As retail evolves, so too do physical stores and retail tech

A new Salesforce report says it's not just AI, it's a new role for physical stores and changing shopping behaviors changing retail.

The retail sector continues to evolve to become more digital, social and connected, a new report from Salesforce found.

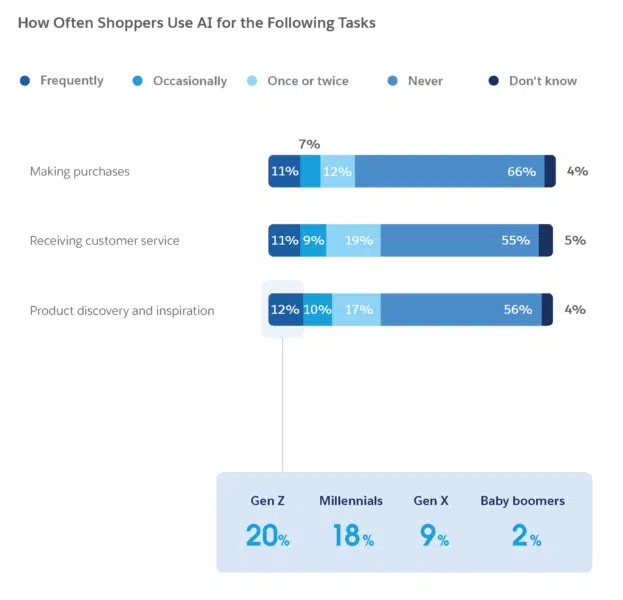

The sixth edition of Salesforce’s “Connected Shoppers” report found agentic AI to be one of the significant drivers of retail’s continued evolution, with 75% of retailers saying AI agents will become essential by 2026.

But AI agents are far from the only thing changing.

The report found that physical stores are expanding as experience hubs and fulfillment centers that bridge digital channels, social platforms and physical shopping journeys.

According to the report, shoppers estimate 41% of their purchase volume will come from physical stores in 2026, down from 45% in 2024.

The report said retailers are transforming their stores more than shopping destinations, delivering elevated retail experiences. More than half (59%) of retailers now offer in-store services like customization and repairs, while 46% provide dedicated spaces for events and community gatherings.

New roles mean new responsibilities for retail associates

Retail location transformation means the stores’ roles are also changing. Traditional checkout duties occupy just 28% of retail workers’ time, while responsibilities such as store operations, customer service and fulfillment activities fill the remaining time.

As their duties expand, retail associates face mounting technological complexity. The report found new associates must master an average of 16 different systems they will use daily — up from 12 in 2023 — and spend 26 hours on technology training in their first month on the job.

AI, and agentic AI in particular, stands poised to ease the burden of retail associates because it makes information easily available and increasingly handles tasks independently. That’s why the report found retailers see AI as their No. 1 opportunity.

Unfortunately, the report also found AI implementation the top operational challenge. For that, high operational costs and disconnected systems, which slow progress, are to blame. Store associates feel the burden of disconnected technology — only 17% have access to a unified view of customer data, the report found.

Yet retailers remain optimistic on AI. The report found 89% of retailers expect returns on their AI investments, with similar shares reporting increased online sales volume and reduced operational costs.

Dig deeper: Salesforce Agentforce: What you need to know

Loyalty programs and social shopping are hot

Brand loyalty can be fleeting today, especially among younger shoppers. The report found retailers are responding to this challenge by reimagining customer service and refining their rewards programs. Eighty-four percent of loyalty program members say such programs make them more likely to repurchase.

Other findings about loyalty programs include:

- Two-thirds of retailers offer a loyalty program.

- 29% plan to introduce one in the next 24 months.

- The average shopper belongs to four loyalty programs.

- Gen Z is three times more likely than baby boomers to value exclusive experiences.

Social shopping is also booming, especially with younger consumers. More than half (53%) of shoppers discover products on social platforms — up from 46% in 2023.

Other social commerce findings from the report include:

- Nearly one-quarter of shoppers follow influencers for inspiration.

- 25% of shoppers buy through social media.

- 16% buy through messaging apps.

YouTube is the most popular social platform for product discovery, followed closely by Instagram and Facebook. Generation plays a key role in shaping habits, with 40% of Gen Z using TikTok for shopping discovery compared to just 4% of baby boomers.

The sixth edition of the “Connected Shoppers” report is based on a survey of 8,350 shoppers and 1,700 retail industry decision-makers. Data in the report are from two double-anonymous surveys conducted from Nov. 27 through Dec. 26, 2024. Respondents represent 21 countries across five continents. All respondents are third-party panelists.

Dig deeper: More consumers using genAI tools to research purchases: Adobe

MarTech is owned by Semrush. We remain committed to providing high-quality coverage of marketing topics. Unless otherwise noted, this page’s content was written by either an employee or a paid contractor of Semrush Inc.

Related stories

New on MarTech