Even Financial launches tool to semi-automate financial compliance for online ads

The Programmatic Compliance Tool -- which Even says is the only one to track compliance after the click -- sends suspected violations to human supervisors.

Compliance-at-scale is a growing need for marketers, given the Federal Trade Commission’s rulings on influencers and the coming of the European Union’s General Data Protection Regulation (GDPR).

For the financial industry, which has long dealt with compliance requirements, New York City-based Even Financial is out with a Programmatic Compliance Tool that helps to semi-automate the process of staying within boundaries.

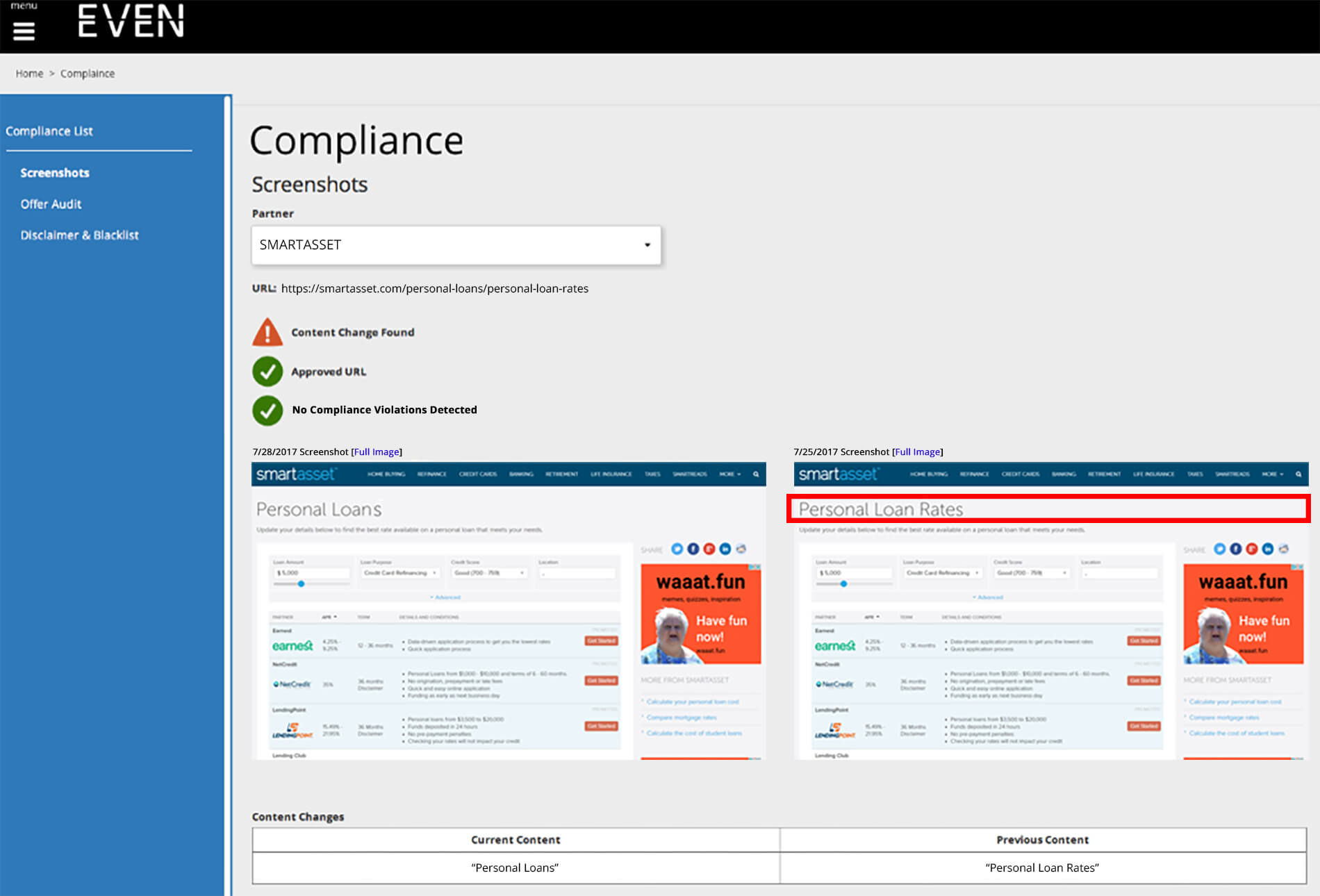

In real time and via an API, the tool looks at the blog, web or app page where a client’s ad for a financial product will appear. Image recognition analyzes daily screen grabs to assess ad placement. The tool also parses the surrounding text on the page to detect any issues that could pose problems with US federal or state regulations, as well as any nearby content that could be embarrassing for the advertising financial service.

If the tool finds or suspects a violation, the ad placement is scratched, and an Even Financial staff member — from a team of three monitors — takes a look and renders a judgment. Even’s staff can send an alert to the publisher, who could be disconnected from the service if violations continued.

CEO and co-founder Phillip Rosen told me that Even’s clients are financial companies — including Lending Club and Discover Loans — which run ads and offer affiliate links for loans, credit cards or other products on about 200 sites, blogs and apps.

The compliance tool looks for both required and prohibited language on the page where the ad will appear, with natural language processing checking for synonyms. The results are used to train the tool’s machine learning so it can identify similar instances in the future.

Rosen said the tool was used internally for six months before it was made available for API access to any publisher. His company’s primary business is acting as a supply side platform (SSP) that delivers ads to publishers, as well as providing a monetization platform with such ecommerce features as forms to apply for loans or other products.

A financial services company like MasterCard, he noted, runs ads to get leads for its credit cards through its affiliates. Of course, it knows the laws, but it needs to make sure that the pages where ads or forms are displayed are compliant in text and placement.

For instance, the surrounding text can’t tout the offer as “pre-approved” if it’s supposed to be “pre-qualified,” it can’t promote a loan as a “personal loan” if the rates are too high, and it needs to provide the proper disclaimer.

Rosen said he was aware of two other financial compliance tools out there, but “they don’t see outcomes,” such as the post-click approval process for loans.

“Our Compliance Tool is the only one that sees outcomes and sees the actual products,” he said.

In other words, he said, the other tools only scrape text on the page and don’t see what happens downstream, when someone clicks an ad or fills out a form. A blog reader who clicks on a link for a loan could see an advertiser’s landing page outside the blog that contains non-compliant language, for instance.

Could this Compliance Tool ever become self-reliant, without needing humans to check suspected violations and send alerts?

At least for the immediate future of two to five years, Rosen said, humans need to be in the loop.

Contributing authors are invited to create content for MarTech and are chosen for their expertise and contribution to the martech community. Our contributors work under the oversight of the editorial staff and contributions are checked for quality and relevance to our readers. MarTech is owned by Semrush. Contributor was not asked to make any direct or indirect mentions of Semrush. The opinions they express are their own.

Related stories

New on MarTech