions of Semrush. The opinions they express are their own.

Related stories