Facebook organic reach is down 52% for publishers’ Pages this year

While on average publishers' organic reach on Facebook has fallen by 52% in 2016, video and a lower reliance on Facebook has neutralized the pain for some.

Publishers’ organic reach on Facebook continues to plummet, but some have found a parachute.

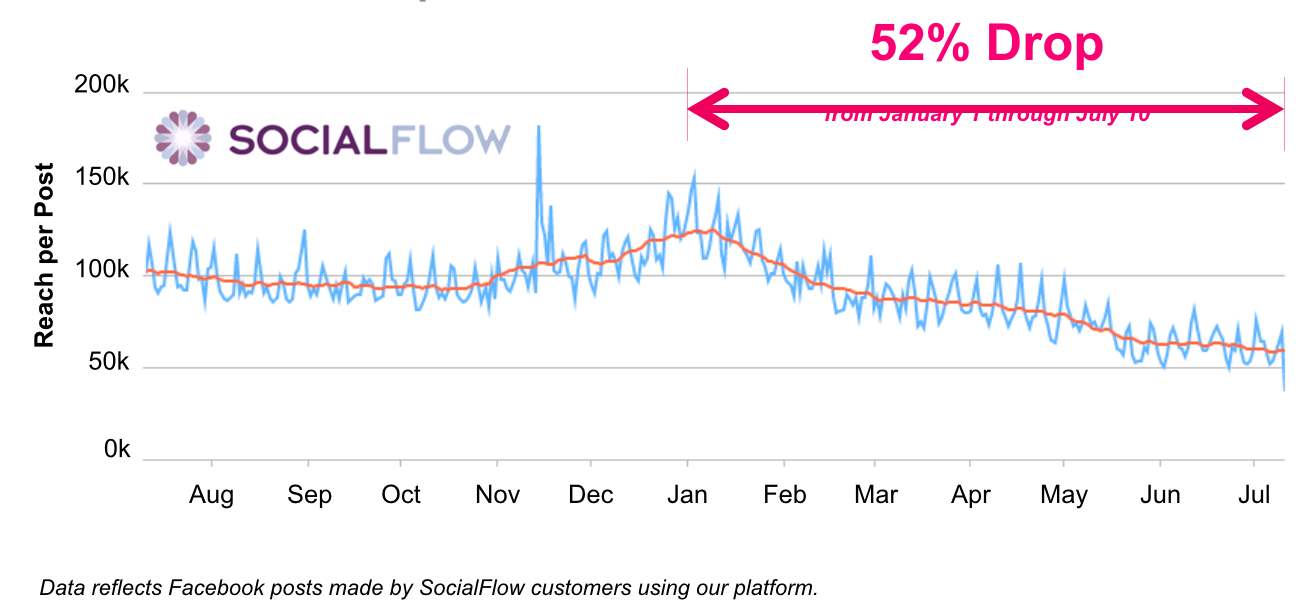

This year, the number of people seeing the average post published on a publisher’s Facebook Page has been cut in half. From January 2016 through mid-July 2016, publishers’ Facebook Pages have experienced a 52-percent decline in organic reach, according to social publishing tool SocialFlow. That stat is based on the company’s analysis of roughly 300 media companies that use its tool to manage their Facebook Pages, which include The New York Times, The Wall Street Journal, Condé Nast and Time Inc.

The stat shows not only how tough things are for publishers on Facebook, but also that things have gotten tougher — even before Facebook’s latest news feed algorithm tweak takes effect. The 52-percent decline is 10 percentage points more than the 42-percent organic reach decline that SocialFlow reported publishers had experienced between January 2016 and May 2016.

This isn’t that much of a shock. Facebook has been systematically cutting back Pages’ organic reach for years, most notably with brands and most recently with publishers. The reason is simple: Individuals and Pages are pushing a lot of posts into people’s news feeds, so Facebook’s news-feed algorithm has needed to get proportionally more stringent about picking out the posts that someone would most like to see and that would most likely keep them coming back to check Facebook regularly.

“[With] an increasing amount of content and a finite amount of consumer attention, arithmetically there’s no other possible outcome than each individual post on average is going to get less reach,” said SocialFlow CEO Jim Anderson.

For publishers, that will likely become even more true in the wake of Facebook’s algorithm change in late June. To recenter people’s feeds around their friends and family members, Facebook announced that it would make Pages’ organic reach more dependent on people sharing their posts than a Page post directly appearing in someone’s feed. That rollout began in late June and is pretty much complete, according to a Facebook spokesperson who declined to comment on SocialFlow’s report. It’s unclear how much impact the algorithm change would have had on SocialFlow’s data; the Facebook spokesperson said the general impact for Pages should be small.

What’s more clear is how publishers are able to adapt to, if not avoid, the decline in organic reach. When it comes to the content they post to Facebook, video appears to be something of a lifesaver. It also helps to not be overly dependent on Facebook for distribution.

Not all publishers have seen their organic reach on Facebook decline. PopSugar and Thrillist Media Group have seen their organic reach actually increase this year. A major reason why: video.

Since adding autoplay video in September 2013, Facebook has been as obvious about its love for video as Steve Urkel was about his love for Laura Winslow.

Facebook has made its news feed algorithm more mindful of video, added public view counts to make people more mindful of how popular video is on Facebook, and its execs have even predicted that Facebook “will be probably all video” in five years.

That video push has come at the expense of other post types, like links to publishers’ sites. “Organic reach on link posts is coming down, for sure,” said Thrillist Media Group president Eric Ashman. “There’s no doubt that Facebook has made a conscious decision in that respect. When we publish link posts, organic reach versus a year ago is certainly lower. It’s noticeably less.”

At the same time as link posts’ organic reach has declined, publishers like Thrillist and PopSugar are pushing out more video posts, which have not only mitigated but more than made up the link-specific reach declines.

“Our reach has gone up a ton. I do think video has been a massive part of that,” said Ashman.

“People like PopSugar are playing to the strengths of what Facebook is prioritizing. We’ve seen an increase in organic reach from January [2016] to July [2016] of about 10 percent,” said PopSugar Senior VP of Product Marketing Chris George.

These publishers are benefitting from the fact that people on Facebook appear to be more willing to share, like and comment on video posts than any other Page post type.

“Video is the type of post that performs best by far. Video comprised about one percent of posts in the data we analyzed; we take about 1.5 million posts over the course of the month. But those posts generated eight times the reach and 12 times the shares when compared to other types of posts,” Anderson said.

On average, PopSugar generated 17 percent more engagements with its Page posts per day in July than it had in January. “Video is certainly a driver of that,” George said.

When I pulled data from NewsWhip last month on publishers’ most-shared post types on Facebook, video posts eclipsed link posts and photo posts. That’s especially important in light of the June algorithm change that prioritizes share counts for organic reach.

But publishers aren’t going all-in on video and expecting that their organic reach on Facebook will climb forever upward. In addition to SocialFlow’s stat that only one percent of the examined posts were video, execs at Bustle, PopSugar and Thrillist all said that video remains a minor share of the posts they’re pushing on Facebook.

“Video has certainly grown as a share. It’s still less than a third of the posts due to the overall volume, but that share has probably doubled over the past year,” said George.

“If you look at our daily feed, probably somewhere in the neighborhood of 25 percent to 40 percent could be video, depending on the day,” said Ashman.

For the same reason that publishers can’t count on video alone to be their saving grace on Facebook, they can’t count on Facebook alone as a distribution stream. And the publishers who haven’t been hit as hard, or at all, when it comes to organic reach on Facebook are less reliant on the social network.

“Only about a third of our traffic comes from social distribution in the first place. About a third of our traffic onto Thrillist.com comes from search and a third of our traffic comes direct,” said Ashman.

Bustle’s organic reach on Facebook in July 2016 was 13 percent lower than its average for the year — partially skewed by record reach in January — but only a third of its traffic comes from Facebook. So the reach dip hurts, but not fatally.

“We have never really been fully dependent on Facebook,” said Francis Thai, VP of marketing and audience development at Bustle. “We do extremely well in organic search. So even if Facebook reach is down, it’s not as big of a hit.”

Contributing authors are invited to create content for MarTech and are chosen for their expertise and contribution to the martech community. Our contributors work under the oversight of the editorial staff and contributions are checked for quality and relevance to our readers. MarTech is owned by Semrush. Contributor was not asked to make any direct or indirect mentions of Semrush. The opinions they express are their own.

Related stories

New on MarTech