IDC: Smartphone Growth Slows, Apple Watch Now #2 Wearable After Fitbit

China’s stock market crash has inserted fear and doubt into the global economy over the past week. A faltering Chinese market could also have a major impact on hardware device sales, especially smartphones. Independent of this immediate crisis, however, IDC has been predicting slowing China sales as the market becomes more mature. Below are the […]

China’s stock market crash has inserted fear and doubt into the global economy over the past week. A faltering Chinese market could also have a major impact on hardware device sales, especially smartphones.

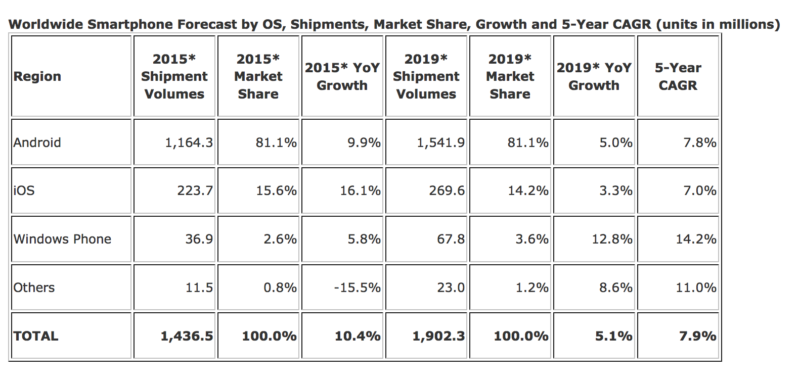

Independent of this immediate crisis, however, IDC has been predicting slowing China sales as the market becomes more mature. Below are the firm’s latest smartphone shipments estimates, which do not indicate sales or real-world market share but are taken as a proxy for those things.

According to these figures, Android will maintain its current 81 percent market-share dominance through 2019. Apple’s iPhone will lose some ground, says IDC, which also predicts Windows Phone will grow from a 2.6 percent global share in 2015 to a 3.6 percent share. However, that’s somewhat dubious, given Microsoft’s current ambivalence about its mobile platform and its “pivot” toward Android and iOS.

According to these figures, Android will maintain its current 81 percent market-share dominance through 2019. Apple’s iPhone will lose some ground, says IDC, which also predicts Windows Phone will grow from a 2.6 percent global share in 2015 to a 3.6 percent share. However, that’s somewhat dubious, given Microsoft’s current ambivalence about its mobile platform and its “pivot” toward Android and iOS.

IDC sees so-called phablets remaining popular and driving growth across both developed and developing markets.

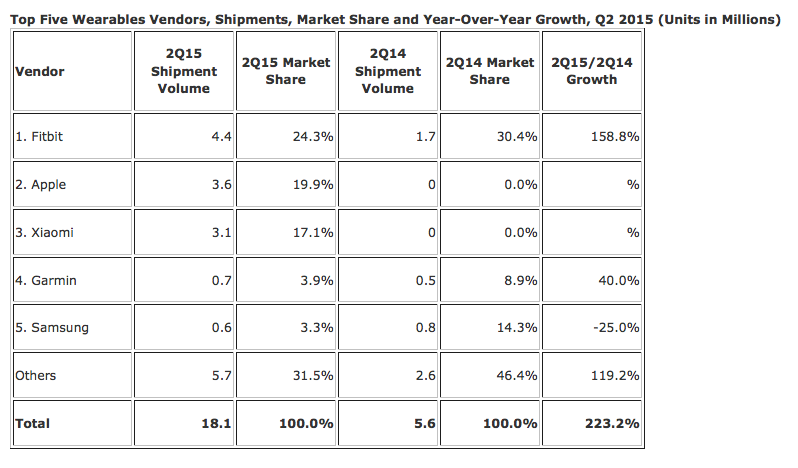

As part of that same report, IDC said that the Apple Watch has become the number two wearable in the market after market leader Fitbit. The firm estimates that Apple shipped 3.6 million watches in Q2. Below is the leaderboard for wearables manufacturers on a global basis, according to IDC estimates.

Consumers have so far had a somewhat muted response to smartwatches. Apple sales have been decent, though below expectations, while Android Wear device sales have been more disappointing.

Contributing authors are invited to create content for MarTech and are chosen for their expertise and contribution to the martech community. Our contributors work under the oversight of the editorial staff and contributions are checked for quality and relevance to our readers. MarTech is owned by Semrush. Contributor was not asked to make any direct or indirect mentions of Semrush. The opinions they express are their own.

Related stories

New on MarTech