Dun & Bradstreet is testing blockchain as a way to securely distribute its content

The venerable commercial data firm is engaged in several projects with this potentially revolutionary tech, because its financial customers are.

Lest you think blockchain technology is still in the far future of commercial communications and commerce, keep in mind that the venerable Dun & Bradstreet is busily kicking the technology’s tires.

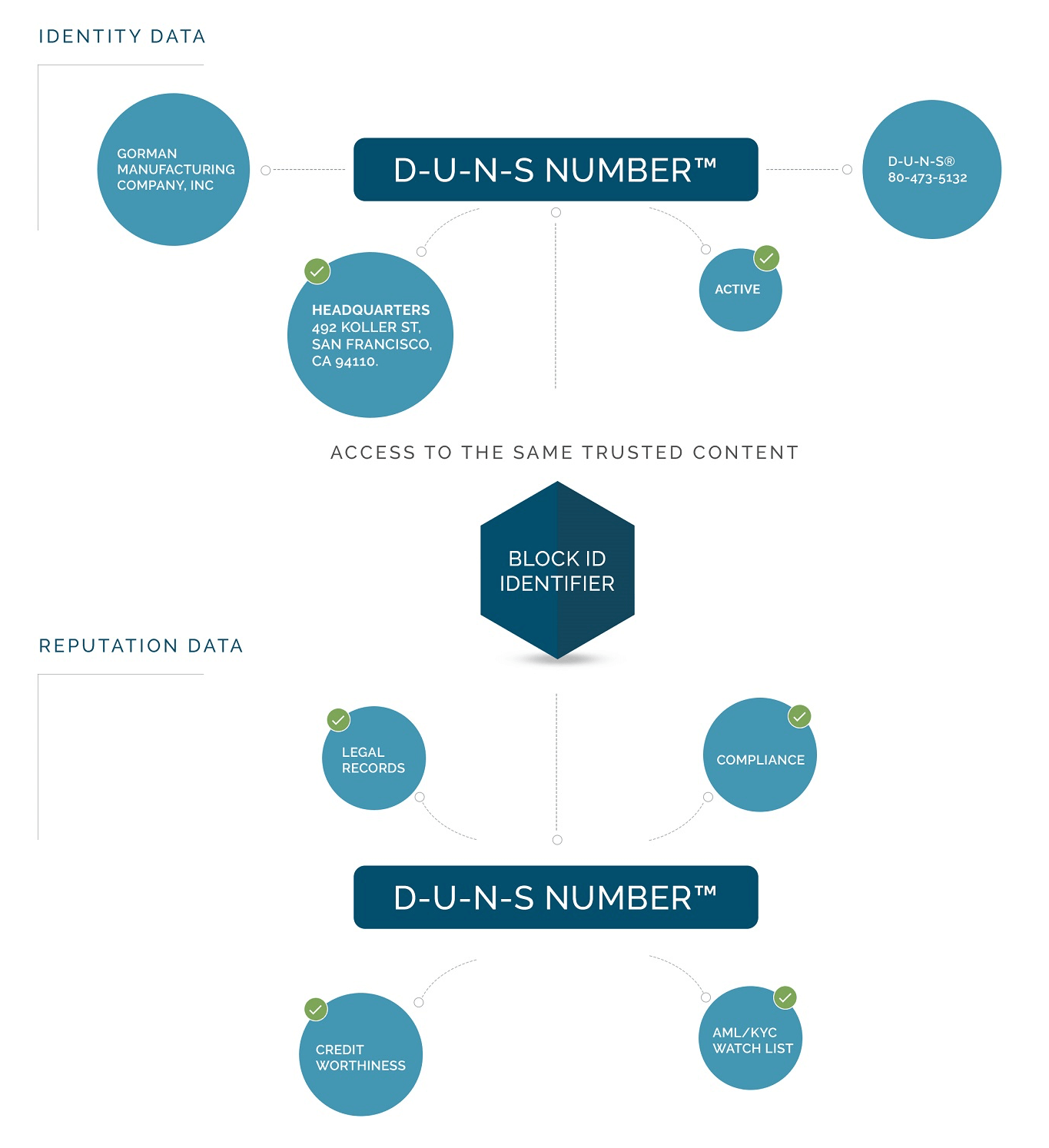

The company — whose origins stretch back to the middle of the 19th century — is currently testing a pilot project that allows clients to verify the identity of a potential business partner through a unique blockchain identifying number that corresponds to the traditional Dun & Bradstreet D-U-N-S Number.

The nine digit D-U-N-S Number is a widely accepted way of identifying a business entity. Blockchain is a new kind of online distributed software ledger that forms the technological underpinning for a variety of applications, the most famous of which is the bitcoin digital currency. Dun & Bradstreet says it has the world’s largest commercial database, providing basic information and reputational assessments for companies around the globe.

Several firms that use its data are involved in testing this project, which launched last fall. One firm, the company said, wants to see if it can dramatically reduce the cost of onboarding new suppliers.

Basic data about 6,500 public companies — such as name, street and web address, CEO and so on — are recorded in company profiles that are housed in “smart contracts” in an instance of the open-source Ethereum blockchain platform.

A smart contract is a blockchain-based software-encoded agreement that can implement its own terms, such as releasing an agreed-upon payment under certain conditions at a given time.

In this case, VP for Data Innovation Saleem Khan told me, the smart contract is “like a mold, housing the basic company info.” Each company has a D-U-N-S Number and has been assigned a unique public key that acts as its corresponding blockchain identifier.

Suppose Company A in the US wants to buy several tons of widgets from Company B in Singapore, Khan suggested, but the two firms have never done business before. So, A wants to check up on B.

Let’s also say that A is part of this Dun & Bradstreet blockchain consortium, so it is allowed to download a node from the cloud where this blockchain instance resides. As is characteristic of blockchains, each node is automatically updated with all data contained in the master blockchain. Company A can search its node and verify that B has a corresponding D-U-N-S number and is therefore a bona fide company.

“We confirm that the counter-party is who they say they are,” Khan said.

Company A can also conduct an “off-blockchain” call via an API to obtain more detailed info, like a credit check on B, or to see if it is a sanctioned company. An API call is used, Khan said, because of the small memory size currently available in each smart contract in the blockchain. Here is how Dun & Bradstreet visualizes this identity and reputational access, with the top half being blockchain-based and the bottom half available via API and both linked by the blockchain identifier:

Once A has verified that B is a real company and has a good credit rating, it can make payment in conventional ways. Or, Khan said, it can use B’s blockchain identifier number to make payment via a public digital currency like bitcoin or through some private digital payment system still to be developed.

A Dun & Bradstreet website, “Your story, on the blockchain,” has been set up to visualize how the client company might use this blockchain to search the database, although the actual data distribution is envisioned to take place via nodes and API calls.

Proponents of blockchain tout several advantages for the technology, including an immutable recording of data, a purported inability to be hacked and the near-instant availability of recorded data throughout the entire blockchain.

Khan declined to take a position on validity of these blockchain claims, adding that the main reason his company is developing blockchain projects is because its customers, such as banks, are beginning to use this technology and “we want to make sure we’re accessible.”

“For us,” he said, “blockchain is for identity verification,” adding that, as a content company, his company also sees blockchain as a new kind of distribution.

Additionally, Dun & Bradstreet is developing a project that could provide master data management for the various blockchain-based data standards that have emerged.

The company also has also a partnership with financial services IT/consulting firm Synechron, where Dun & Bradstreet identity verification data is used in an Ethereum blockchain instance to provide a trade finance accelerator solution for financial services firms.

Contributing authors are invited to create content for MarTech and are chosen for their expertise and contribution to the martech community. Our contributors work under the oversight of the editorial staff and contributions are checked for quality and relevance to our readers. MarTech is owned by Semrush. Contributor was not asked to make any direct or indirect mentions of Semrush. The opinions they express are their own.

Related stories