Twitter Has $710 Million Q4, 86% Of Ad Revenues Came From Mobile

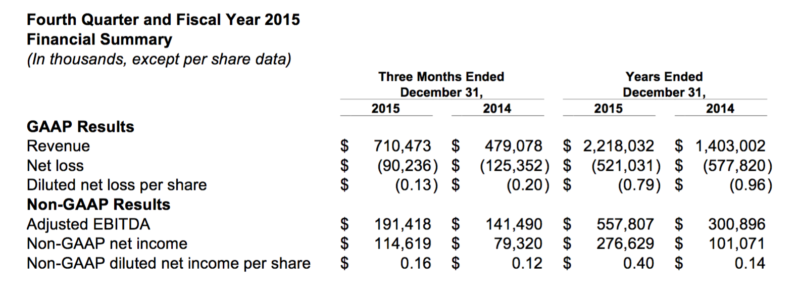

Twitter announced Q4 earnings this afternoon and disappointed investors. Revenues of $710 million were up 48 percent versus 2014 but in line with expectations. Earnings per share of 16 cents, however, beat analyst expectations. First quarter guidance was $595 million to $610 million versus $629 million expected by analysts. For the full year, Twitter made […]

Twitter announced Q4 earnings this afternoon and disappointed investors. Revenues of $710 million were up 48 percent versus 2014 but in line with expectations. Earnings per share of 16 cents, however, beat analyst expectations.

First quarter guidance was $595 million to $610 million versus $629 million expected by analysts.

For the full year, Twitter made $2.2 billion in revenue. Ad revenue was $641 million. Mobile drove 86 percent of total advertising revenue.

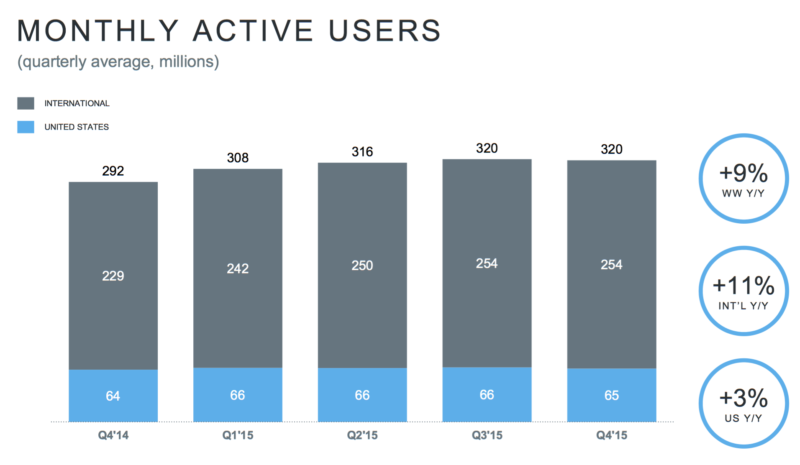

Monthly active users, a key Twitter metric that analysts closely watch, were flat versus Q3 at 320 million, though up nine percent versus last year. Wall Street had expected modest growth in monthly users. Both in the US and globally, the Twitter user base was flat to moderately down.

Total US revenue was $463 million (47 percent growth), and international revenues were $247 million (51 percent growth). In a letter to shareholders accompanying the earnings release, Twitter management tried to reassure investors that user metrics would return to growth:

We saw a decline in monthly active usage in Q4, but we’ve already seen January monthly actives bounce back to Q3 levels. We’re confident that, with disciplined execution, this growth trend will continue over time.

Contributing authors are invited to create content for MarTech and are chosen for their expertise and contribution to the martech community. Our contributors work under the oversight of the editorial staff and contributions are checked for quality and relevance to our readers. MarTech is owned by Semrush. Contributor was not asked to make any direct or indirect mentions of Semrush. The opinions they express are their own.

Related stories

New on MarTech